Why Husqvarna (OM:HUSQ B) Is Down 7.1% After Robotics Push, Factory Closure and CEO Change

Reviewed by Sasha Jovanovic

- Husqvarna Group has announced a series of actions including the launch of seven new AI-powered robotic lawnmowers, the decommissioning of its Brastad factory to increase cost efficiency, and the appointment of Glen Instone as CEO, alongside reporting its third-quarter 2025 earnings results.

- This combination of advanced product innovation and renewed operational focus marks a significant shift in how Husqvarna is positioning itself for future competitiveness and profitability.

- We'll now explore how Husqvarna's move to outsource manufacturing and boost robotics innovation could reshape its investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Husqvarna Investment Narrative Recap

To be a Husqvarna shareholder today, you need to believe in the company’s ability to drive earnings growth by transitioning toward robotics, intelligent products, and a more asset-light operating model. The recent Brastad factory closure and move to outsource production are meaningful for cost savings but do not materially change the most important short-term catalyst: increased market penetration and pricing power in robotics, nor do they resolve the biggest risk, margin pressure from low-cost competitors.

The standout announcement shaping the near-term story is Husqvarna’s launch of seven new AI-powered robotic lawnmowers. This directly supports the main business catalyst: expanding market share and margins by offering technologically advanced solutions, while also positioning the company to better defend against competitors aiming at the entry and mid-range segments. The alignment of innovation with operational shifts will be closely watched as the company aims for sustained profitability.

Yet, despite these positive moves, the risk of continued price pressure from aggressive competitors remains information every investor should seriously consider...

Read the full narrative on Husqvarna (it's free!)

Husqvarna's outlook anticipates SEK52.5 billion in revenue and SEK3.6 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 2.9% and an earnings increase of SEK2.3 billion from the current SEK1.3 billion.

Uncover how Husqvarna's forecasts yield a SEK58.25 fair value, a 25% upside to its current price.

Exploring Other Perspectives

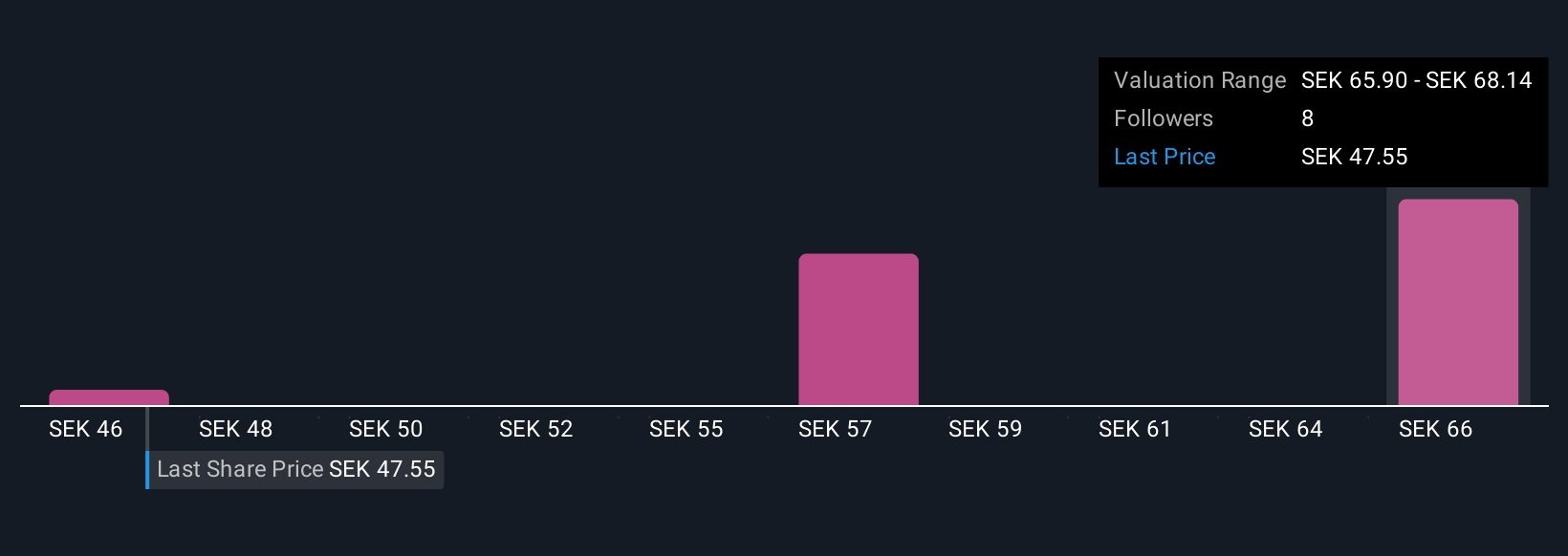

Three members of the Simply Wall St Community have published fair value estimates for Husqvarna ranging from SEK45.71 to SEK68.12. While many focus on Husqvarna’s robotics innovation as a key revenue driver, the risk of ongoing margin pressure from low‐cost competition continues to shape the broader investment outlook, check out more perspectives from the community and see how views diverge.

Explore 3 other fair value estimates on Husqvarna - why the stock might be worth as much as 46% more than the current price!

Build Your Own Husqvarna Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Husqvarna research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Husqvarna research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Husqvarna's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Husqvarna might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HUSQ B

Husqvarna

Produces and sells outdoor power products, watering products, and lawn care power equipment.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives