- Poland

- /

- Specialty Stores

- /

- WSE:CCC

3 European Stocks Estimated To Be Trading Up To 26% Below Intrinsic Value

Reviewed by Simply Wall St

As European markets experience a positive shift, with major indexes like the STOXX Europe 600 and Germany's DAX seeing notable gains, investors are increasingly focused on opportunities within this region. In such an environment, identifying stocks that are trading below their intrinsic value can be particularly appealing, as these may offer potential for growth amid improving economic indicators and strengthened business activity across the Eurozone.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Talgo (BME:TLGO) | €2.57 | €5.12 | 49.8% |

| Robit Oyj (HLSE:ROBIT) | €1.105 | €2.16 | 48.8% |

| Pandora (CPSE:PNDORA) | DKK881.80 | DKK1749.66 | 49.6% |

| Lingotes Especiales (BME:LGT) | €5.70 | €11.09 | 48.6% |

| High Quality Food (BIT:HQF) | €0.608 | €1.20 | 49.3% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.361 | €0.71 | 48.8% |

| Echo Investment (WSE:ECH) | PLN5.46 | PLN10.71 | 49% |

| Bonesupport Holding (OM:BONEX) | SEK227.80 | SEK442.34 | 48.5% |

| Arcoma (OM:ARCOMA) | SEK8.66 | SEK17.15 | 49.5% |

| Aquafil (BIT:ECNL) | €1.98 | €3.85 | 48.5% |

Let's explore several standout options from the results in the screener.

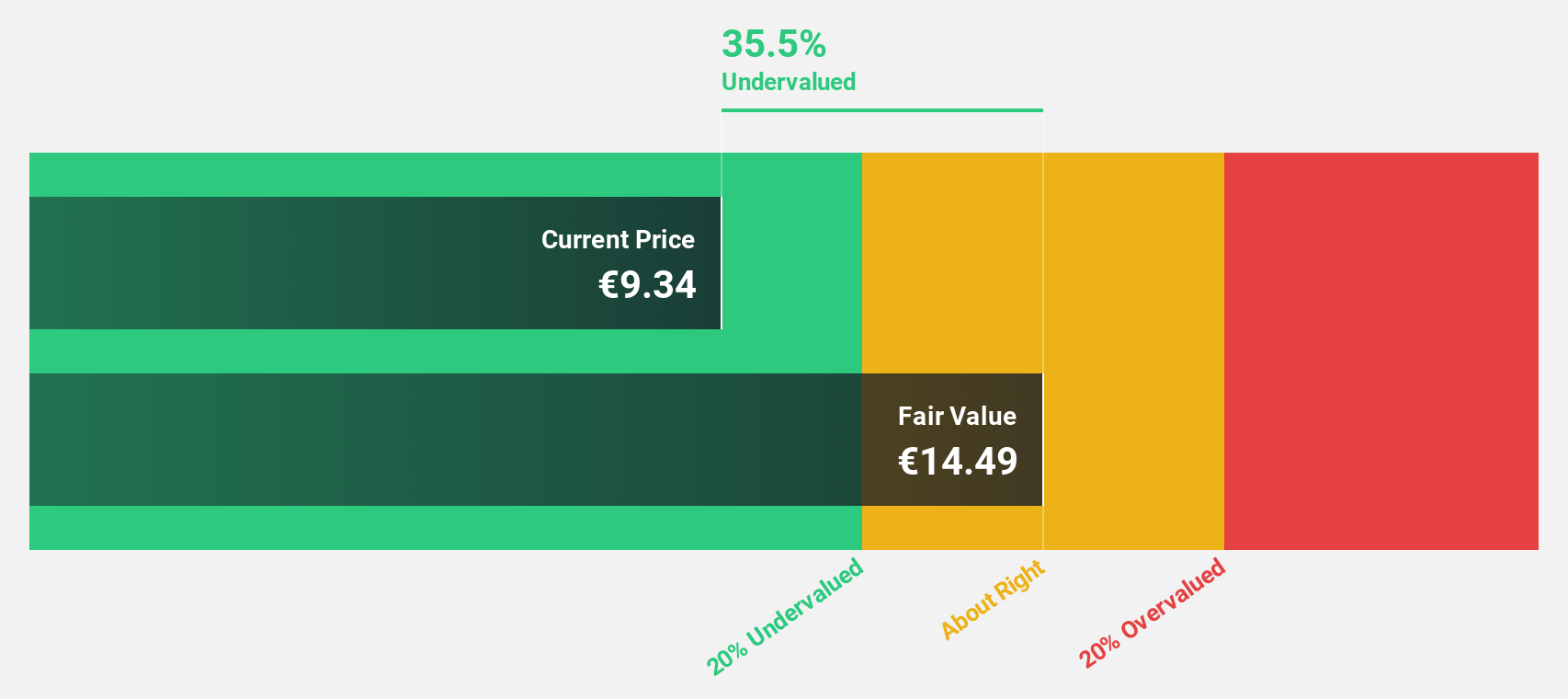

BFF Bank (BIT:BFF)

Overview: BFF Bank S.p.A. operates in non-recourse factoring and credit management for public administration bodies and private hospitals across several European countries, with a market cap of €1.98 billion.

Operations: The company's revenue segment includes Financial Services - Commercial, generating €384.46 million.

Estimated Discount To Fair Value: 26%

BFF Bank is trading at €10.51, significantly below its estimated fair value of €14.21, making it undervalued based on discounted cash flow analysis. Despite a high level of debt and an unstable dividend track record, BFF's earnings are expected to grow at 16.6% annually, outpacing the Italian market's 10%. However, profit margins have declined from 49.5% last year to 32.3%, and recent half-year net income dropped to €70.41 million from €161.78 million previously.

- According our earnings growth report, there's an indication that BFF Bank might be ready to expand.

- Unlock comprehensive insights into our analysis of BFF Bank stock in this financial health report.

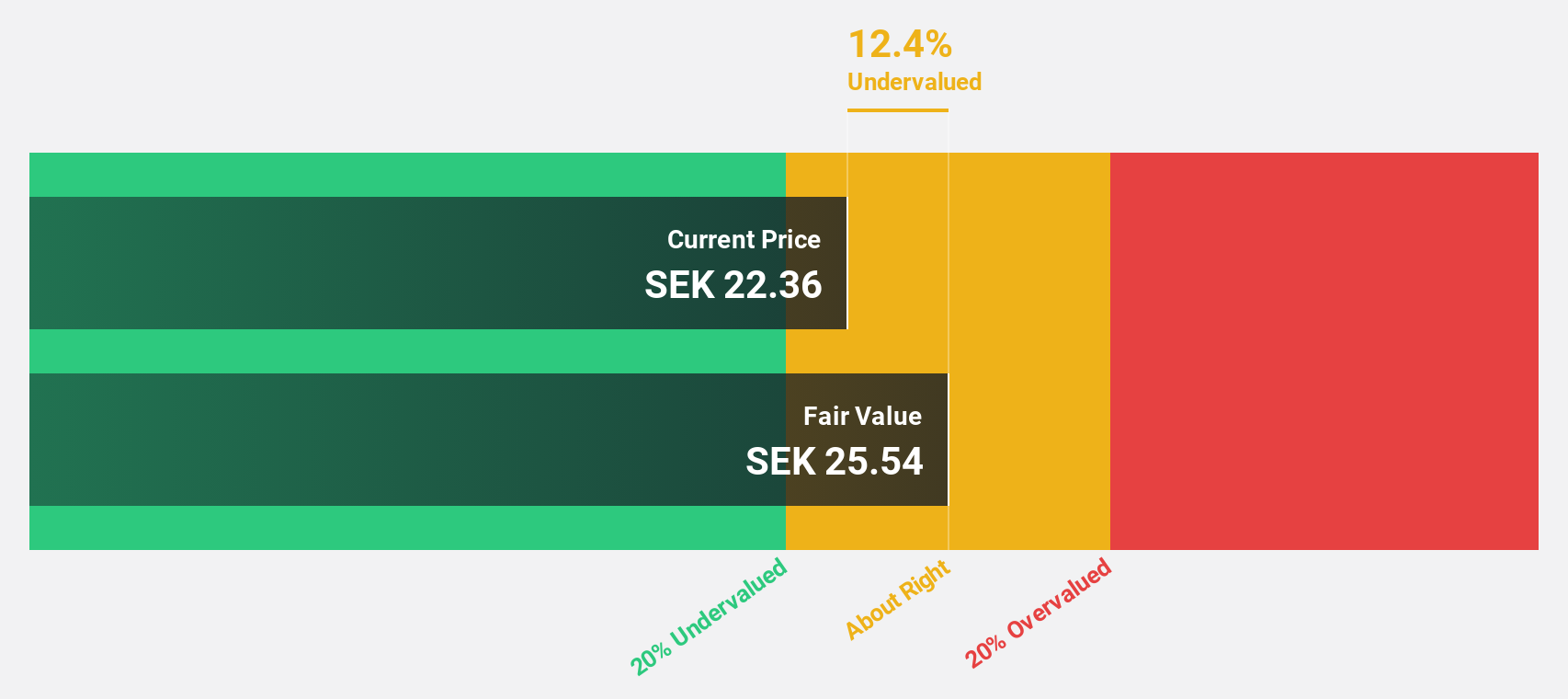

Hexatronic Group (OM:HTRO)

Overview: Hexatronic Group AB (publ) operates in the development, manufacturing, marketing, and sale of fiber communication solutions across Sweden, the United States, Germany, the United Kingdom, and other international markets with a market cap of SEK4.55 billion.

Operations: Hexatronic Group AB generates revenue through its development, manufacturing, marketing, and sales of fiber communication solutions in Sweden, the United States, Germany, the United Kingdom, and various international markets.

Estimated Discount To Fair Value: 14.2%

Hexatronic Group is trading at SEK22.1, below its estimated fair value of SEK25.77, indicating undervaluation based on discounted cash flow analysis. Despite a decline in profit margins and recent net losses, earnings are forecast to grow significantly over the next three years, surpassing Swedish market expectations. However, interest payments remain poorly covered by earnings. The company's focus on acquisitions aims to support its sales target for 2028 amidst current revenue challenges.

- Our growth report here indicates Hexatronic Group may be poised for an improving outlook.

- Dive into the specifics of Hexatronic Group here with our thorough financial health report.

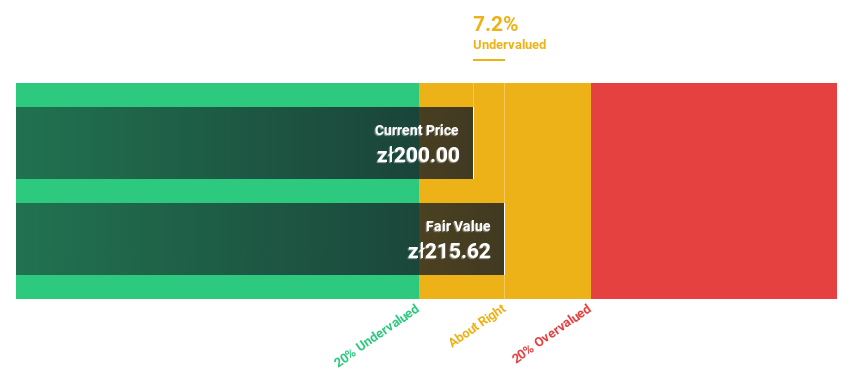

CCC (WSE:CCC)

Overview: CCC S.A. operates in the retail sale of footwear and other products across Poland, Central and Eastern Europe, and Western Europe, with a market cap of PLN11.48 billion.

Operations: The company's revenue segments include Halfprice at PLN1.97 billion, CCC Omnichannel at PLN4.68 billion, Modivo Omnichannel at PLN974.60 million, and a Segment Adjustment of PLN3.06 billion.

Estimated Discount To Fair Value: 19.9%

CCC is trading at PLN149, below its estimated fair value of PLN186.13, reflecting undervaluation based on discounted cash flow analysis. Despite a significant earnings growth forecast of 23.24% annually, recent results show a decline in net income and earnings per share compared to last year. Revenue is expected to grow faster than the Polish market but slower than 20% annually. Interest payments remain poorly covered by earnings, impacting financial stability despite high future return on equity projections.

- Upon reviewing our latest growth report, CCC's projected financial performance appears quite optimistic.

- Click here to discover the nuances of CCC with our detailed financial health report.

Key Takeaways

- Navigate through the entire inventory of 209 Undervalued European Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:CCC

CCC

Engages in the retail sale of footwear and other products in Poland, Central and Eastern Europe, and Western Europe.

High growth potential with solid track record.

Market Insights

Community Narratives