- Sweden

- /

- Industrials

- /

- OM:HAKI B

Improved Earnings Required Before HAKI Safety AB (publ) (STO:HAKI B) Stock's 27% Jump Looks Justified

HAKI Safety AB (publ) (STO:HAKI B) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Looking further back, the 23% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

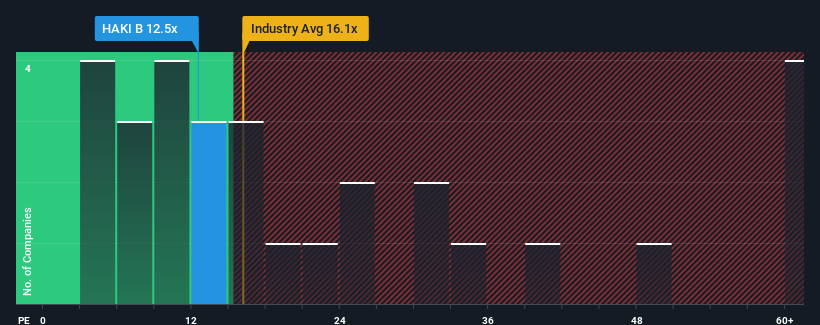

Even after such a large jump in price, HAKI Safety may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 12.5x, since almost half of all companies in Sweden have P/E ratios greater than 22x and even P/E's higher than 40x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

HAKI Safety could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for HAKI Safety

Is There Any Growth For HAKI Safety?

There's an inherent assumption that a company should underperform the market for P/E ratios like HAKI Safety's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 6.9% per year over the next three years. With the market predicted to deliver 19% growth each year, the company is positioned for a weaker earnings result.

With this information, we can see why HAKI Safety is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From HAKI Safety's P/E?

Despite HAKI Safety's shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that HAKI Safety maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 5 warning signs for HAKI Safety that you need to take into consideration.

If these risks are making you reconsider your opinion on HAKI Safety, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if HAKI Safety might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HAKI B

HAKI Safety

Provides safety products and solutions for infrastructure, energy, industry, aviation, rail and construction, and civil engineering industries in Europe and North America.

Good value with reasonable growth potential.

Market Insights

Community Narratives