- Sweden

- /

- Aerospace & Defense

- /

- OM:GOMX

GomSpace Group (STO:GOMX shareholders incur further losses as stock declines 11% this week, taking five-year losses to 68%

GomSpace Group AB (publ) (STO:GOMX) shareholders will doubtless be very grateful to see the share price up 223% in the last quarter. But that is little comfort to those holding over the last half decade, sitting on a big loss. Indeed, the share price is down 76% in the period. So is the recent increase sufficient to restore confidence in the stock? Not yet. Of course, this could be the start of a turnaround.

After losing 11% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for GomSpace Group

GomSpace Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last half decade, GomSpace Group saw its revenue increase by 11% per year. That's a fairly respectable growth rate. So the stock price fall of 12% per year seems pretty steep. The market can be a harsh master when your company is losing money and revenue growth disappoints.

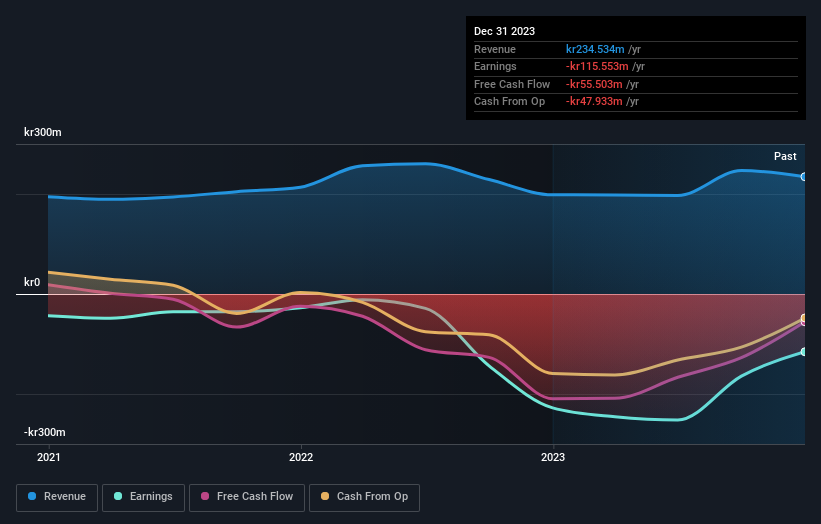

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on GomSpace Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered GomSpace Group's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. GomSpace Group hasn't been paying dividends, but its TSR of -68% exceeds its share price return of -76%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

We're pleased to report that GomSpace Group shareholders have received a total shareholder return of 107% over one year. Notably the five-year annualised TSR loss of 11% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 5 warning signs for GomSpace Group (4 are concerning!) that you should be aware of before investing here.

We will like GomSpace Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:GOMX

GomSpace Group

Through its subsidiaries, designs, develops, integrates, and manufactures nanosatellites for the academic, government, and commercial markets.

Excellent balance sheet very low.