FlexQube AB (publ) (STO:FLEXQ) Stock's 29% Dive Might Signal An Opportunity But It Requires Some Scrutiny

FlexQube AB (publ) (STO:FLEXQ) shares have had a horrible month, losing 29% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 48% in that time.

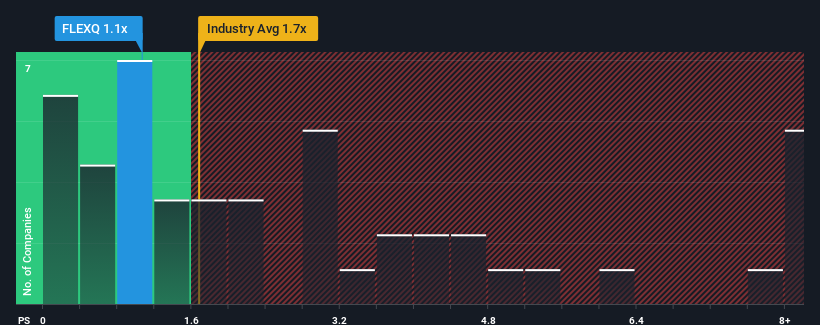

After such a large drop in price, FlexQube may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.1x, since almost half of all companies in the Machinery industry in Sweden have P/S ratios greater than 1.7x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for FlexQube

What Does FlexQube's P/S Mean For Shareholders?

FlexQube could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think FlexQube's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

FlexQube's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 36%. Even so, admirably revenue has lifted 38% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 97% during the coming year according to the lone analyst following the company. With the industry only predicted to deliver 2.9%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that FlexQube's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On FlexQube's P/S

FlexQube's recently weak share price has pulled its P/S back below other Machinery companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at FlexQube's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you take the next step, you should know about the 4 warning signs for FlexQube (2 can't be ignored!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:FLEXQ

FlexQube

Designs, develops, and sells flexible and robust industrial carts and robots for material handling in the United States, Mexico, Germany, the United Kingdom, and Sweden.

Adequate balance sheet with low risk.

Market Insights

Community Narratives