- Sweden

- /

- Electrical

- /

- OM:FERRO

Ferroamp AB (publ) (STO:FERRO) Stock Catapults 34% Though Its Price And Business Still Lag The Industry

Ferroamp AB (publ) (STO:FERRO) shares have continued their recent momentum with a 34% gain in the last month alone. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 83% share price drop in the last twelve months.

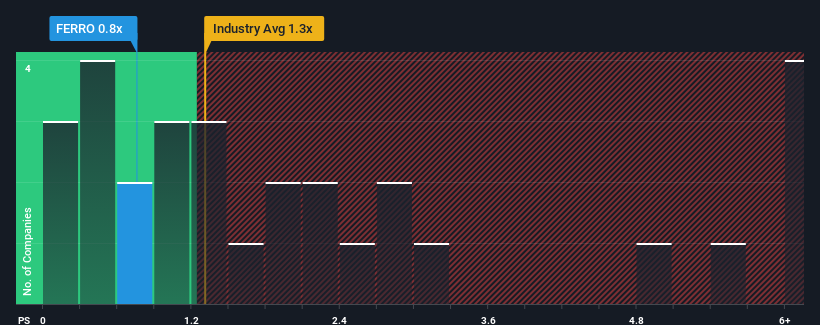

Even after such a large jump in price, considering around half the companies operating in Sweden's Electrical industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Ferroamp as an solid investment opportunity with its 0.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Ferroamp

What Does Ferroamp's P/S Mean For Shareholders?

Ferroamp certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ferroamp.Is There Any Revenue Growth Forecasted For Ferroamp?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Ferroamp's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 65%. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 14% during the coming year according to the one analyst following the company. Meanwhile, the broader industry is forecast to expand by 16%, which paints a poor picture.

With this in consideration, we find it intriguing that Ferroamp's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Ferroamp's P/S?

The latest share price surge wasn't enough to lift Ferroamp's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Ferroamp's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

You need to take note of risks, for example - Ferroamp has 5 warning signs (and 3 which are concerning) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:FERRO

Ferroamp

Provides energy and power optimization solutions for homeowners, tenant owner associations, and property owners in Sweden.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives