- Sweden

- /

- Electrical

- /

- OM:FERRO

What Kind Of Shareholders Hold The Majority In Ferroamp Elektronik AB (publ)'s (STO:FERRO) Shares?

Every investor in Ferroamp Elektronik AB (publ) (STO:FERRO) should be aware of the most powerful shareholder groups. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

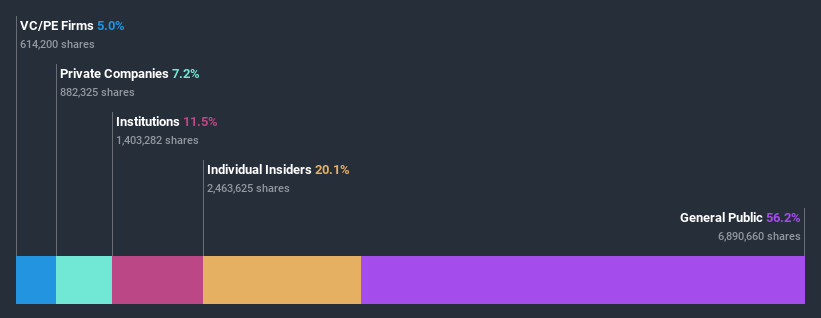

Ferroamp Elektronik is not a large company by global standards. It has a market capitalization of kr881m, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutional investors have bought into the company. We can zoom in on the different ownership groups, to learn more about Ferroamp Elektronik.

See our latest analysis for Ferroamp Elektronik

What Does The Institutional Ownership Tell Us About Ferroamp Elektronik?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

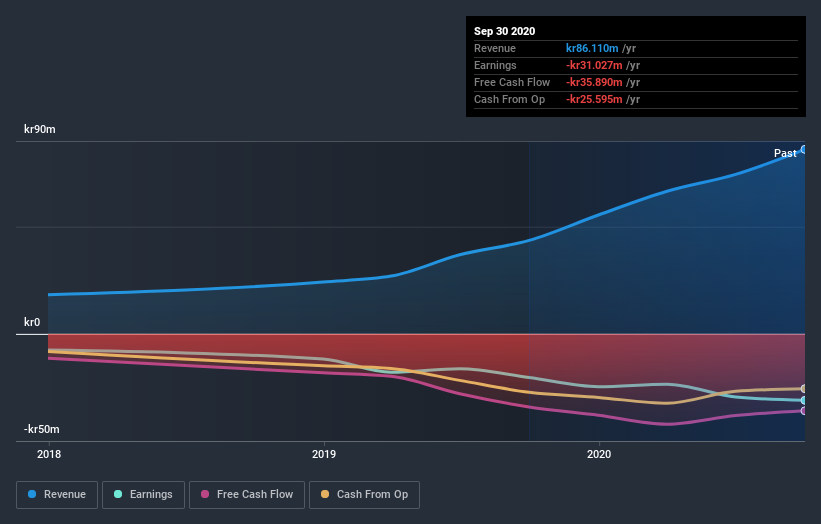

Ferroamp Elektronik already has institutions on the share registry. Indeed, they own a respectable stake in the company. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Ferroamp Elektronik, (below). Of course, keep in mind that there are other factors to consider, too.

We note that hedge funds don't have a meaningful investment in Ferroamp Elektronik. From our data, we infer that the largest shareholder is Björn Jernström (who also holds the title of Top Key Executive) with 12% of shares outstanding. Its usually considered a good sign when insiders own a significant number of shares in the company, and in this case, we're glad to see a company insider play the role of a key stakeholder. For context, the second largest shareholder holds about 6.8% of the shares outstanding, followed by an ownership of 6.7% by the third-largest shareholder.

A deeper look at our ownership data shows that the top 13 shareholders collectively hold less than half of the register, suggesting a large group of small holders where no single shareholder has a majority.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Ferroamp Elektronik

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

It seems insiders own a significant proportion of Ferroamp Elektronik AB (publ). It has a market capitalization of just kr881m, and insiders have kr177m worth of shares in their own names. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

The general public, mostly retail investors, hold a substantial 56% stake in Ferroamp Elektronik, suggesting it is a fairly popular stock. This level of ownership gives retail investors the power to sway key policy decisions such as board composition, executive compensation, and the dividend payout ratio.

Private Equity Ownership

With an ownership of 5.0%, private equity firms are in a position to play a role in shaping corporate strategy with a focus on value creation. Sometimes we see private equity stick around for the long term, but generally speaking they have a shorter investment horizon and -- as the name suggests -- don't invest in public companies much. After some time they may look to sell and redeploy capital elsewhere.

Private Company Ownership

We can see that Private Companies own 7.2%, of the shares on issue. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 3 warning signs we've spotted with Ferroamp Elektronik (including 1 which is doesn't sit too well with us) .

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading Ferroamp Elektronik or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Ferroamp, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OM:FERRO

Ferroamp

Provides energy and power optimization solutions for homeowners, tenant owner associations, and property owners in Sweden.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives