Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like AB Fagerhult (STO:FAG). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for AB Fagerhult

How Fast Is AB Fagerhult Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. It is therefore awe-striking that AB Fagerhult's EPS went from kr1.17 to kr4.78 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

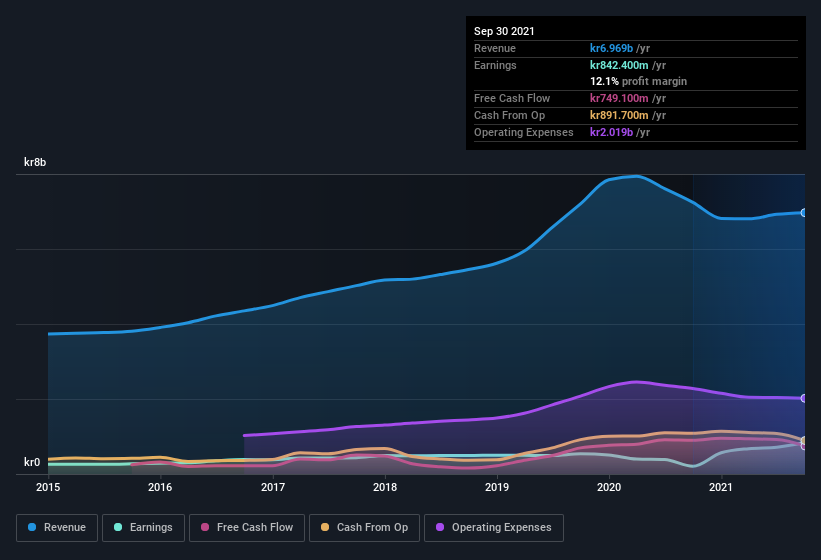

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Unfortunately, AB Fagerhult's revenue dropped 3.8% last year, but the silver lining is that EBIT margins improved from 6.0% to 8.9%. That falls short of ideal.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check AB Fagerhult's balance sheet strength, before getting too excited.

Are AB Fagerhult Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Over the last 12 months AB Fagerhult insiders spent kr972k more buying shares than they received from selling them. On balance, that's a good sign. It is also worth noting that it was Chief Sustainability Officer Anders Fransson who made the biggest single purchase, worth kr1.5m, paying kr66.90 per share.

On top of the insider buying, it's good to see that AB Fagerhult insiders have a valuable investment in the business. To be specific, they have kr395m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 3.5% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add AB Fagerhult To Your Watchlist?

AB Fagerhult's earnings per share have taken off like a rocket aimed right at the moon. What's more insiders own a significant stake in the company and have been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest AB Fagerhult belongs on the top of your watchlist. What about risks? Every company has them, and we've spotted 3 warning signs for AB Fagerhult (of which 1 is potentially serious!) you should know about.

The good news is that AB Fagerhult is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:FAG

Fagerhult Group

Designs, manufactures, and markets professional lighting solutions worldwide.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives