Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in AB Fagerhult (publ.) (STO:FAG). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for AB Fagerhult (publ.)

AB Fagerhult (publ.)'s Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, AB Fagerhult (publ.) has grown EPS by 13% per year. That's a good rate of growth, if it can be sustained.

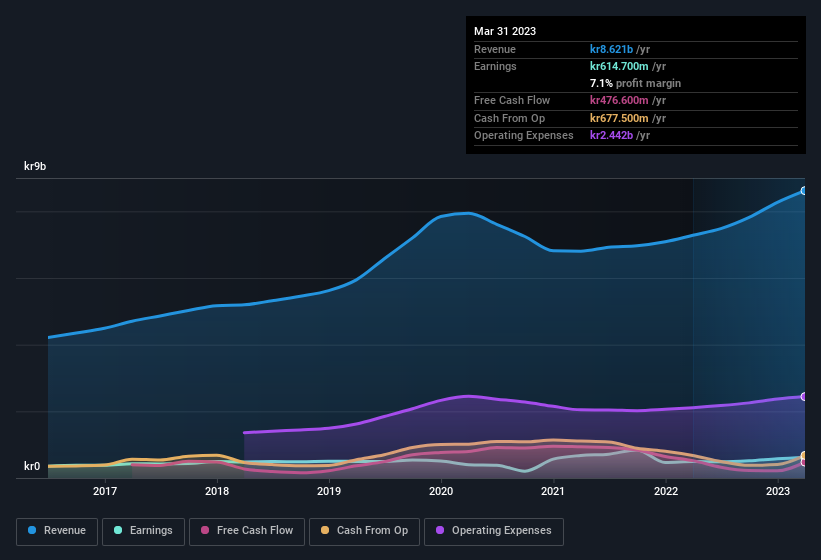

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note AB Fagerhult (publ.) achieved similar EBIT margins to last year, revenue grew by a solid 18% to kr8.6b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are AB Fagerhult (publ.) Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Despite some AB Fagerhult (publ.) insiders disposing of some shares, we note that there was kr525k more in buying interest among those who know the company best On balance, that's a good sign. We also note that it was the CEO, President & Acting Head of Business Area Infrastructure, Bodil Gallon, who made the biggest single acquisition, paying kr518k for shares at about kr49.11 each.

The good news, alongside the insider buying, for AB Fagerhult (publ.) bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have kr345m worth of shares. This considerable investment should help drive long-term value in the business. While their ownership only accounts for 2.9%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Is AB Fagerhult (publ.) Worth Keeping An Eye On?

One positive for AB Fagerhult (publ.) is that it is growing EPS. That's nice to see. In addition, insiders have been busy adding to their sizeable holdings in the company. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for AB Fagerhult (publ.) (1 can't be ignored) you should be aware of.

Keen growth investors love to see insider buying. Thankfully, AB Fagerhult (publ.) isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:FAG

Fagerhult Group

Designs, manufactures, and markets professional lighting solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives