Here's Why Epiroc (STO:EPI A) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Epiroc (STO:EPI A). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Quickly Is Epiroc Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Epiroc grew its EPS by 5.0% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

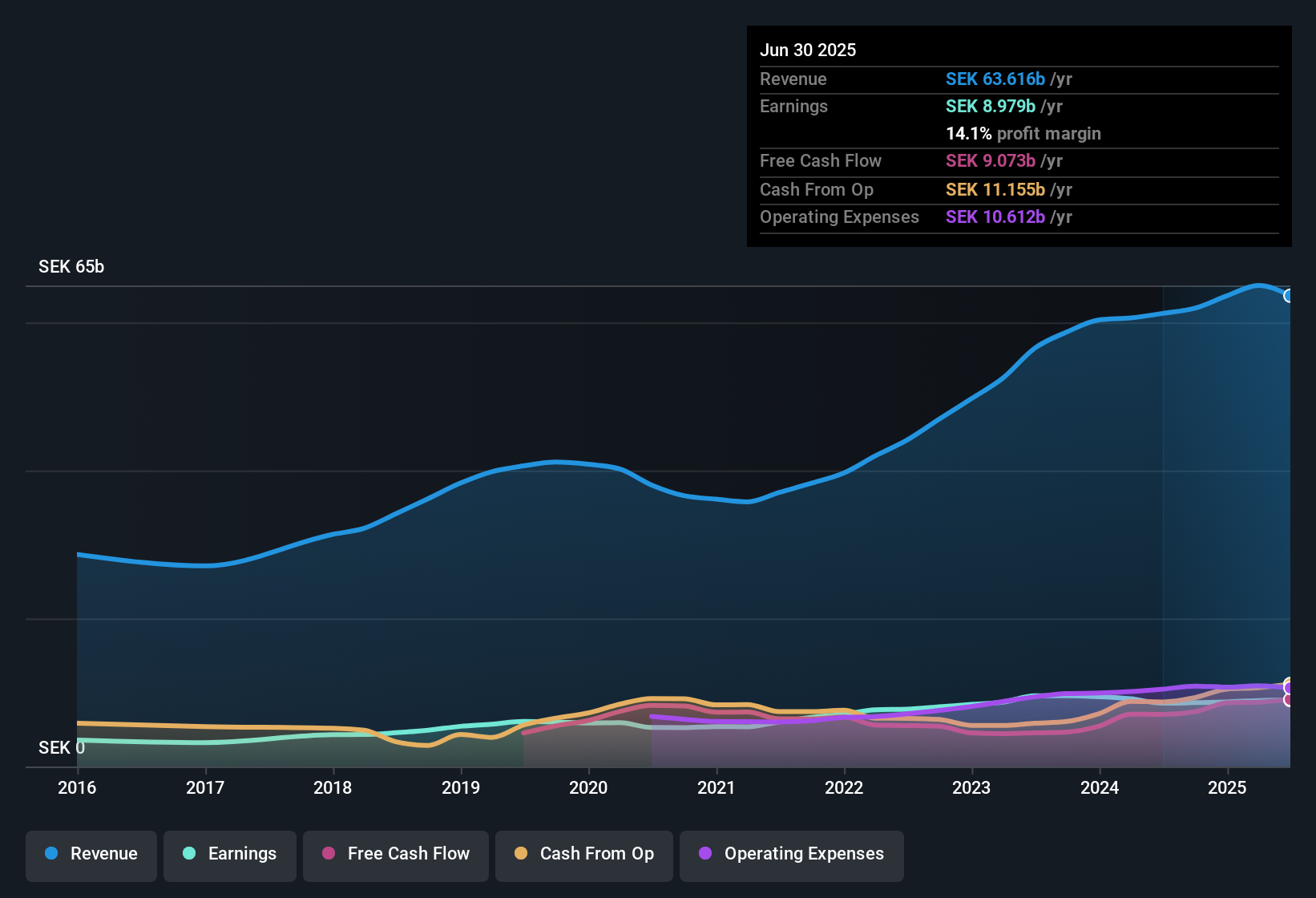

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Epiroc remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 3.9% to kr64b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

See our latest analysis for Epiroc

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Epiroc's forecast profits?

Are Epiroc Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it Epiroc shareholders can gain quiet confidence from the fact that insiders shelled out kr2.6m to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. We also note that it was the company insider, Luis Araneda, who made the biggest single acquisition, paying kr700k for shares at about kr195 each.

It's reassuring that Epiroc insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Namely, Epiroc has a very reasonable level of CEO pay. Our analysis has discovered that the median total compensation for the CEOs of companies like Epiroc, with market caps over kr75b, is about kr30m.

The Epiroc CEO received kr22m in compensation for the year ending December 2024. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Epiroc To Your Watchlist?

One positive for Epiroc is that it is growing EPS. That's nice to see. And there's more to Epiroc, with the insider buying and modest CEO pay being a great look for those with an eye on the company. The sum of all that, points to a quality business, and a genuine prospect for further research. If you think Epiroc might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

Keen growth investors love to see insider activity. Thankfully, Epiroc isn't the only one. You can see a a curated list of Swedish companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Epiroc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:EPI A

Epiroc

Develops and produces equipment for use in surface and underground applications in North America, Europe, South America, Europe, Africa, the Middle East, Asia, Australia, and India.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives