- Sweden

- /

- Construction

- /

- OM:EOLU B

Eolus Aktiebolag (publ) (STO:EOLU B) Consensus Forecasts Have Become A Little Darker Since Its Latest Report

There's been a major selloff in Eolus Aktiebolag (publ) (STO:EOLU B) shares in the week since it released its second-quarter report, with the stock down 22% to kr44.70. Revenues of kr364m beat estimates by a substantial 29% margin. Eolus Aktiebolag also reported a statutory loss of kr1.51 per share, which was roughly in line with what the analysts predicted. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

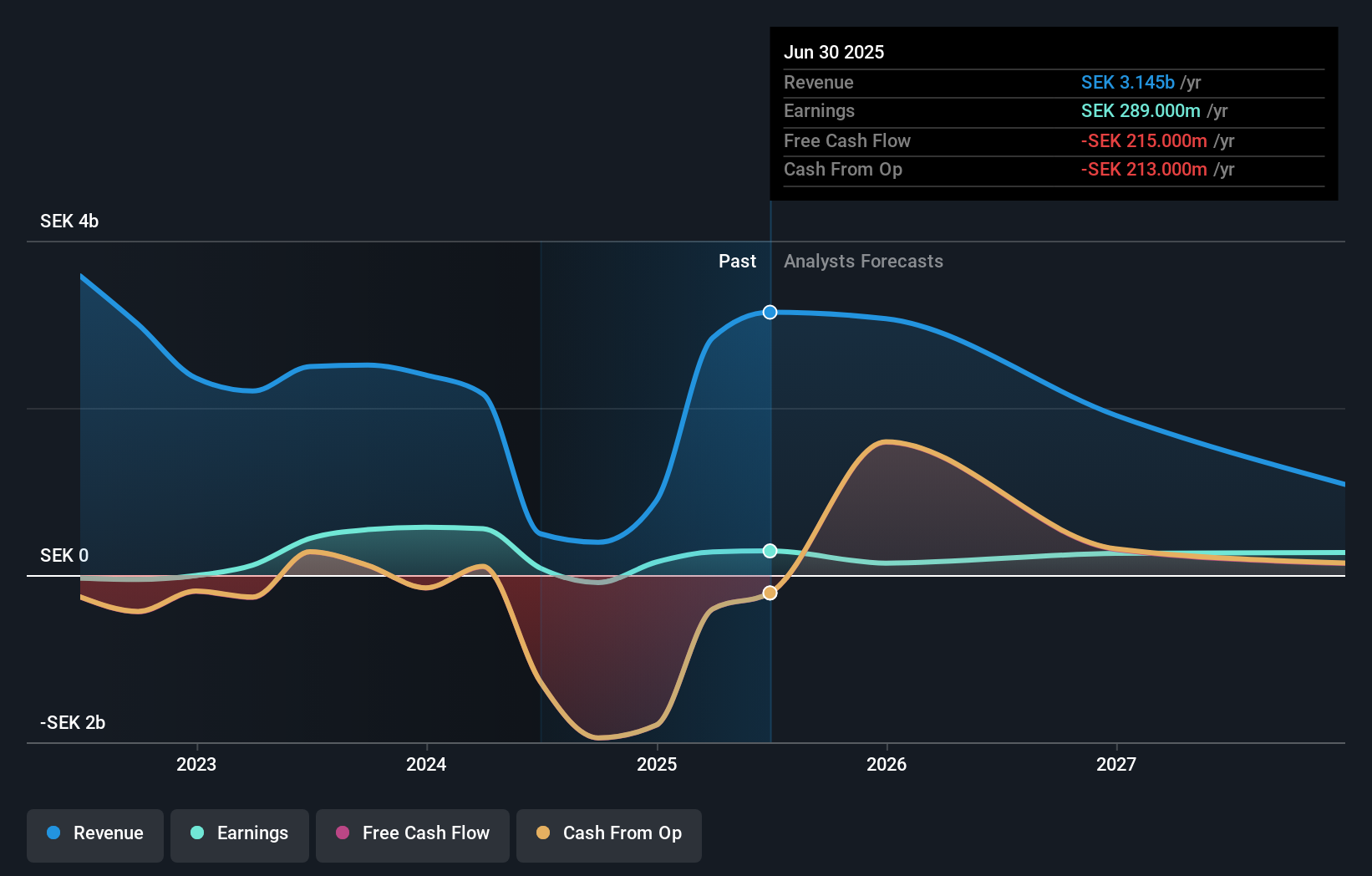

After the latest results, the consensus from Eolus Aktiebolag's twin analysts is for revenues of kr3.07b in 2025, which would reflect a discernible 2.5% decline in revenue compared to the last year of performance. Statutory earnings per share are expected to nosedive 50% to kr5.78 in the same period. Yet prior to the latest earnings, the analysts had been anticipated revenues of kr3.55b and earnings per share (EPS) of kr13.05 in 2025. Indeed, we can see that the analysts are a lot more bearish about Eolus Aktiebolag's prospects following the latest results, administering a substantial drop in revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for Eolus Aktiebolag

It'll come as no surprise then, to learn that the analysts have cut their price target 17% to kr85.00.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Eolus Aktiebolag's past performance and to peers in the same industry. Over the past five years, revenues have declined around 2.4% annually. Worse, forecasts are essentially predicting the decline to accelerate, with the estimate for an annualised 4.9% decline in revenue until the end of 2025. Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 4.4% annually. So it's pretty clear that, while it does have declining revenues, the analysts also expect Eolus Aktiebolag to suffer worse than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. On the negative side, they also downgraded their revenue estimates, and forecasts imply they will perform worse than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of Eolus Aktiebolag's future valuation.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for Eolus Aktiebolag going out as far as 2027, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Eolus Aktiebolag (at least 2 which are concerning) , and understanding these should be part of your investment process.

Valuation is complex, but we're here to simplify it.

Discover if Eolus Aktiebolag might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:EOLU B

Eolus Aktiebolag

Primarily engages in the development, construction, and operation of renewable energy assets in Sweden, Finland, the United States, Poland, Spain, and the Baltic states.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives