Stock Analysis

- Sweden

- /

- Construction

- /

- OM:ELTEL

If You Had Bought Eltel's (STO:ELTEL) Shares Five Years Ago You Would Be Down 74%

Statistically speaking, long term investing is a profitable endeavour. But unfortunately, some companies simply don't succeed. Zooming in on an example, the Eltel AB (publ) (STO:ELTEL) share price dropped 74% in the last half decade. That's an unpleasant experience for long term holders. There was little comfort for shareholders in the last week as the price declined a further 4.1%.

View our latest analysis for Eltel

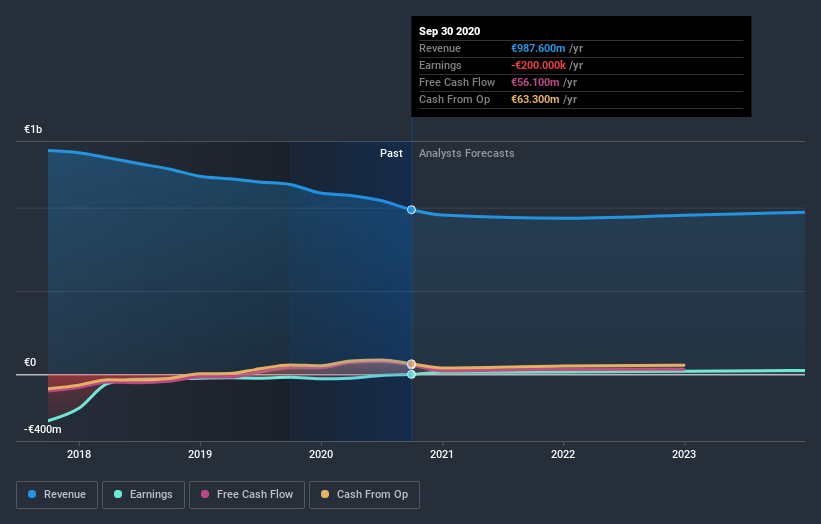

Eltel isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Eltel reduced its trailing twelve month revenue by 5.3% for each year. That's not what investors generally want to see. The share price fall of 12% (per year, over five years) is a stern reminder that money-losing companies are expected to grow revenue. It takes a certain kind of mental fortitude (or recklessness) to buy shares in a company that loses money and doesn't grow revenue. That is not really what the successful investors we know aim for.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Eltel's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Eltel's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Eltel's TSR, which was a 55% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

It's good to see that Eltel has rewarded shareholders with a total shareholder return of 22% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 9% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

When trading Eltel or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Eltel is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:ELTEL

Eltel

Provides services for the power and communication infrastructure networks in Finland, Sweden, Luxembourg, the United Kingdom, the United States, and internationally.

Undervalued with excellent balance sheet.