Stock Analysis

Swedish Exchange Showcases Three Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets and heightened political uncertainties in Europe, the Swedish stock exchange continues to offer intriguing opportunities for investors. Particularly noteworthy are growth companies with high insider ownership, which often signal strong confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| BioArctic (OM:BIOA B) | 35.1% | 50.9% |

| Sileon (OM:SILEON) | 33.3% | 109.3% |

| Biovica International (OM:BIOVIC B) | 12.9% | 73.8% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| InCoax Networks (OM:INCOAX) | 18% | 104.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| Yubico (OM:YUBICO) | 37.5% | 43.8% |

| SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

Let's dive into some prime choices out of from the screener.

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fortnox AB (publ) offers financial and administrative software solutions tailored for small and medium-sized businesses, accounting firms, and organizations, with a market capitalization of SEK 39.03 billion.

Operations: The company generates revenue through various segments including Core Products at SEK 698 million, Entrepreneurship at SEK 356 million, The Agency at SEK 327 million, and Marketplaces at SEK 150 million.

Insider Ownership: 21%

Fortnox, a Swedish growth company with significant insider ownership, has demonstrated robust financial performance and promising forecasts. Over the past year, earnings surged by 58.8%, with recent quarterly reports showing net income rising from SEK 106 million to SEK 149 million. Looking ahead, earnings are expected to grow at an annual rate of 21.1%, outpacing the Swedish market's average of 13.8%. Despite this strong growth trajectory in profits and revenue—which is also forecasted to exceed market trends—insider transactions have been modest recently.

- Get an in-depth perspective on Fortnox's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Fortnox's current price could be inflated.

AB Sagax (OM:SAGA A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company with operations across Sweden, Finland, France, Benelux, Spain, Germany, and other European countries, boasting a market capitalization of approximately SEK 95.68 billion.

Operations: The company generates its revenue primarily from real estate rentals, totaling SEK 4.47 billion.

Insider Ownership: 28.3%

AB Sagax, a Swedish company with substantial insider ownership, has shown strong financial growth and holds promising forecasts. Over the past year, earnings increased by 53.3%, and are expected to grow at an annual rate of 33.5%, which is significantly higher than the Swedish market average of 13.8%. However, revenue growth projections are modest at 9.3% annually, though still above the market's 1.7%. Recent activities include issuing a €500 million green bond to support corporate initiatives under its Green Finance Framework.

- Delve into the full analysis future growth report here for a deeper understanding of AB Sagax.

- In light of our recent valuation report, it seems possible that AB Sagax is trading beyond its estimated value.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Truecaller AB (publ) operates globally, developing and publishing mobile caller ID applications for both individuals and businesses in regions including India, the Middle East, and Africa, with a market capitalization of approximately SEK 13.29 billion.

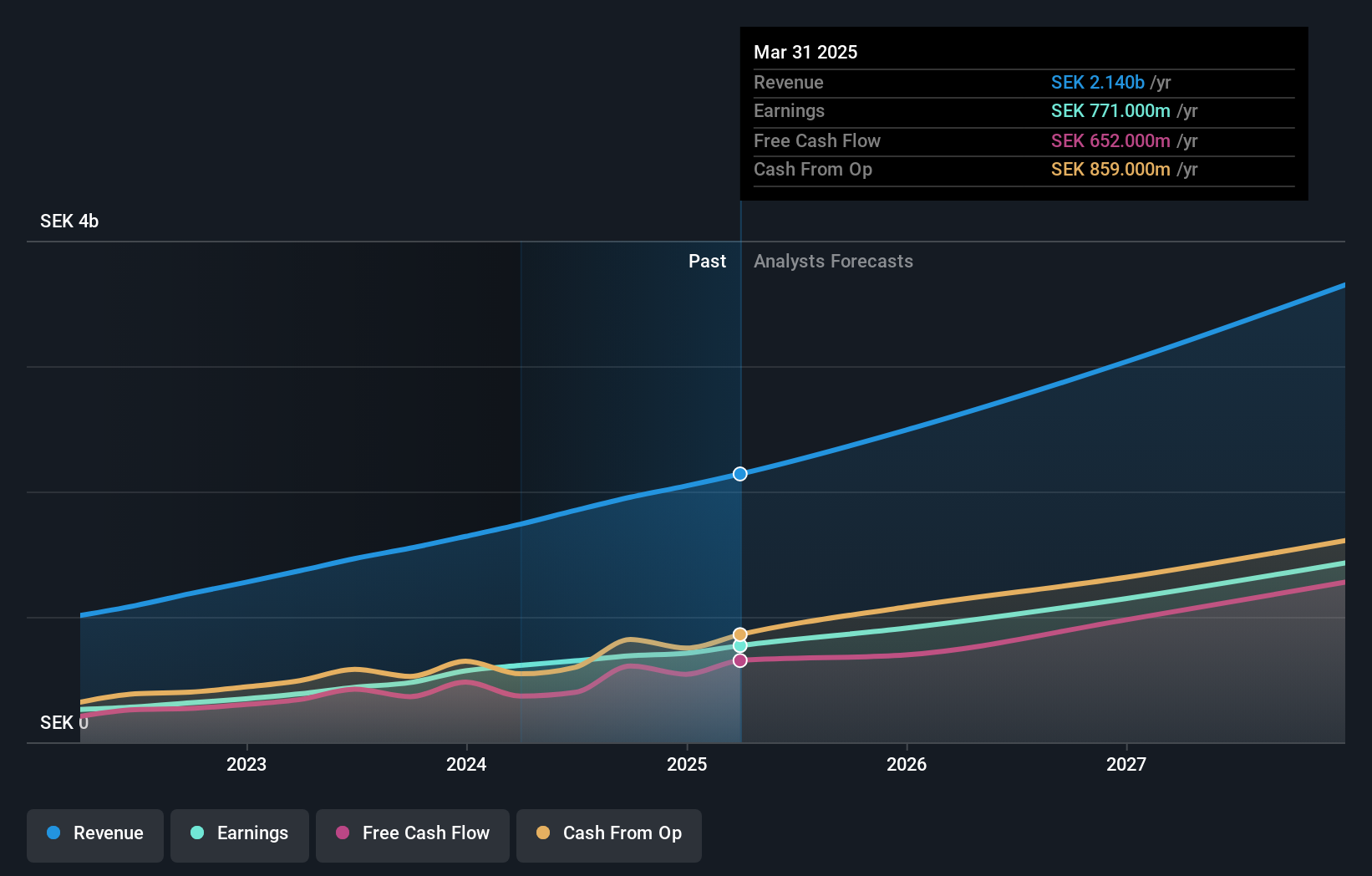

Operations: The company generates revenue primarily through its Communications Software segment, which earned SEK 1.78 billion.

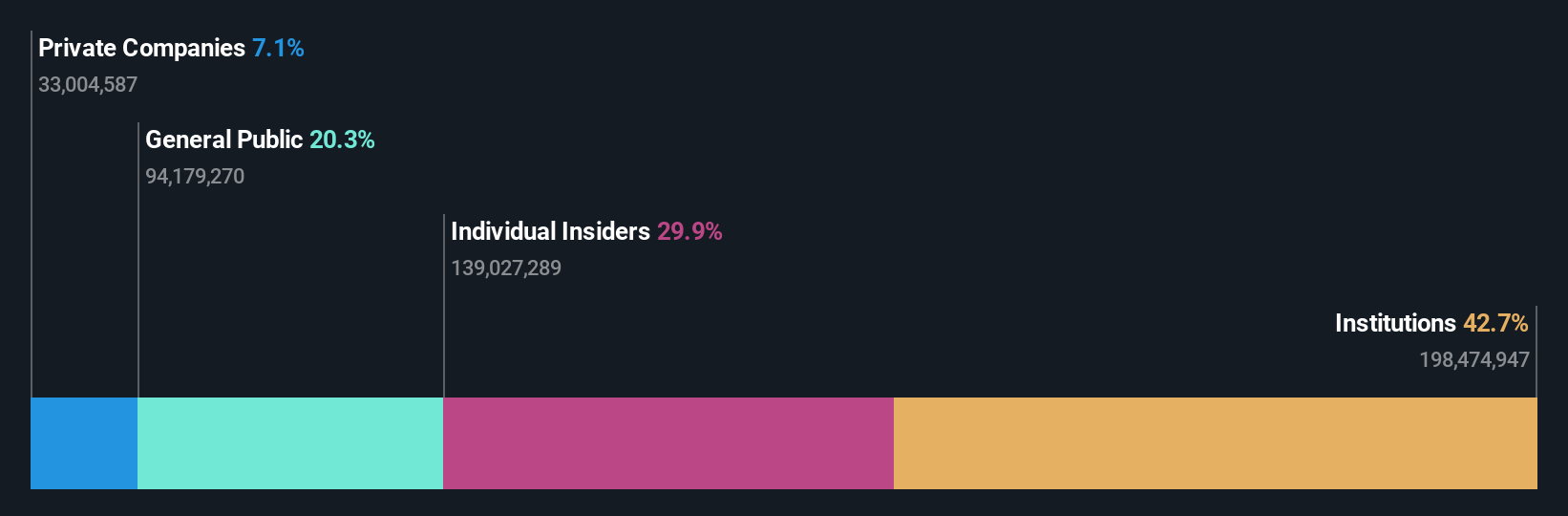

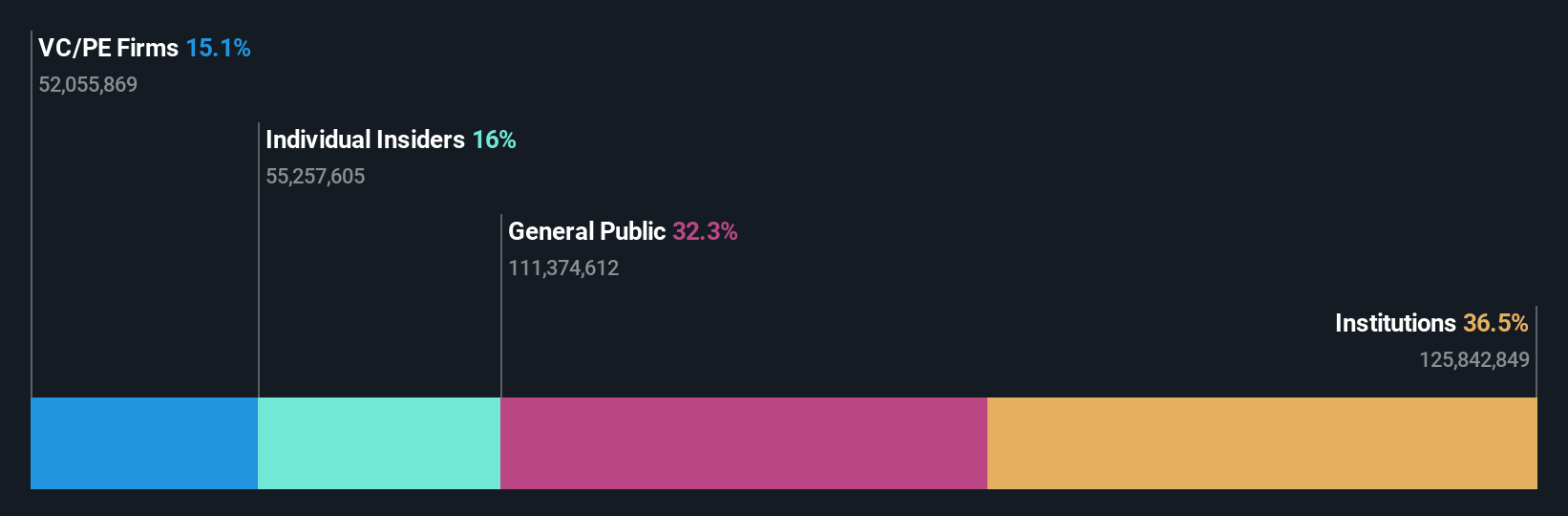

Insider Ownership: 14.7%

Truecaller, a Swedish growth company with notable insider ownership, has recently enhanced its product offerings with the AI Call Scanner to combat AI-generated voice scams. Despite trading below analyst price targets and expected to rise by 53.6%, Truecaller's revenue growth is projected at 18% annually, slightly under the significant mark of 20%. Insider activity shows more buying than selling in the past three months, reflecting confidence from those within. The company also maintains a very high forecasted Return on Equity at 43.8% in three years.

- Navigate through the intricacies of Truecaller with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Truecaller is trading behind its estimated value.

Key Takeaways

- Click this link to deep-dive into the 86 companies within our Fast Growing Swedish Companies With High Insider Ownership screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Truecaller is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TRUE B

Truecaller

Develops and publishes mobile caller ID applications for individuals and business in India, the Middle East, Africa, and internationally.

Very undervalued with flawless balance sheet.