Ecoclime Group AB (publ) (STO:ECC B) Stock's 28% Dive Might Signal An Opportunity But It Requires Some Scrutiny

To the annoyance of some shareholders, Ecoclime Group AB (publ) (STO:ECC B) shares are down a considerable 28% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 60% share price decline.

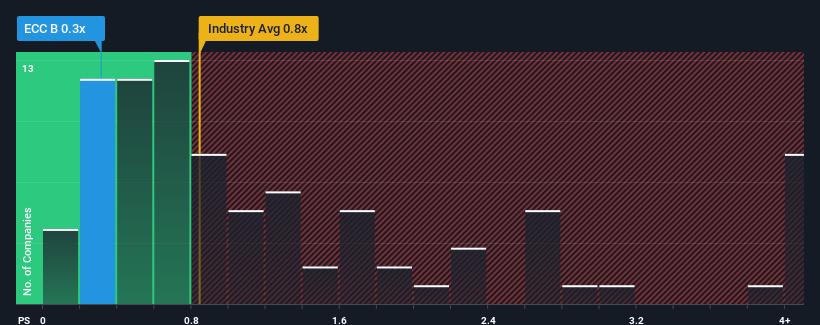

Following the heavy fall in price, when close to half the companies operating in Sweden's Building industry have price-to-sales ratios (or "P/S") above 1.3x, you may consider Ecoclime Group as an enticing stock to check out with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Ecoclime Group

What Does Ecoclime Group's Recent Performance Look Like?

Recent times haven't been great for Ecoclime Group as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ecoclime Group.How Is Ecoclime Group's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Ecoclime Group's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.8% last year. Pleasingly, revenue has also lifted 97% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 4.0% during the coming year according to the dual analysts following the company. With the industry predicted to deliver 5.2% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Ecoclime Group's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Ecoclime Group's P/S?

Ecoclime Group's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It looks to us like the P/S figures for Ecoclime Group remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Ecoclime Group that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Ecoclime Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ECC B

Ecoclime Group

Provides solutions for extraction, recycling, storage, and distribution of thermal energy in properties in Sweden.

Flawless balance sheet slight.

Market Insights

Community Narratives