Top Swedish Growth Stocks With High Insider Ownership In August 2024

Reviewed by Simply Wall St

As global markets grapple with economic uncertainties and shifting investor sentiment, Sweden's stock market has shown resilience, attracting attention for its stable growth sectors. In this environment, companies with high insider ownership often signal strong confidence from those closest to the business, making them compelling options for investors seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Biovica International (OM:BIOVIC B) | 18.7% | 73.8% |

| Yubico (OM:YUBICO) | 37.5% | 43.8% |

| BioArctic (OM:BIOA B) | 34% | 104.2% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| InCoax Networks (OM:INCOAX) | 18.1% | 104.9% |

| Calliditas Therapeutics (OM:CALTX) | 12.7% | 52.9% |

| SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

| edyoutec (NGM:EDYOU) | 13.4% | 63.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

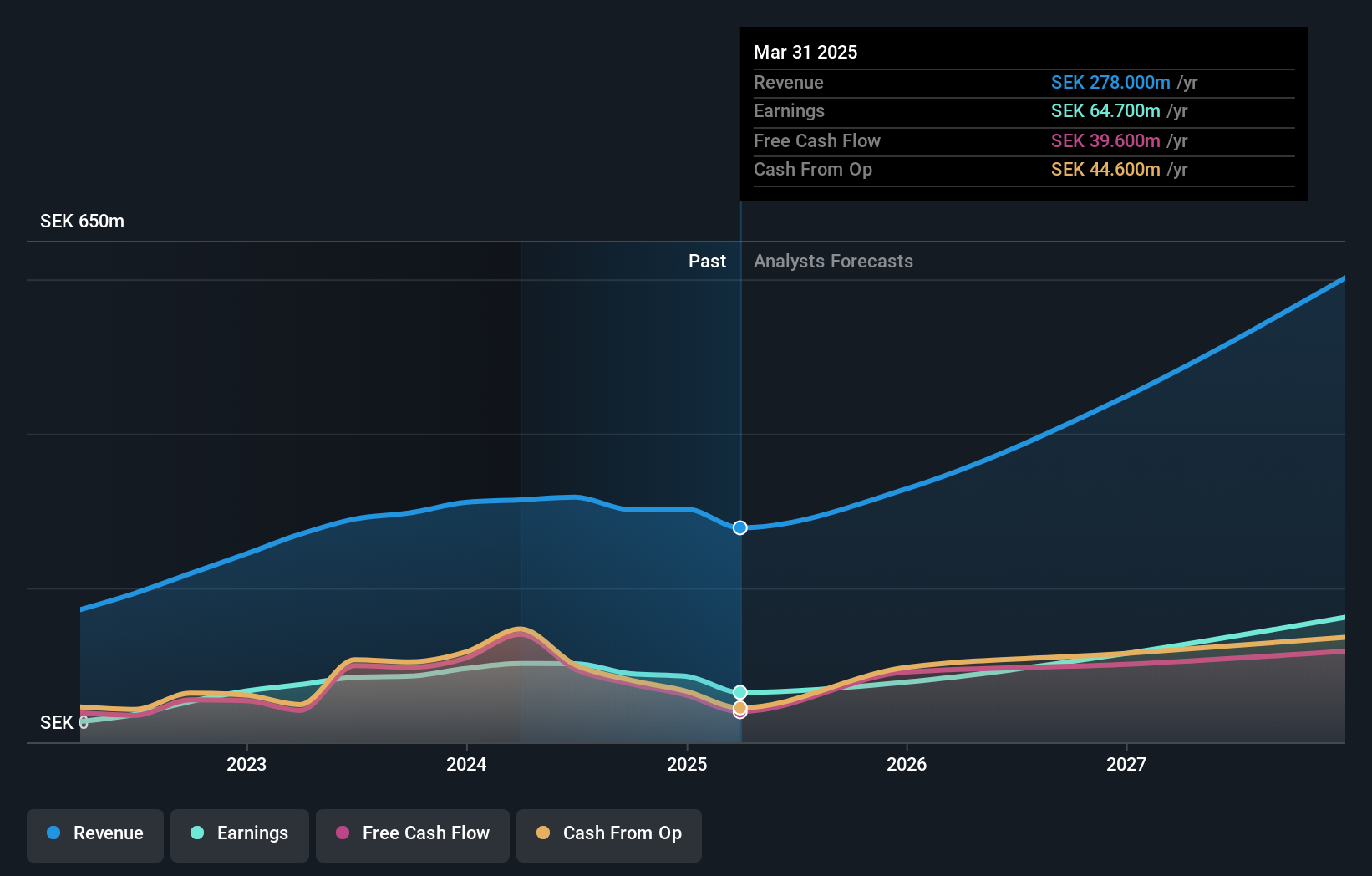

CTT Systems (OM:CTT)

Simply Wall St Growth Rating: ★★★★★★

Overview: CTT Systems AB (publ) designs, manufactures, and sells humidity control systems for aircraft in Sweden, Denmark, France, the United States, and internationally with a market cap of SEK3.41 billion.

Operations: The company generates revenue primarily from its Aerospace & Defense segment, which amounted to SEK317.70 million.

Insider Ownership: 16.9%

Earnings Growth Forecast: 24.8% p.a.

CTT Systems, a Swedish growth company with high insider ownership, is forecast to see significant annual earnings growth of 24.8% and revenue growth of 21.9% over the next three years, surpassing market averages. Despite an unstable dividend track record, the company's return on equity is expected to be very high at 44.4%. Recent insider activity shows substantial buying, indicating confidence in future performance. CTT's recent sales guidance and strong airline interest in its humidifier products further support its positive outlook.

- Click to explore a detailed breakdown of our findings in CTT Systems' earnings growth report.

- Upon reviewing our latest valuation report, CTT Systems' share price might be too pessimistic.

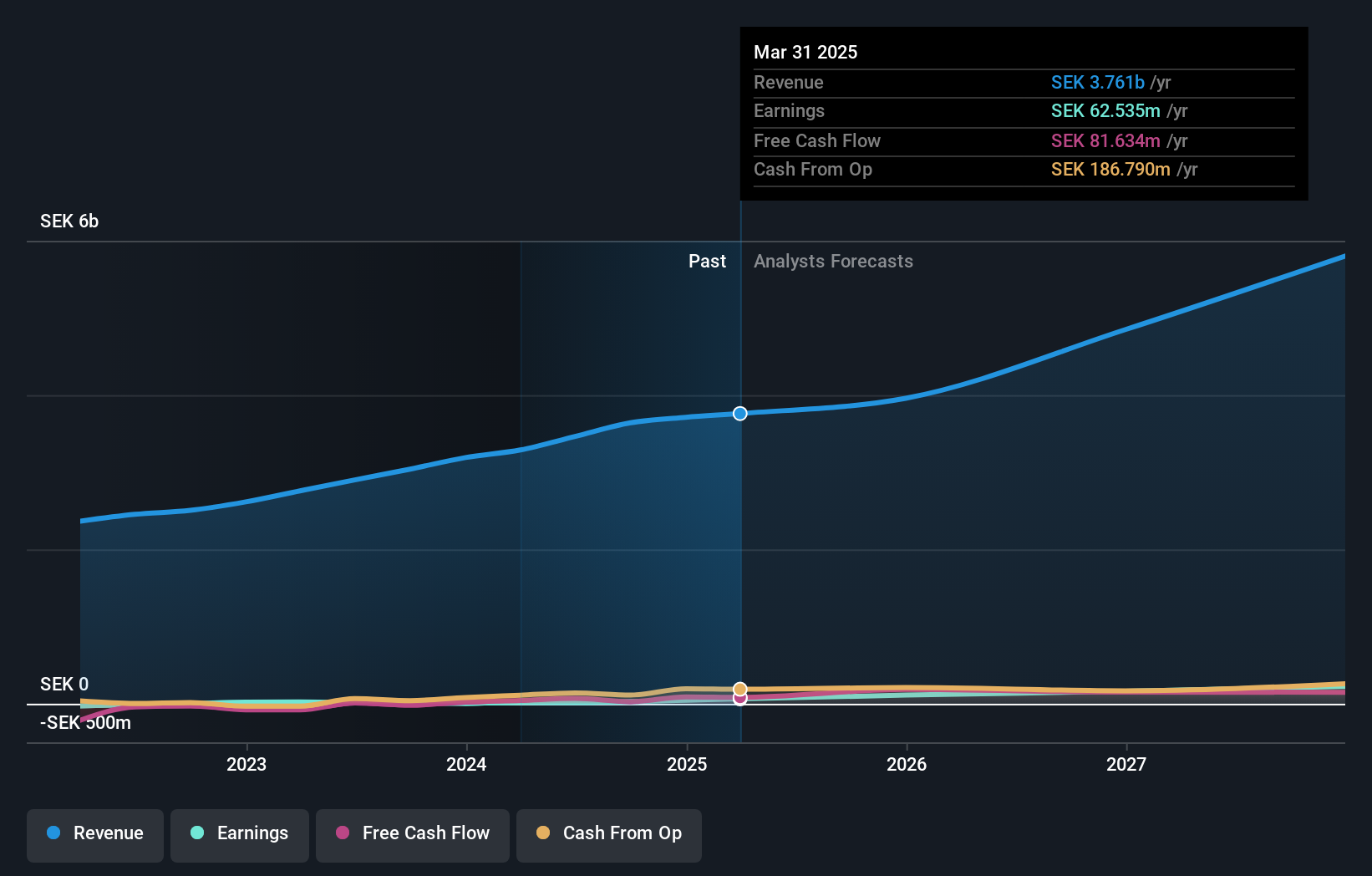

Haypp Group (OM:HAYPP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Haypp Group AB (publ) is an online retailer specializing in tobacco-free nicotine pouches and snus products, operating across Sweden, Norway, the rest of Europe, and the United States with a market cap of SEK2.93 billion.

Operations: The company's revenue segments are divided into Core (SEK2.42 billion) and Growth (SEK834.20 million).

Insider Ownership: 10.9%

Earnings Growth Forecast: 88.6% p.a.

Haypp Group, experiencing substantial insider ownership, is forecasted to achieve significant annual earnings growth of 88.6%, outpacing the Swedish market's 15.8%. Despite a slight decline in profit margins from 0.8% to 0.5% over the past year and recent shareholder dilution, revenue is expected to grow at a solid rate of 16.5% annually. Recent board additions include Deppak Mishra and Adam Schatz, potentially enhancing strategic direction ahead of their Q2 2024 earnings call on August 9th.

- Click here and access our complete growth analysis report to understand the dynamics of Haypp Group.

- Our comprehensive valuation report raises the possibility that Haypp Group is priced higher than what may be justified by its financials.

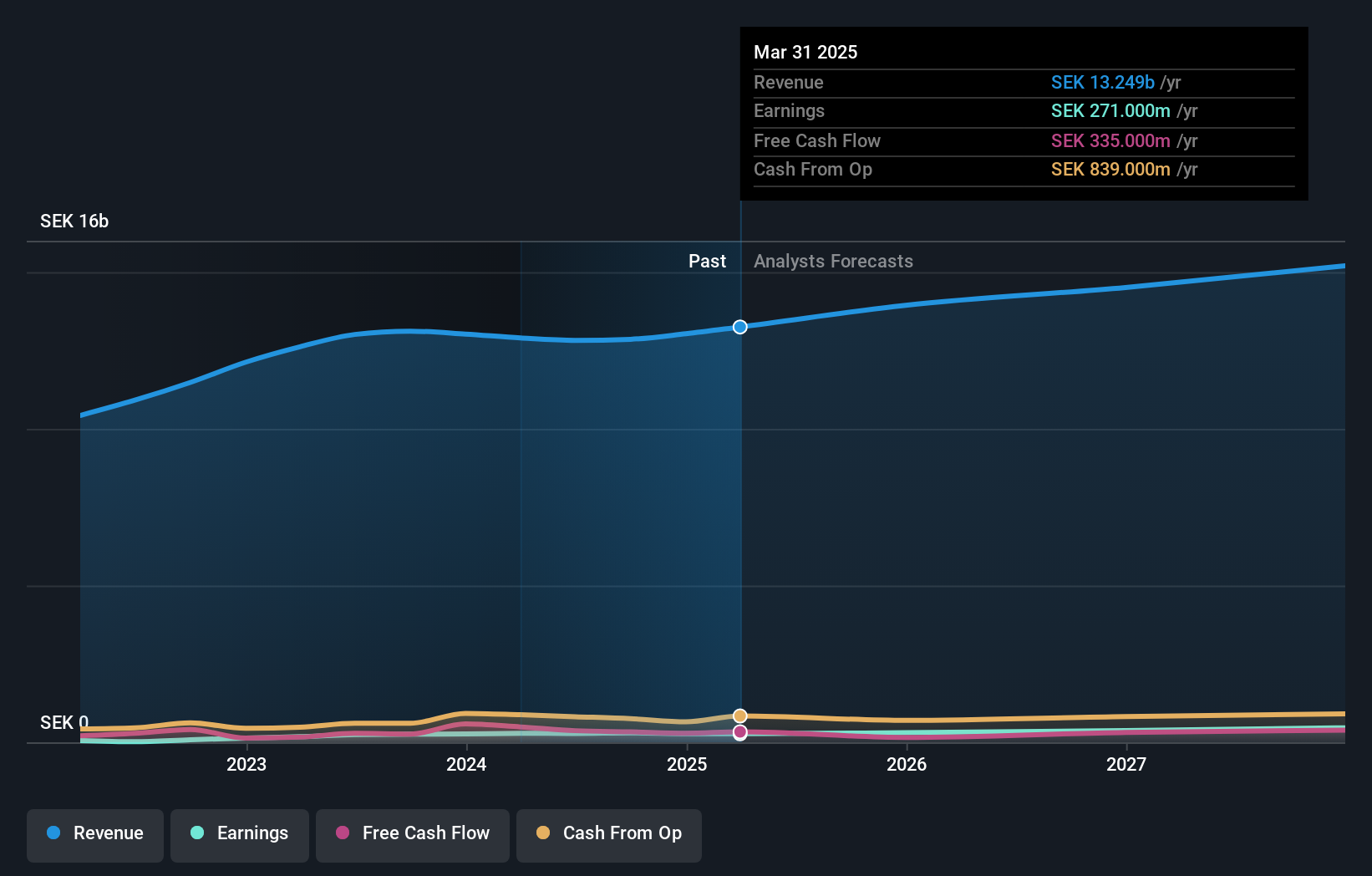

Scandi Standard (OM:SCST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Scandi Standard AB (publ) produces and sells chilled, frozen, and ready-to-eat chicken products across various regions including Sweden, Norway, Ireland, Denmark, Finland, Germany, the United Kingdom, rest of Europe, and internationally with a market cap of SEK5.49 billion.

Operations: Scandi Standard AB generates revenue primarily from its Ready-To-Cook segment at SEK9.70 billion and its Ready-To-Eat segment at SEK2.61 billion.

Insider Ownership: 14.6%

Earnings Growth Forecast: 20.4% p.a.

Scandi Standard, with significant insider buying in the past three months, is forecasted to achieve substantial annual earnings growth of 20.4%, surpassing the Swedish market's average. Despite a high debt level and an unstable dividend track record, the company trades at 48.1% below its estimated fair value. Recent developments include securing a SEK 3,200 million sustainability-linked bank loan to refinance existing debt and support strategic growth initiatives.

- Take a closer look at Scandi Standard's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Scandi Standard shares in the market.

Taking Advantage

- Investigate our full lineup of 87 Fast Growing Swedish Companies With High Insider Ownership right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SCST

Scandi Standard

Produces and sells chilled, frozen, and ready-to-eat chicken products in Sweden, Norway, Ireland, Denmark, Finland, Germany, the United Kingdom, rest of Europe, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives