- Sweden

- /

- Aerospace & Defense

- /

- OM:CTT

Discovering Europe's Undiscovered Gems in July 2025

Reviewed by Simply Wall St

In recent weeks, the European market has shown mixed performance, with the pan-European STOXX Europe 600 Index remaining relatively flat and major indexes like France’s CAC 40 and Italy’s FTSE MIB posting modest gains. Amidst this backdrop of cautious optimism and steady inflation rates in the eurozone, investors are increasingly looking towards small-cap stocks that could offer unique opportunities for growth. Identifying a good stock often involves assessing its potential to thrive in current economic conditions while offering innovative solutions or products that meet emerging market demands.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Deutsche Balaton | 5.64% | -7.61% | -16.14% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

GVS (BIT:GVS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: GVS S.p.A. is a company that manufactures and distributes filter solutions for healthcare, life sciences, energy, mobility, and health and safety sectors both in Italy and globally, with a market cap of approximately €1.03 billion.

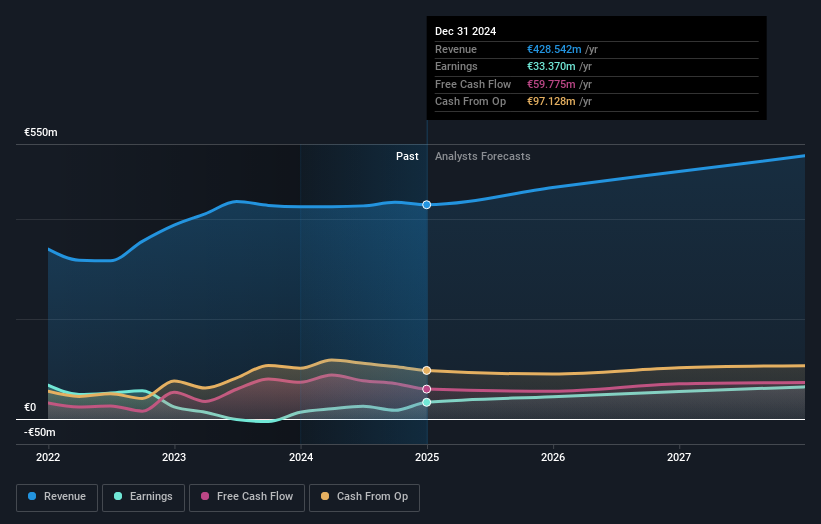

Operations: GVS generates revenue primarily from its Plastics & Rubber segment, contributing €431.86 million. The company has a market cap of approximately €1.03 billion.

GVS, a notable player in the medical equipment sector, has shown robust earnings growth of 25.7% over the past year, outpacing its industry peers. The company's debt to equity ratio improved significantly from 138.3% to 63.4% over five years, yet its net debt to equity remains high at 50.4%. Despite a €19.7 million one-off loss affecting recent results, GVS's interest payments are well-covered by EBIT at 4.5 times coverage. Recently announced share repurchase plans aim to enhance market liquidity and efficiency, reflecting strategic financial management amidst ongoing profitability and positive cash flow dynamics.

- Get an in-depth perspective on GVS' performance by reading our health report here.

Explore historical data to track GVS' performance over time in our Past section.

Paul Hartmann (DB:PHH2)

Simply Wall St Value Rating: ★★★★★☆

Overview: Paul Hartmann AG is a company that manufactures and sells medical and care products across various regions including Europe, the Middle East, Africa, Asia-Pacific, and the Americas, with a market cap of approximately €870.18 million.

Operations: Paul Hartmann AG generates revenue primarily from four segments: Wound Care (€608.93 million), Infection Management (€518.89 million), Incontinence Management (€769.92 million), and Complementary divisions (€510.18 million). The company's net profit margin exhibits a noteworthy trend, reflecting its financial efficiency in converting sales into actual profit after all expenses are accounted for.

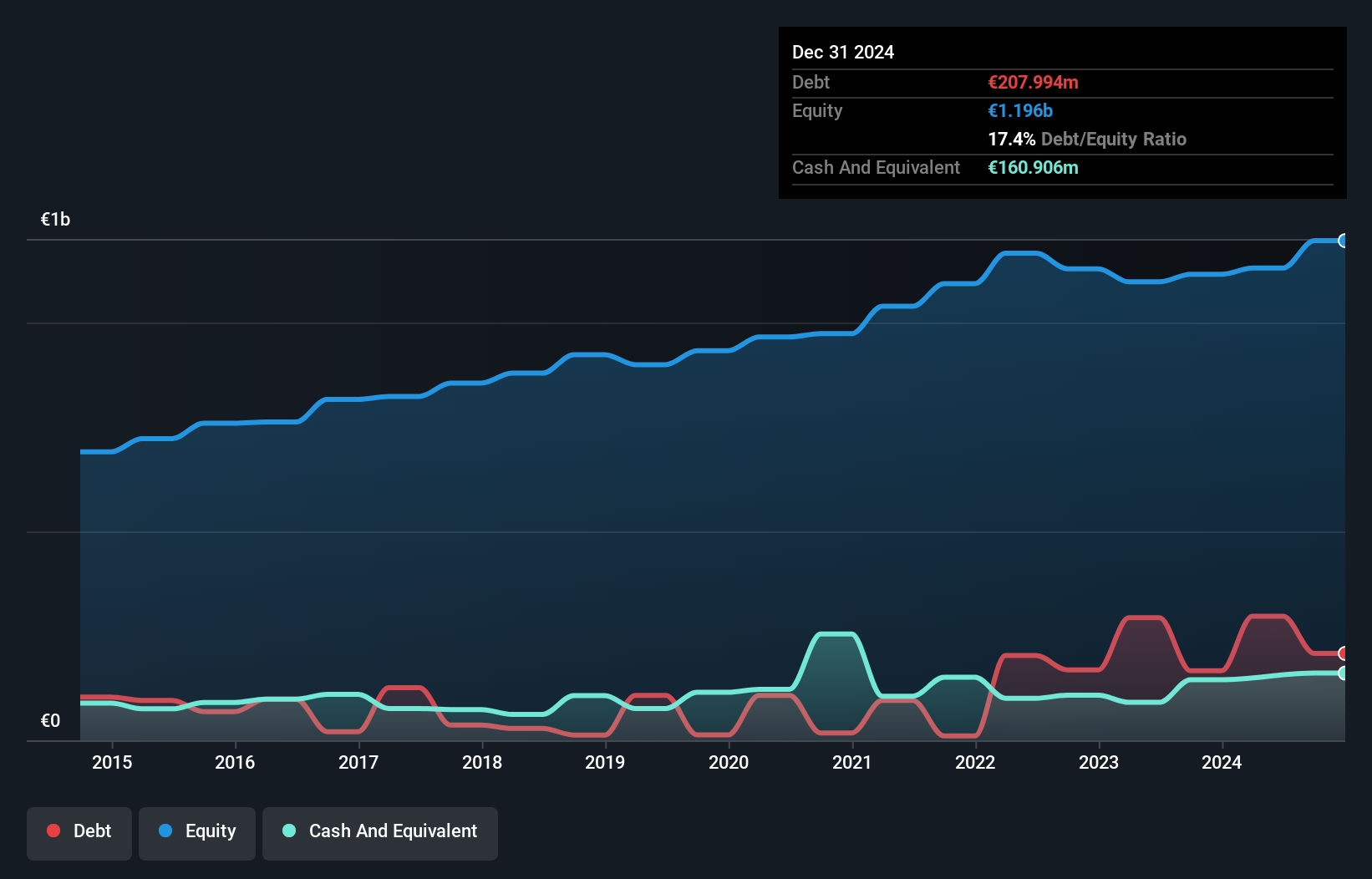

With a promising profile in the medical equipment sector, Paul Hartmann's recent performance is noteworthy. Despite a 12% annual earnings reduction over five years, the company saw an impressive 281.6% earnings growth last year, outpacing industry averages. This surge highlights its robust operational capabilities and potential for recovery. The debt to equity ratio has risen from 1.4% to 17.4%, yet remains manageable with interest payments well-covered at 10.4 times EBIT, indicating financial stability. Valuation appears attractive with a price-to-earnings ratio of 8.1x compared to the broader German market's 19x, suggesting potential value for investors seeking opportunities in smaller firms within Europe’s healthcare landscape.

- Click to explore a detailed breakdown of our findings in Paul Hartmann's health report.

Review our historical performance report to gain insights into Paul Hartmann's's past performance.

CTT Systems (OM:CTT)

Simply Wall St Value Rating: ★★★★★★

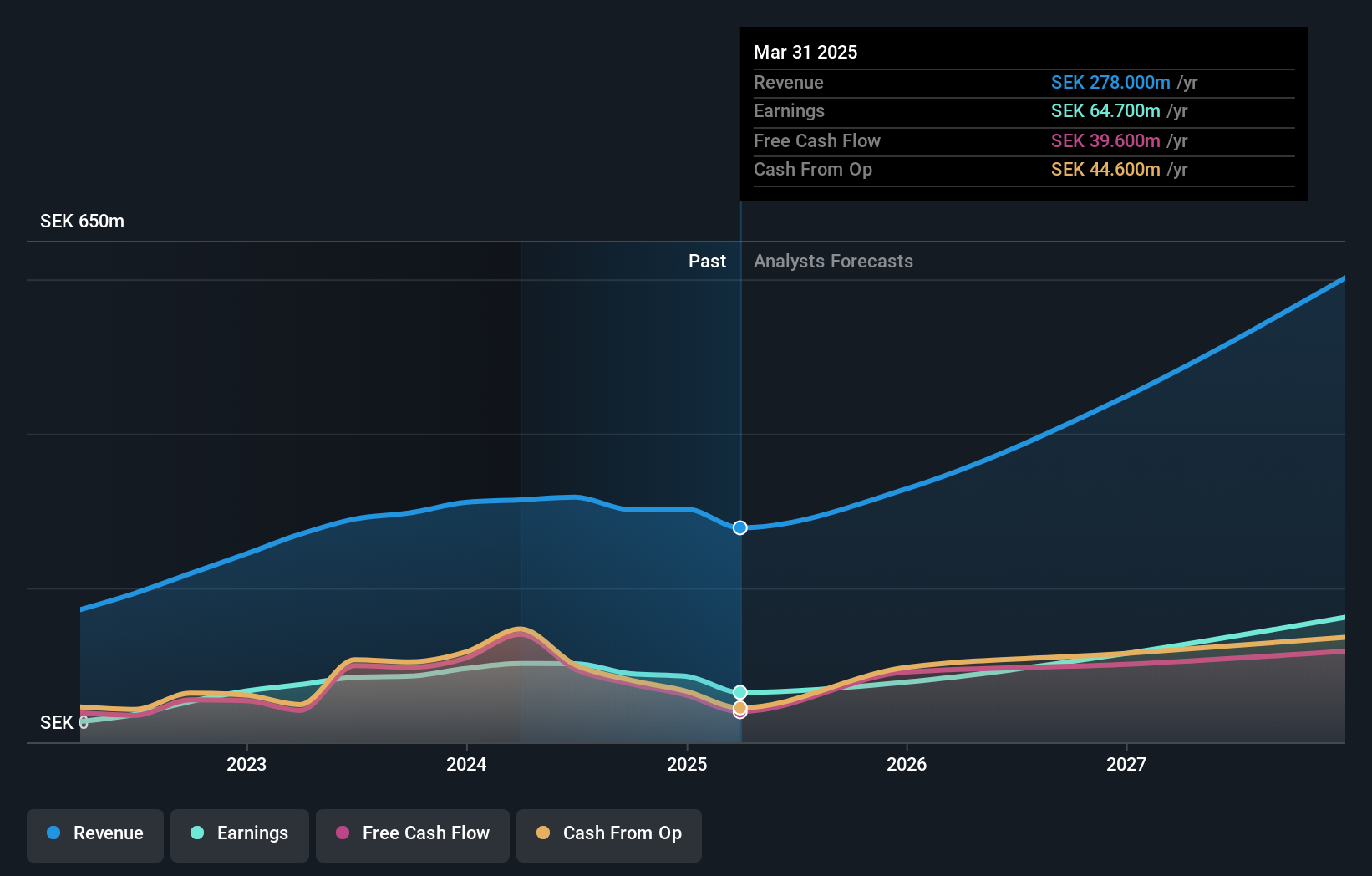

Overview: CTT Systems AB (publ) specializes in providing humidity control systems for aircraft across Sweden, Denmark, France, the United States, and other international markets with a market capitalization of approximately SEK3.16 billion.

Operations: The primary revenue stream for CTT Systems AB comes from its Aerospace & Defense segment, generating SEK278 million. The company's financial performance is reflected in its market capitalization of around SEK3.16 billion.

CTT Systems, a small player in the Aerospace & Defense sector, is trading at 40.4% below its estimated fair value, suggesting potential undervaluation. Despite facing a challenging year with earnings dropping by 36.6%, it boasts high-quality past earnings and has more cash than total debt, indicating robust financial health. The company's EBIT covers interest payments 18 times over, ensuring strong debt management. Recent performance shows first-quarter sales of SEK 54.6 million and net income of SEK 3.7 million compared to SEK 24.5 million last year, reflecting some operational hurdles but also opportunities for future growth with projected annual earnings growth of over 34%.

- Dive into the specifics of CTT Systems here with our thorough health report.

Examine CTT Systems' past performance report to understand how it has performed in the past.

Make It Happen

- Take a closer look at our European Undiscovered Gems With Strong Fundamentals list of 321 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CTT

CTT Systems

Provides humidity control systems for aircraft in Sweden, Denmark, France, the United States, and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives