The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that ByggPartner Gruppen AB (publ) (STO:BYGGP) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for ByggPartner Gruppen

How Much Debt Does ByggPartner Gruppen Carry?

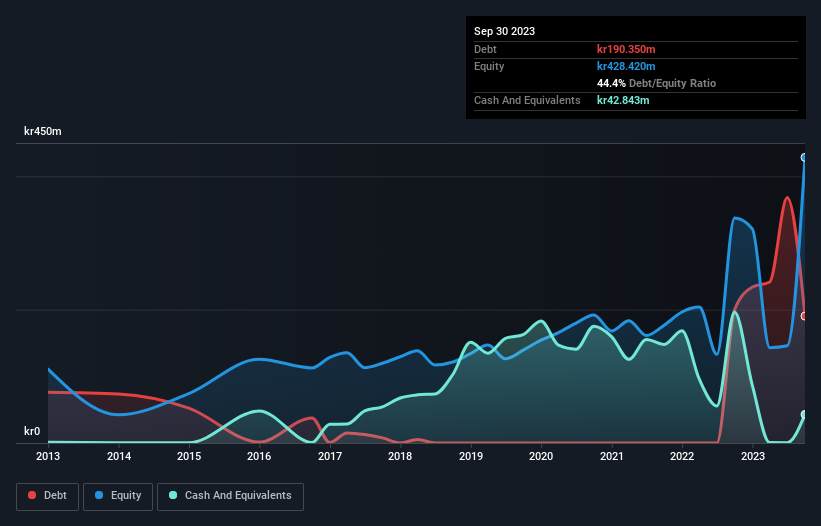

You can click the graphic below for the historical numbers, but it shows that ByggPartner Gruppen had kr190.4m of debt in September 2023, down from kr200.0m, one year before. On the flip side, it has kr42.8m in cash leading to net debt of about kr147.5m.

A Look At ByggPartner Gruppen's Liabilities

Zooming in on the latest balance sheet data, we can see that ByggPartner Gruppen had liabilities of kr1.18b due within 12 months and liabilities of kr249.8m due beyond that. On the other hand, it had cash of kr42.8m and kr961.3m worth of receivables due within a year. So its liabilities total kr429.7m more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of kr629.4m, so it does suggest shareholders should keep an eye on ByggPartner Gruppen's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. There's no doubt that we learn most about debt from the balance sheet. But it is ByggPartner Gruppen's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, ByggPartner Gruppen reported revenue of kr5.0b, which is a gain of 59%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Even though ByggPartner Gruppen managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Indeed, it lost a very considerable kr195m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled kr230m in negative free cash flow over the last twelve months. So suffice it to say we consider the stock very risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 3 warning signs with ByggPartner Gruppen (at least 2 which are a bit concerning) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you're looking to trade ByggPartner Gruppen, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ByggPartner Gruppen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BYGGP

Adequate balance sheet and fair value.