- Sweden

- /

- Trade Distributors

- /

- OM:BEIJ B

Assessing Beijer Ref (OM:BEIJ B)'s Valuation After Recent Subtle Share Price Movement

Reviewed by Simply Wall St

If you have been tracking Beijer Ref (OM:BEIJ B), you may have noticed that there was a recent price move which could make investors pause and wonder what’s ahead. While there’s no dramatic event or headline grabbing the spotlight, sometimes these periods are when evaluation matters most. Steady performers can make subtle shifts that fly under the radar, and for investors deciding what to do next, it is a good time to consider what the numbers are telling us rather than waiting on a major announcement to sway sentiment.

Looking at the bigger picture, Beijer Ref’s shares have delivered a mix of progress and setbacks. Over the year, the stock is almost flat despite pockets of volatility, with mild gains in the past week and month offset by a small pullback in the past month. Those watching closely will know the past three years have led to much stronger returns, hinting at underlying growth potential even as recent momentum has cooled. The company continues to report positive annual growth in both revenue and net income, indicating an underlying business that is powering through shifting market cycles.

With this in mind, is the current level a launch pad for future upside, or is the market simply factoring in all the potential already? Let’s break down the valuation and see where things stand.

Most Popular Narrative: 8.4% Undervalued

Based on the most widely followed analyst narrative, Beijer Ref is trading at a discount to its projected fair value, suggesting room for upside.

"Ongoing growth in the proprietary/private label product portfolio (e.g., Sinclair) and successful rollout into new markets (notably the U.S.) are expected to structurally improve gross margins over time. Own brands generate higher profitability than third-party products, supporting long-term EBITDA and net margin expansion."

What’s fueling this bullish outlook? There is a playbook behind Beijer Ref’s valuation that you have not seen yet. Want to discover the bold financial assumptions, including how future profits and margins are expected to evolve? Find out what drives this narrative and see if the consensus matches your own expectations.

Result: Fair Value of SEK180.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if regulatory costs rise unexpectedly or if integration in new markets falters, these risks could quickly shift the outlook for Beijer Ref’s future growth.

Find out about the key risks to this Beijer Ref narrative.Another View: How Does Market Pricing Compare?

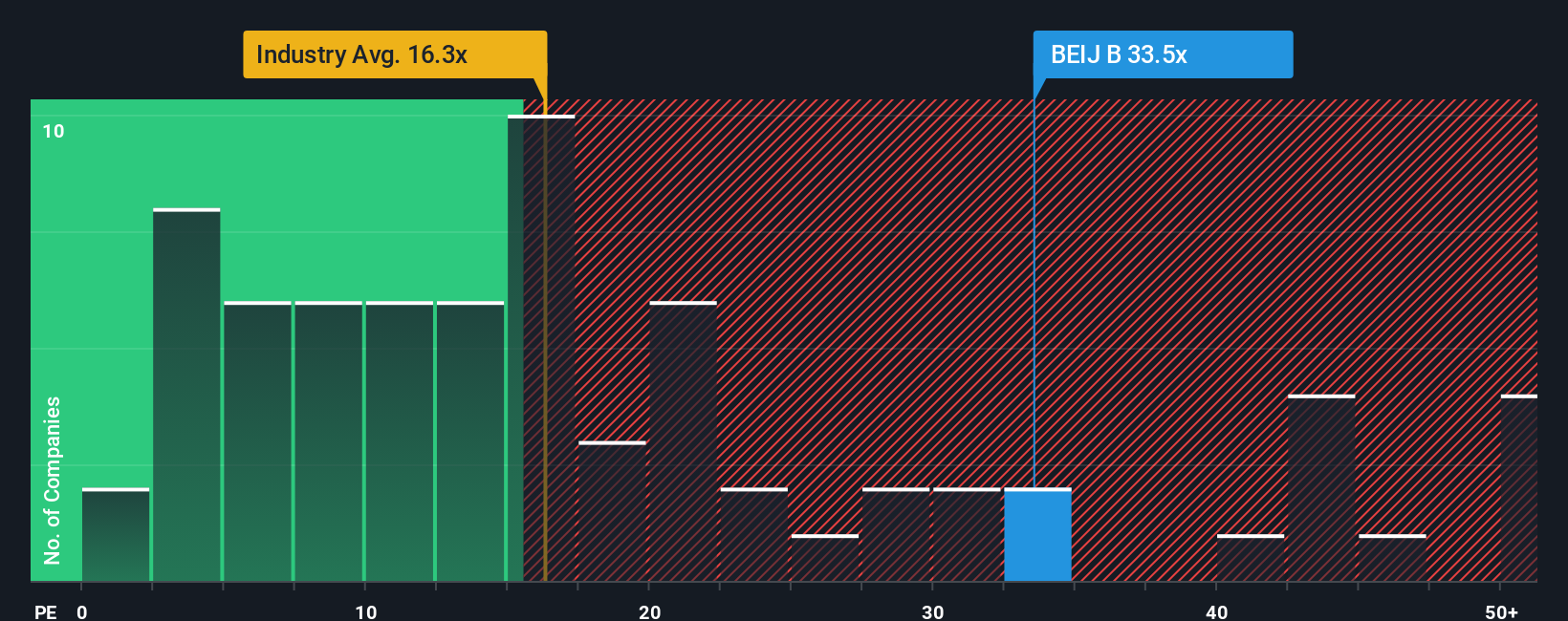

While analysts see upside, a look at current market pricing metrics tells a different story. Compared to others in its industry, Beijer Ref is priced more highly, which hints at a demanding valuation. Are investor expectations getting ahead of reality? Or is the market right to price in future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Beijer Ref Narrative

If the consensus analysis does not quite fit your own perspective, or you are someone who likes to dig deeper into the numbers, you can easily craft your own Beijer Ref story in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Beijer Ref.

Want Even More Investment Ideas?

Smart investors never stop searching for edge. Give yourself access to tomorrow’s opportunities by using the Simply Wall Street Screener to target standout companies across different themes, before they hit everyone’s radar.

- Locate hidden value in the market by tracking trends among undervalued stocks based on cash flows making headlines for their strong cash flow potential.

- Spot innovation’s winners by uncovering AI penny stocks leading breakthroughs in real-world applications, from automation to smarter healthcare and beyond.

- Secure your future with stable income streams. Zero in on dividend stocks with yields > 3% that deliver healthy, reliable yields above the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijer Ref might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About OM:BEIJ B

Beijer Ref

Provides commercial and industrial refrigeration, heating, and air conditioning products worldwide.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives