For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like BE Group (STO:BEGR), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for BE Group

How Quickly Is BE Group Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. I, for one, am blown away by the fact that BE Group has grown EPS by 58% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). BE Group shareholders can take confidence from the fact that EBIT margins are up from 1.8% to 5.8%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

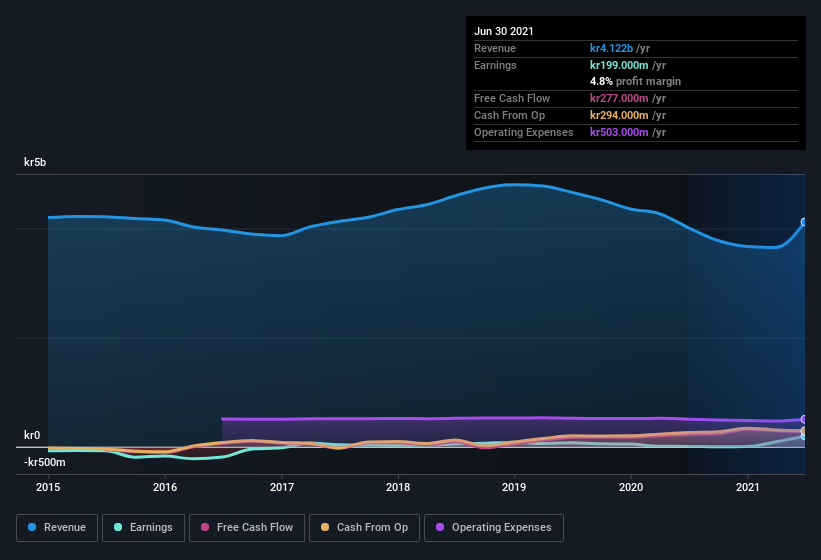

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since BE Group is no giant, with a market capitalization of kr1.5b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are BE Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

In the last twelve months BE Group insiders spent kr137k on stock; good news for shareholders. While this isn't much, we also note an absence of sales.

The good news, alongside the insider buying, for BE Group bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold kr372m worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 25% of the company, demonstrating a degree of high-level alignment with shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Peter Andersson is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations between kr867m and kr3.5b, like BE Group, the median CEO pay is around kr3.5m.

The BE Group CEO received kr3.0m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add BE Group To Your Watchlist?

BE Group's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. What's more insiders own a significant stake in the company and have been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest BE Group belongs on the top of your watchlist. It is worth noting though that we have found 2 warning signs for BE Group (1 is significant!) that you need to take into consideration.

The good news is that BE Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if BE Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:BEGR

BE Group

Operates as a trading and service company in steel, stainless steel, and aluminum products in Sweden, Poland, Finland, and Baltics.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives