- Sweden

- /

- Electrical

- /

- OM:AZELIO

Analysts Just Made A Major Revision To Their Azelio AB (publ) (STO:AZELIO) Revenue Forecasts

One thing we could say about the analysts on Azelio AB (publ) (STO:AZELIO) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

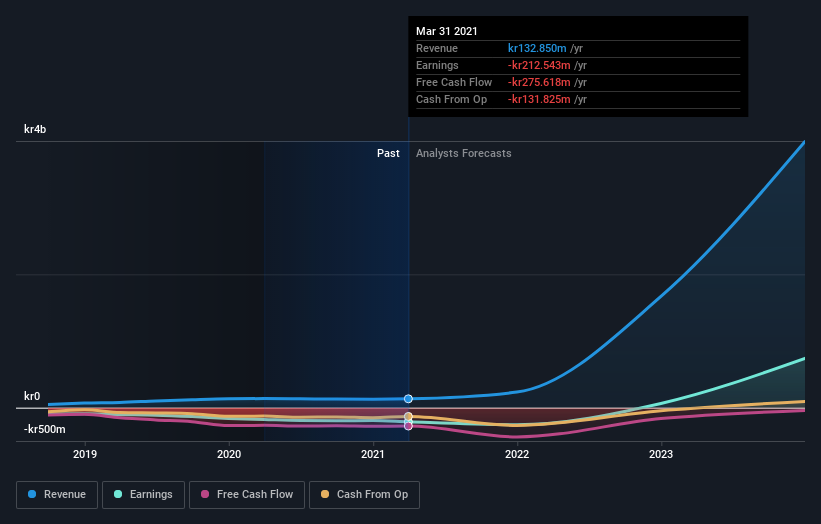

Following the downgrade, the latest consensus from Azelio's dual analysts is for revenues of kr234m in 2021, which would reflect a substantial 76% improvement in sales compared to the last 12 months. Before the latest update, the analysts were foreseeing kr280m of revenue in 2021. The consensus view seems to have become more pessimistic on Azelio, noting the substantial drop in revenue estimates in this update.

View our latest analysis for Azelio

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. One thing stands out from these estimates, which is that Azelio is forecast to grow faster in the future than it has in the past, with revenues expected to display 76% annualised growth until the end of 2021. If achieved, this would be a much better result than the 2.8% annual decline over the past year. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 35% per year. So it looks like Azelio is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Azelio this year. The analysts also expect revenues to grow faster than the wider market. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of Azelio going forwards.

Of course, there's always more to the story. At least one of Azelio's dual analysts has provided estimates out to 2023, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading Azelio or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Azelio, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:AZELIO

Azelio

Azelio AB (publ) manufactures and supplies Stirling engine-based renewable energy solutions in Sweden.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives