The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like AVTECH Sweden (STO:AVT B). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide AVTECH Sweden with the means to add long-term value to shareholders.

See our latest analysis for AVTECH Sweden

AVTECH Sweden's Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for AVTECH Sweden to have grown EPS from kr0.042 to kr0.13 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. This could point to the business hitting a point of inflection.

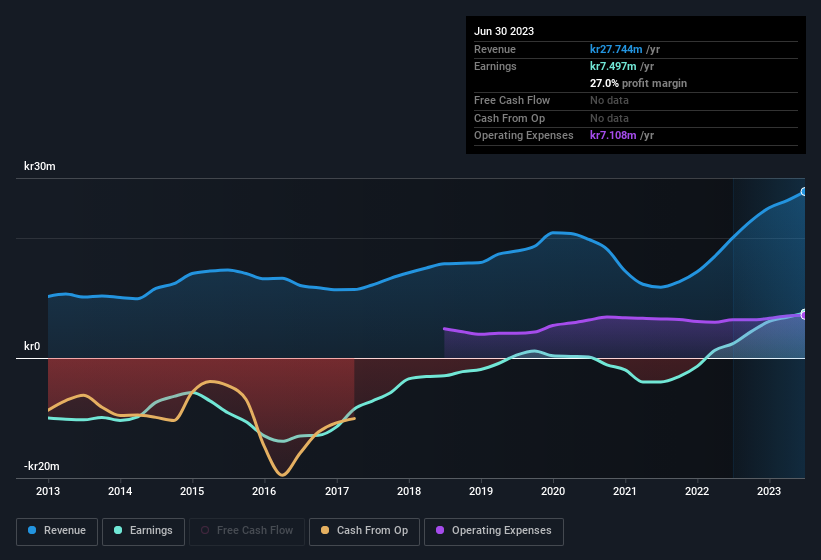

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. AVTECH Sweden shareholders can take confidence from the fact that EBIT margins are up from 12% to 27%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since AVTECH Sweden is no giant, with a market capitalisation of kr214m, you should definitely check its cash and debt before getting too excited about its prospects.

Are AVTECH Sweden Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

In the last twelve months AVTECH Sweden insiders spent kr104k on stock; good news for shareholders. While this investment may be modest, it is great considering the lack of insider selling. We also note that it was the Independent Director, Christer Fehrling, who made the biggest single acquisition, paying kr36k for shares at about kr3.56 each.

Is AVTECH Sweden Worth Keeping An Eye On?

AVTECH Sweden's earnings per share have been soaring, with growth rates sky high. Growth-minded people will be intrigued by the incredible movement in EPS growth. And indeed, it could be a sign that the business is at an inflection point. If this is the case, then keeping a watch over AVTECH Sweden could be in your best interest. You should always think about risks though. Case in point, we've spotted 2 warning signs for AVTECH Sweden you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of AVTECH Sweden, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:AVT B

AVTECH Sweden

Engages in the development and sale of products and services for digital air traffic control systems.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.