- Sweden

- /

- Aerospace & Defense

- /

- OM:AVT B

AVTECH Sweden AB (publ) (STO:AVT B) Shares Slammed 27% But Getting In Cheap Might Be Difficult Regardless

AVTECH Sweden AB (publ) (STO:AVT B) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Longer-term, the stock has been solid despite a difficult 30 days, gaining 24% in the last year.

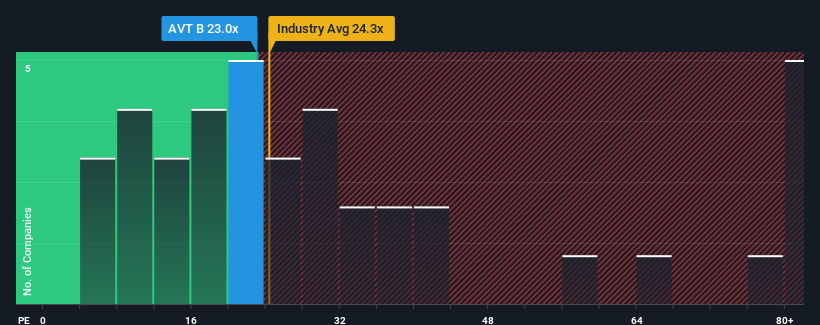

Even after such a large drop in price, given around half the companies in Sweden have price-to-earnings ratios (or "P/E's") below 19x, you may still consider AVTECH Sweden as a stock to potentially avoid with its 23x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With earnings growth that's exceedingly strong of late, AVTECH Sweden has been doing very well. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for AVTECH Sweden

Is There Enough Growth For AVTECH Sweden?

There's an inherent assumption that a company should outperform the market for P/E ratios like AVTECH Sweden's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 423%. Pleasingly, EPS has also lifted 2,434% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 16% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we can see why AVTECH Sweden is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On AVTECH Sweden's P/E

There's still some solid strength behind AVTECH Sweden's P/E, if not its share price lately. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of AVTECH Sweden revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Having said that, be aware AVTECH Sweden is showing 3 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on AVTECH Sweden, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade AVTECH Sweden, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:AVT B

AVTECH Sweden

Engages in the development and sale of products and services for digital air traffic control systems.

Flawless balance sheet with high growth potential.