Atlas Copco (STO:ATCO A) Will Pay A Larger Dividend Than Last Year At SEK1.40

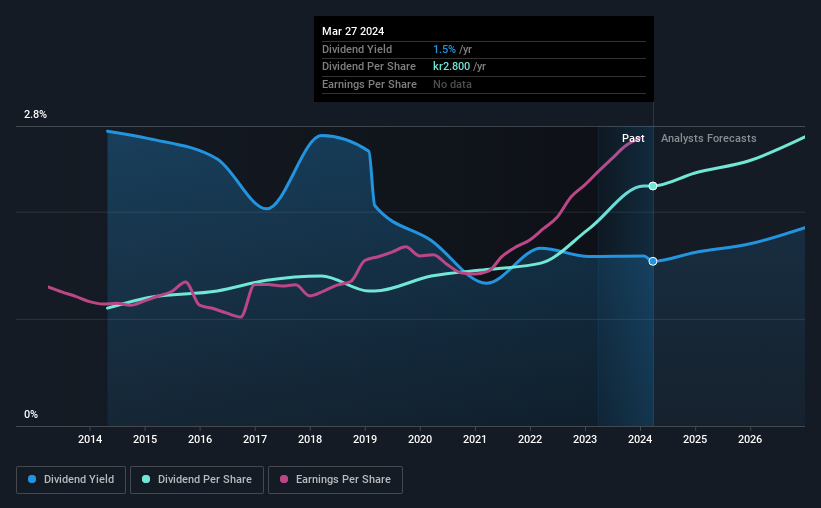

Atlas Copco AB's (STO:ATCO A) dividend will be increasing from last year's payment of the same period to SEK1.40 on 2nd of May. Although the dividend is now higher, the yield is only 1.5%, which is below the industry average.

See our latest analysis for Atlas Copco

Atlas Copco's Dividend Is Well Covered By Earnings

If it is predictable over a long period, even low dividend yields can be attractive. The last dividend was quite easily covered by Atlas Copco's earnings. This means that a large portion of its earnings are being retained to grow the business.

Over the next year, EPS is forecast to expand by 16.2%. If the dividend continues along recent trends, we estimate the payout ratio will be 40%, which is in the range that makes us comfortable with the sustainability of the dividend.

Atlas Copco Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2014, the annual payment back then was SEK1.38, compared to the most recent full-year payment of SEK2.80. This implies that the company grew its distributions at a yearly rate of about 7.4% over that duration. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. Atlas Copco has seen EPS rising for the last five years, at 12% per annum. The company is paying a reasonable amount of earnings to shareholders, and is growing earnings at a decent rate so we think it could be a decent dividend stock.

Atlas Copco Looks Like A Great Dividend Stock

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. Distributions are quite easily covered by earnings, which are also being converted to cash flows. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Earnings growth generally bodes well for the future value of company dividend payments. See if the 20 Atlas Copco analysts we track are forecasting continued growth with our free report on analyst estimates for the company. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ATCO A

Atlas Copco

Provides compressed air and gas, vacuum, energy, dewatering and industrial pump, industrial power tool, and assembly and machine vision solutions in North America, South America, Europe, Africa, the Middle East, Asia, and Oceania.

Flawless balance sheet with solid track record and pays a dividend.