Should You Be Adding AGES Industri (STO:AGES B) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like AGES Industri (STO:AGES B). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for AGES Industri

AGES Industri's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, AGES Industri has grown EPS by 15% per year. That's a good rate of growth, if it can be sustained.

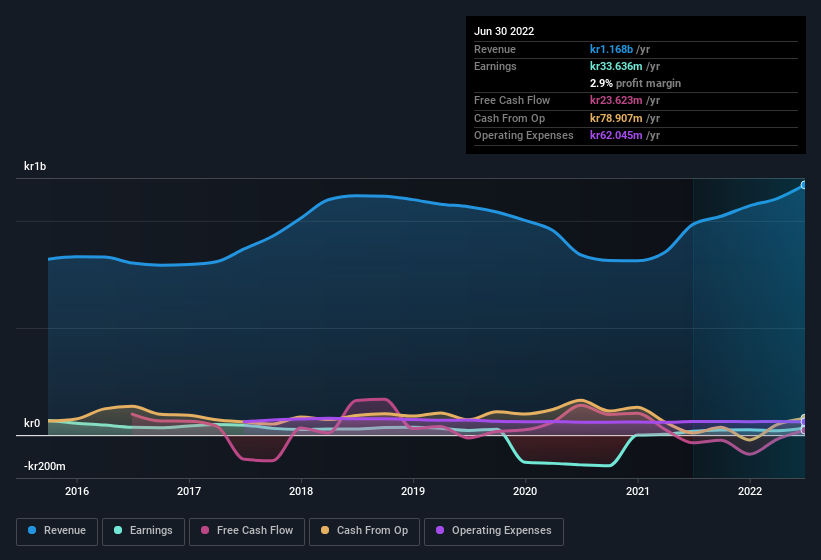

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. AGES Industri shareholders can take confidence from the fact that EBIT margins are up from 2.1% to 4.5%, and revenue is growing. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Since AGES Industri is no giant, with a market capitalisation of kr342m, you should definitely check its cash and debt before getting too excited about its prospects.

Are AGES Industri Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's nice to see that there have been no reports of any insiders selling shares in AGES Industri in the previous 12 months. So it's definitely nice that Chief Financial Officer Johan Bladh bought kr130k worth of shares at an average price of around kr43.25. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in AGES Industri.

And the insider buying isn't the only sign of alignment between shareholders and the board, since AGES Industri insiders own more than a third of the company. In fact, they own 45% of the shares, making insiders a very influential shareholder group. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. Although, with AGES Industri being valued at kr342m, this is a small company we're talking about. That means insiders only have kr155m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Does AGES Industri Deserve A Spot On Your Watchlist?

One important encouraging feature of AGES Industri is that it is growing profits. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. We don't want to rain on the parade too much, but we did also find 4 warning signs for AGES Industri (2 are concerning!) that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of AGES Industri, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:AGES B

AGES Industri

Engages in the die casting, machining, tooling, welding, and assembly of precision components.

Flawless balance sheet and fair value.

Market Insights

Community Narratives