- Sweden

- /

- Trade Distributors

- /

- OM:ADDT B

Addtech (OM:ADDT B) Valuation in Focus Following Strong Sales and Earnings Growth

Reviewed by Simply Wall St

Addtech AB (publ.) (OM:ADDT B) just released its latest earnings, providing investors with a closer look at how the business is progressing. The company reported higher sales and net income for both the second quarter and first half of the fiscal year.

See our latest analysis for Addtech AB (publ.).

Building on this momentum, Addtech AB (publ.) has seen its share price climb nearly 6% over the past month and deliver a solid 8% total return over the past year. The share price’s positive move suggests investors are taking note of the company’s improving earnings, especially following the latest set of robust results.

If Addtech’s steady growth has you curious about what else is out there, it could be the perfect moment to discover fast growing stocks with high insider ownership.

With these consistent results and the stock trading around 14% below analysts’ price targets, the question remains: is Addtech still undervalued, or is the market already pricing in all of the company’s future growth?

Most Popular Narrative: 12.3% Undervalued

With the consensus fair value estimate at SEK 367, Addtech AB (publ.) currently trades below this mark. This hints at a potential upside for investors who trust the narrative’s projections.

The strong financial position and international expansion strategy, including an increasing presence outside the Nordics, suggest the potential for sustained revenue growth. The company's strategic diversification aims to mitigate regional economic risks. Addtech's focus on energy, particularly in infrastructure products for electrical transmission and power distribution, also positions it well for revenue growth as demand in these areas remains strong. This is supported by the transition to renewable energy sources.

Want to know the calculation behind this figure? The outlook relies on ambitious revenue and profit margin improvements, along with future multiples that rival high-growth sectors. Which assumptions give the narrative such conviction? Dive into the full narrative to uncover what could drive the next big move.

Result: Fair Value of $367 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, solid expansion faces challenges, as higher costs or slowing order growth in key segments could weigh on profits and disrupt positive projections.

Find out about the key risks to this Addtech AB (publ.) narrative.

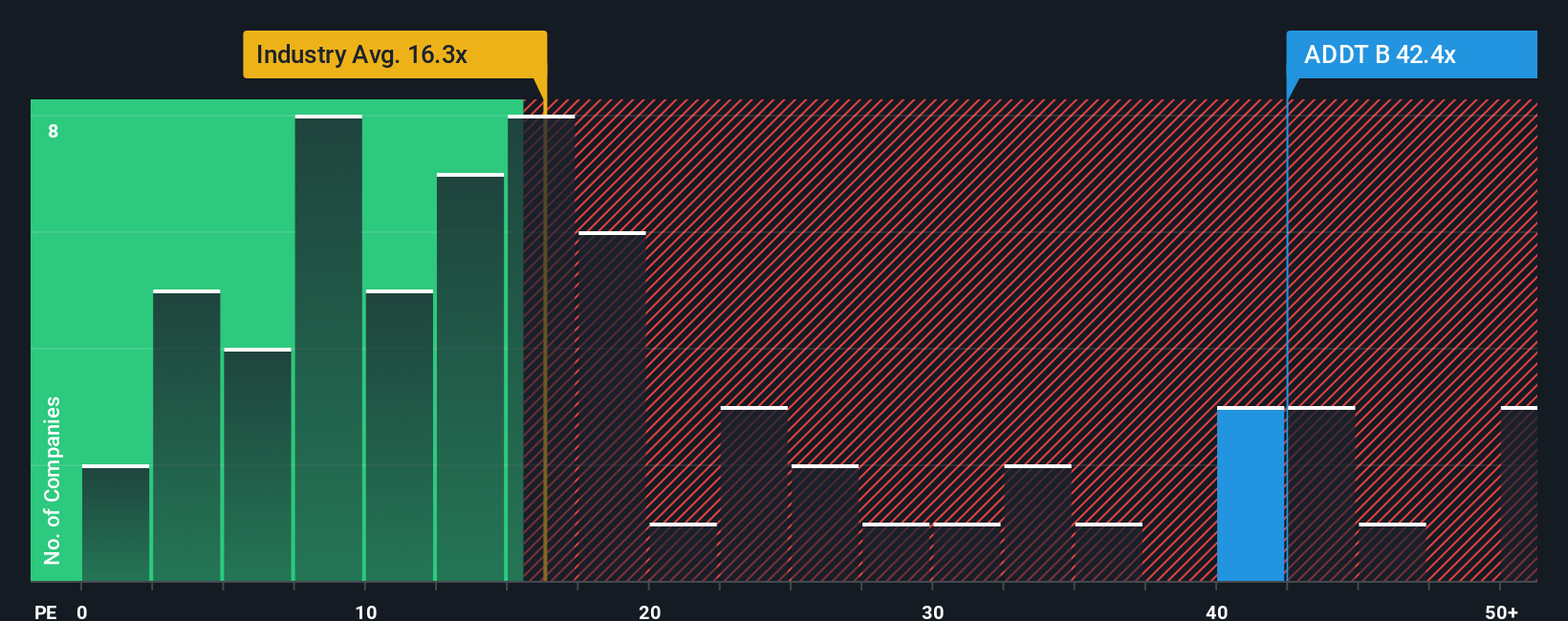

Another View: Stretch in the Multiples?

Looking at value from another angle, Addtech AB (publ.) is currently trading at a price-to-earnings ratio of 43.4x. This is much higher than both its peer average of 36.4x and the European industry average of just 16.8x, and it also stands well above the fair ratio of 25.5x suggested by market trends. This gap highlights extra optimism in the share and may signal valuation risk if growth slows or expectations falter. Does the premium reflect long-term growth, or could expectations be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Addtech AB (publ.) Narrative

If you want a fresh perspective or trust your own research more, you can quickly build your own narrative and dig into the numbers yourself, all in under three minutes with our tools. Do it your way.

A great starting point for your Addtech AB (publ.) research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Seize the chance to act now and find other growth, value, and tech trends before the crowd catches on.

- Boost your search for untapped value by checking out these 840 undervalued stocks based on cash flows poised for a breakout, and spot your next potential winner early.

- Get ahead of the curve and target impressive yields by browsing these 22 dividend stocks with yields > 3% delivering payouts above 3% and robust fundamentals.

- Fuel your curiosity for emerging disruption by seeking out these 28 quantum computing stocks which could shape the future of technology as new breakthroughs unfold.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ADDT B

Addtech AB (publ.)

Provides high-tech products and solutions in Sweden, Denmark, Finland, Norway, Germany, the United Kingdom, rest of Europe, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion