- Sweden

- /

- Trade Distributors

- /

- OM:ADDT B

Addtech (OM:ADDT B) Margin Expansion Reinforces Bullish Narratives, Despite Valuation Concerns

Reviewed by Simply Wall St

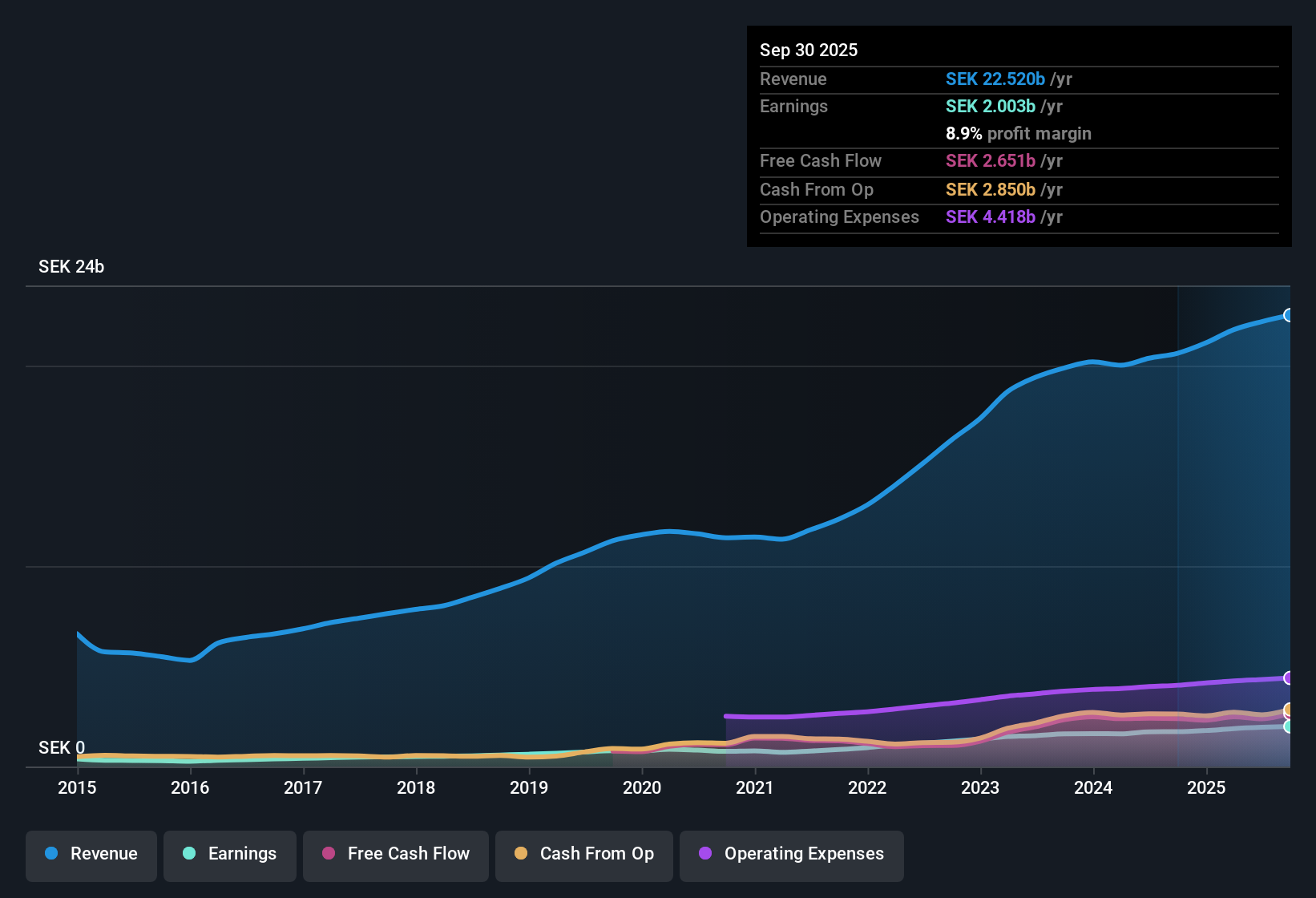

Addtech AB (OM:ADDT B) posted average annual earnings growth of 21.1% over the past five years, with net profit margins now at 8.8% compared to 8.5% last year. For the most recent year, earnings were up 12.8%, trailing the company’s five-year pace, and forecasts project 11.96% yearly earnings growth ahead, as revenue is seen rising by 6.2% per year. This outpaces the broader Swedish market’s 3.6% rate. Investors are weighing these consistently positive trends alongside a premium valuation and the fact that expected growth is set to trail the Swedish market, signaling some caution about the runway for future gains.

See our full analysis for Addtech AB (publ.).The next section puts these headline results side by side with the most widely followed narratives, highlighting where the numbers support the prevailing story and where they call it into question.

See what the community is saying about Addtech AB (publ.)

Margins Approach Double Digits with Efficiency Gains

- Analysts project net profit margins to increase from their current 8.8% to 10.4% by 2028, reflecting expectations for improved operational efficiency as Addtech integrates recent acquisitions.

- Consensus narrative suggests this margin expansion is anchored by a better product mix and stronger pricing power. Both of these factors are seen as supporting continued profitability even as revenue growth normalizes:

- An enhanced EBITA margin of 14.4% is credited to strategic improvements rather than one-off gains, supporting the analysts' consensus view that profitability is becoming more sustainable over time.

- While efficiency gains back the bullish case, consensus also highlights stable order backlogs and expansion into energy infrastructure as drivers for maintaining or growing margins relative to peers.

Skeptics waiting for margin pressures to show up could be caught off guard if efficiency and diversification continue to do the heavy lifting. 📊 Read the full Addtech AB (publ.) Consensus Narrative.

Premium Valuation versus DCF Fair Value

- Addtech’s price-to-earnings multiple stands at 44.5x, materially higher than both its industry (16.4x) and peer group average (36.2x). The current share price of SEK 322.2 sits well above the DCF fair value of 226.90.

- Consensus narrative points to a classic growth premium. Analysts have penciled in a consensus price target of SEK 364.75, 16.6% ahead of the current share price. However, for this target to be realized, Addtech must deliver on ambitious 2028 growth and margin forecasts:

- The ongoing valuation gap requires investors to bet on stated earnings growing from SEK 2.0 billion to SEK 2.8 billion by 2028, or risk a correction if these targets falter.

- Bears highlight how trading at a premium, especially above industry and DCF levels, raises expectations and leaves less cushion if challenges arise in high-cost or slow-growth segments.

Acquisition-Driven Revenue Growth with Integration Risks

- Revenue is forecast to climb by 6.2% each year, outpacing the Swedish market’s expected 3.6% rate. Eleven acquisitions in the past year alone have contributed SEK 1.4 billion in additional sales.

- Consensus narrative highlights both upside and caution. The company’s aggressive expansion in energy infrastructure and non-Nordic markets brings clear growth potential, but challenges in sectors like forestry and negative book-to-bill ratios in Industrial Solutions could threaten that trajectory:

- Addtech's full backlog and strategic focus on renewables-driven infrastructure are widely viewed as buffers, helping offset market hesitancy and delays in major investments.

- On the flip side, rising receivables and inventory could dampen cash flow and strain working capital, testing management’s ability to realize the expected long-term benefits from recent acquisitions.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Addtech AB (publ.) on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own view on the figures? Take just a few minutes to turn your insights into a personal narrative and see how your story compares. Do it your way

A great starting point for your Addtech AB (publ.) research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Addtech’s lofty valuation, premium price-to-earnings ratio, and reliance on ambitious forecasts leave little margin for error if industry growth slows or targets slip.

If you want to minimize valuation risk and spot opportunities trading at more reasonable prices, check out these 876 undervalued stocks based on cash flows to find companies with stronger upside potential and better risk-adjusted entry points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ADDT B

Addtech AB (publ.)

Provides high-tech products and solutions in Sweden, Denmark, Finland, Norway, Germany, the United Kingdom, rest of Europe, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives