- Sweden

- /

- Aerospace & Defense

- /

- OM:AAC

Further Upside For AAC Clyde Space AB (publ) (STO:AAC) Shares Could Introduce Price Risks After 37% Bounce

AAC Clyde Space AB (publ) (STO:AAC) shares have had a really impressive month, gaining 37% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 18% is also fairly reasonable.

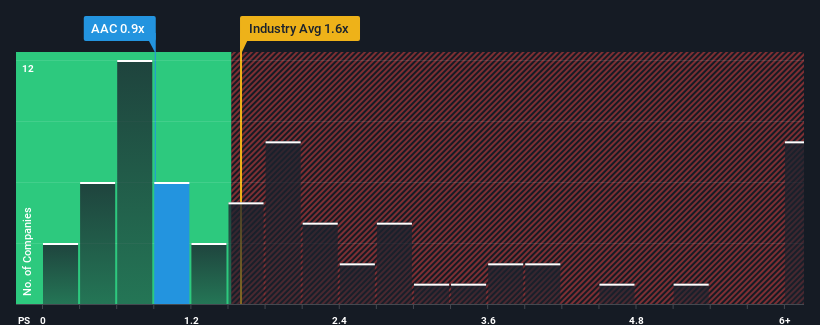

Even after such a large jump in price, AAC Clyde Space's price-to-sales (or "P/S") ratio of 0.9x might still make it look like a buy right now compared to the Aerospace & Defense industry in Sweden, where around half of the companies have P/S ratios above 2.5x and even P/S above 6x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for AAC Clyde Space

How AAC Clyde Space Has Been Performing

With revenue growth that's inferior to most other companies of late, AAC Clyde Space has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think AAC Clyde Space's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For AAC Clyde Space?

The only time you'd be truly comfortable seeing a P/S as low as AAC Clyde Space's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.4%. The latest three year period has also seen an excellent 95% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 77% over the next year. That's shaping up to be materially higher than the 19% growth forecast for the broader industry.

With this in consideration, we find it intriguing that AAC Clyde Space's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

AAC Clyde Space's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A look at AAC Clyde Space's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Plus, you should also learn about these 3 warning signs we've spotted with AAC Clyde Space.

If these risks are making you reconsider your opinion on AAC Clyde Space, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:AAC

AAC Clyde Space

Provides small satellite technologies and services in Sweden, the United Kingdom, rest of Europe, the United States, Asia, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success