Does Skandinaviska Enskilda Banken (STO:SEB A) Deserve A Spot On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Skandinaviska Enskilda Banken (STO:SEB A). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Skandinaviska Enskilda Banken

How Fast Is Skandinaviska Enskilda Banken Growing Its Earnings Per Share?

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Skandinaviska Enskilda Banken's EPS shot up from kr8.98 to kr12.02; a result that's bound to keep shareholders happy. That's a fantastic gain of 34%.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that Skandinaviska Enskilda Banken's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. Skandinaviska Enskilda Banken maintained stable EBIT margins over the last year, all while growing revenue 13% to kr55b. That's encouraging news for the company!

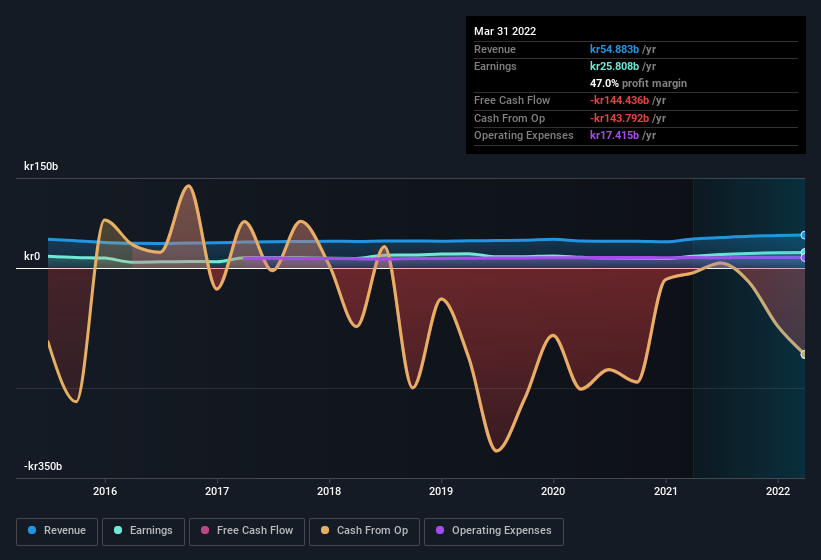

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Skandinaviska Enskilda Banken's future EPS 100% free.

Are Skandinaviska Enskilda Banken Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We do note that Skandinaviska Enskilda Banken insiders netted kr1.1m worth of shares over the last year. But the silver lining to that cloud is that Signhild Hansen, the Independent Director, spent kr1.5m buying shares at an average price of kr111. And that's a reason to be optimistic.

Recent insider purchases of Skandinaviska Enskilda Banken stock is not the only way management has kept the interests of the general public shareholders in mind. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalisations over kr80b, like Skandinaviska Enskilda Banken, the median CEO pay is around kr26m.

Skandinaviska Enskilda Banken's CEO took home a total compensation package worth kr21m in the year leading up to December 2021. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Skandinaviska Enskilda Banken Deserve A Spot On Your Watchlist?

For growth investors, Skandinaviska Enskilda Banken's raw rate of earnings growth is a beacon in the night. But wait, it gets better. We have seen insider buying and the executive pay seems on the modest side of things. On balance the message seems to be that this stock is worth looking at, at least for a while. We should say that we've discovered 2 warning signs for Skandinaviska Enskilda Banken (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

Keen growth investors love to see insider buying. Thankfully, Skandinaviska Enskilda Banken isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SEB A

Skandinaviska Enskilda Banken

Provides corporate, retail, investment, and private banking services.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives