Do Skandinaviska Enskilda Banken's (STO:SEB A) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Skandinaviska Enskilda Banken (STO:SEB A). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Skandinaviska Enskilda Banken

Skandinaviska Enskilda Banken's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Skandinaviska Enskilda Banken has grown EPS by 29% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

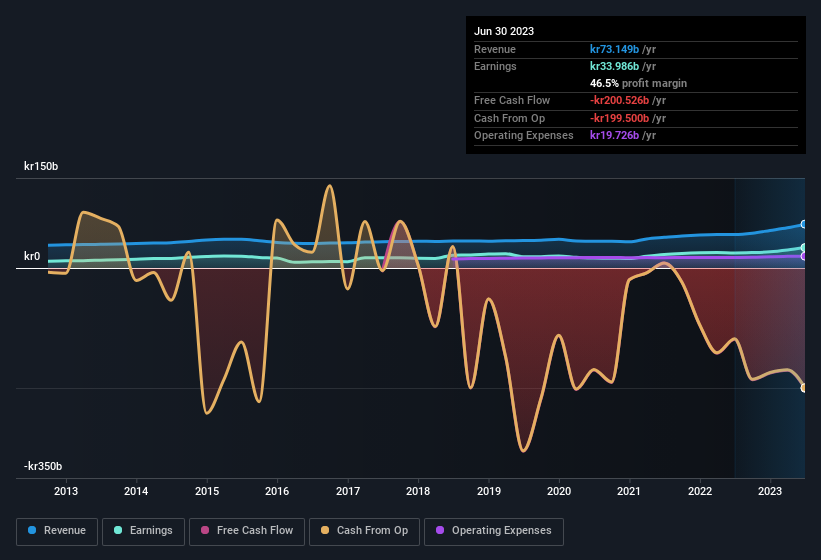

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that Skandinaviska Enskilda Banken's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Skandinaviska Enskilda Banken maintained stable EBIT margins over the last year, all while growing revenue 31% to kr73b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Skandinaviska Enskilda Banken's future profits.

Are Skandinaviska Enskilda Banken Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Over the last 12 months Skandinaviska Enskilda Banken insiders spent kr2.0m more buying shares than they received from selling them. Although some people may hesitate due to the share sales, the fact that insiders bought more than they sold, is a positive thing to note. Zooming in, we can see that the biggest insider purchase was by company insider Svein Tore Holsether for kr1.2m worth of shares, at about kr115 per share.

Along with the insider buying, another encouraging sign for Skandinaviska Enskilda Banken is that insiders, as a group, have a considerable shareholding. To be specific, they have kr154m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.06% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. The cherry on top is that the CEO, Johan Torgeby is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations over kr85b, like Skandinaviska Enskilda Banken, the median CEO pay is around kr30m.

Skandinaviska Enskilda Banken offered total compensation worth kr22m to its CEO in the year to December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Skandinaviska Enskilda Banken Worth Keeping An Eye On?

You can't deny that Skandinaviska Enskilda Banken has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. These things considered, this is one stock worth watching. Still, you should learn about the 2 warning signs we've spotted with Skandinaviska Enskilda Banken (including 1 which is a bit unpleasant).

The good news is that Skandinaviska Enskilda Banken is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Skandinaviska Enskilda Banken, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SEB A

Skandinaviska Enskilda Banken

Provides corporate, retail, investment, and private banking services.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives