As the European market navigates through mixed performances and cautious optimism amid ongoing trade discussions with the U.S., investors are keenly observing opportunities that offer stability and income. In this context, dividend stocks can be particularly appealing, as they provide a consistent income stream while potentially benefiting from Europe's steady industrial output and widening trade surplus.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.41% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.18% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.67% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.73% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.77% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.77% | ★★★★★★ |

| ERG (BIT:ERG) | 5.21% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.02% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.56% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.47% | ★★★★★★ |

Click here to see the full list of 226 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Oeneo (ENXTPA:SBT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oeneo SA operates in the wine industry worldwide and has a market cap of €608.54 million.

Operations: Oeneo SA generates its revenue from two main segments: Closures, which contributes €222.47 million, and Winemaking, which accounts for €82.65 million.

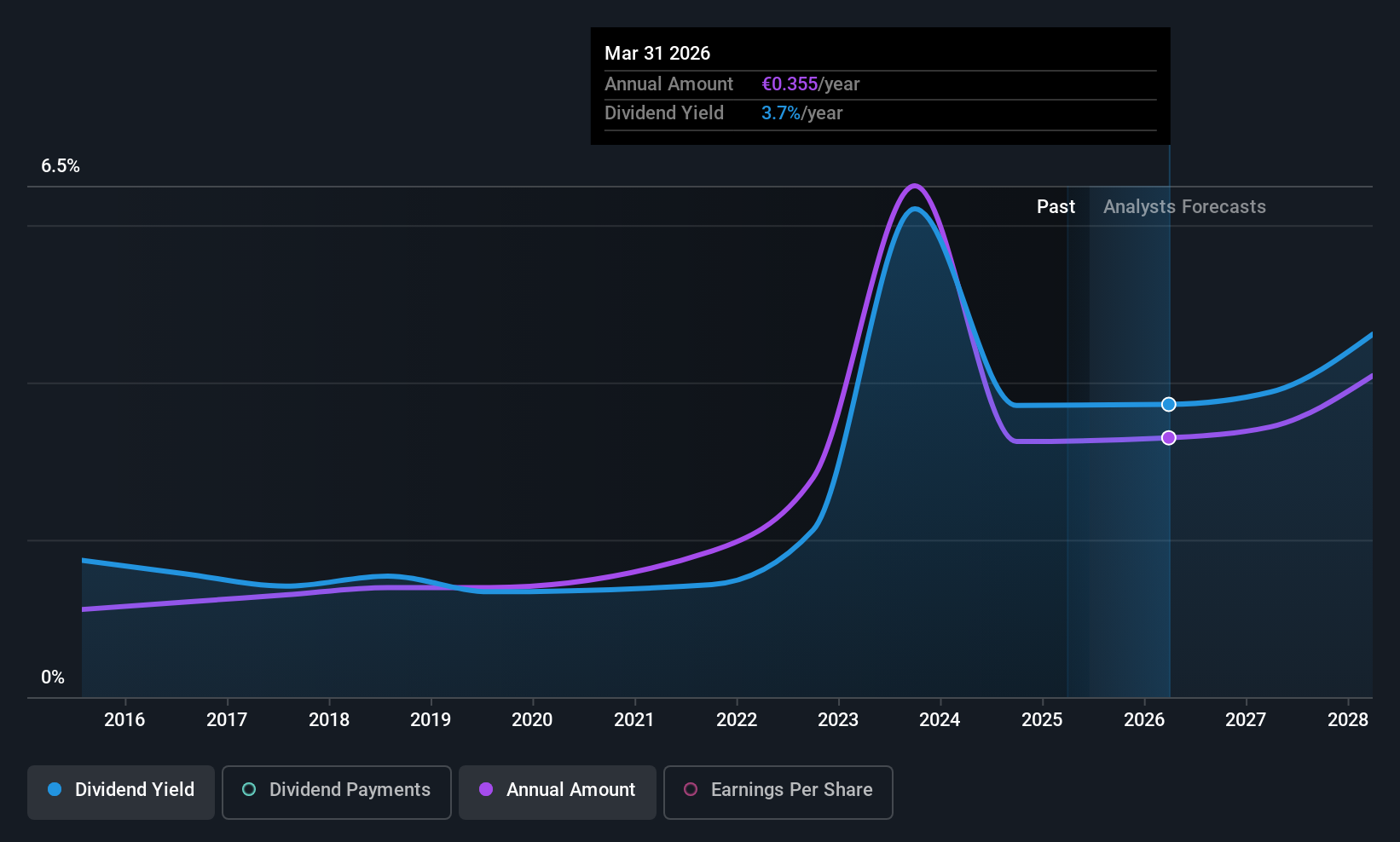

Dividend Yield: 3.7%

Oeneo's dividend payments have been volatile over the past decade, with an unstable track record. Despite this, dividends are covered by both earnings and cash flows, with payout ratios of 75.3% and 59.1%, respectively. The recent AGM approved a €0.35 per share dividend for the 2024-2025 financial year, payable on October 3, 2025. Earnings grew slightly to €29.77 million in the last fiscal year, indicating some stability in profit growth amidst dividend challenges.

- Dive into the specifics of Oeneo here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Oeneo shares in the market.

Nordea Bank Abp (HLSE:NDA FI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordea Bank Abp provides a range of banking products and services to individuals, families, and businesses across Sweden, Finland, Norway, Denmark, and internationally with a market cap of €43.77 billion.

Operations: Nordea Bank Abp's revenue is primarily derived from Personal Banking (€4.61 billion), Business Banking (€3.22 billion), Large Corporates & Institutions (€2.27 billion), and Asset and Wealth Management (€1.43 billion).

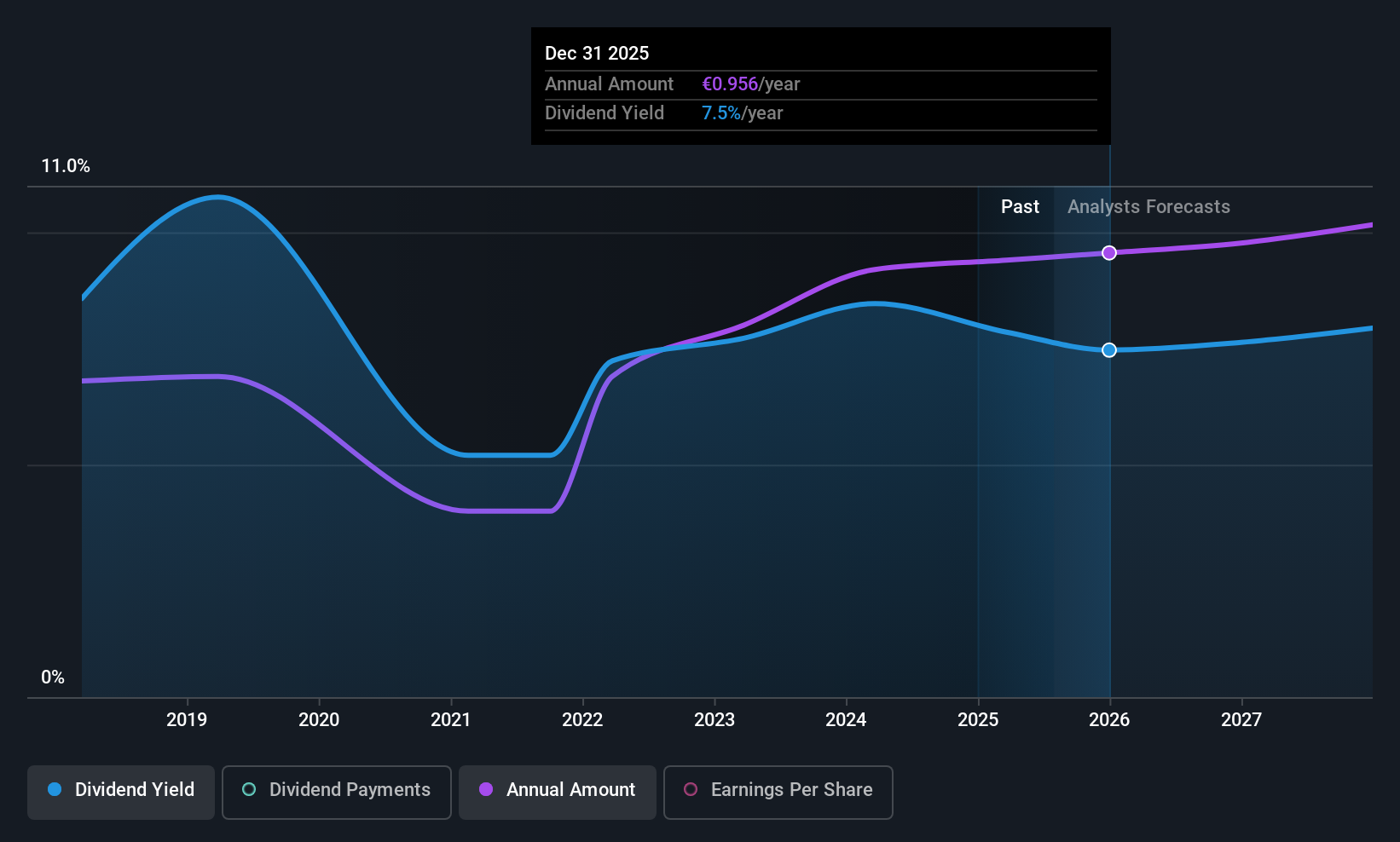

Dividend Yield: 7.4%

Nordea Bank Abp's dividend yield is among the top 25% in Finland, supported by a reasonable payout ratio of 67.8%. However, its dividend history is less reliable, with volatility over the past seven years. Recent earnings showed a decline in net income to €1.22 billion for Q2 2025 from €1.30 billion a year earlier. The company initiated a share buyback program worth €250 million to optimize capital structure and improve shareholder returns.

- Delve into the full analysis dividend report here for a deeper understanding of Nordea Bank Abp.

- According our valuation report, there's an indication that Nordea Bank Abp's share price might be on the cheaper side.

Skandinaviska Enskilda Banken (OM:SEB A)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Skandinaviska Enskilda Banken AB (publ) offers a range of corporate, retail, investment, and private banking services with a market capitalization of SEK341.15 billion.

Operations: Skandinaviska Enskilda Banken AB (publ) generates revenue through several segments, including Baltic at SEK11.89 billion, Business & Retail Banking at SEK24.39 billion, and Corporate & Investment Banking at SEK30.54 billion.

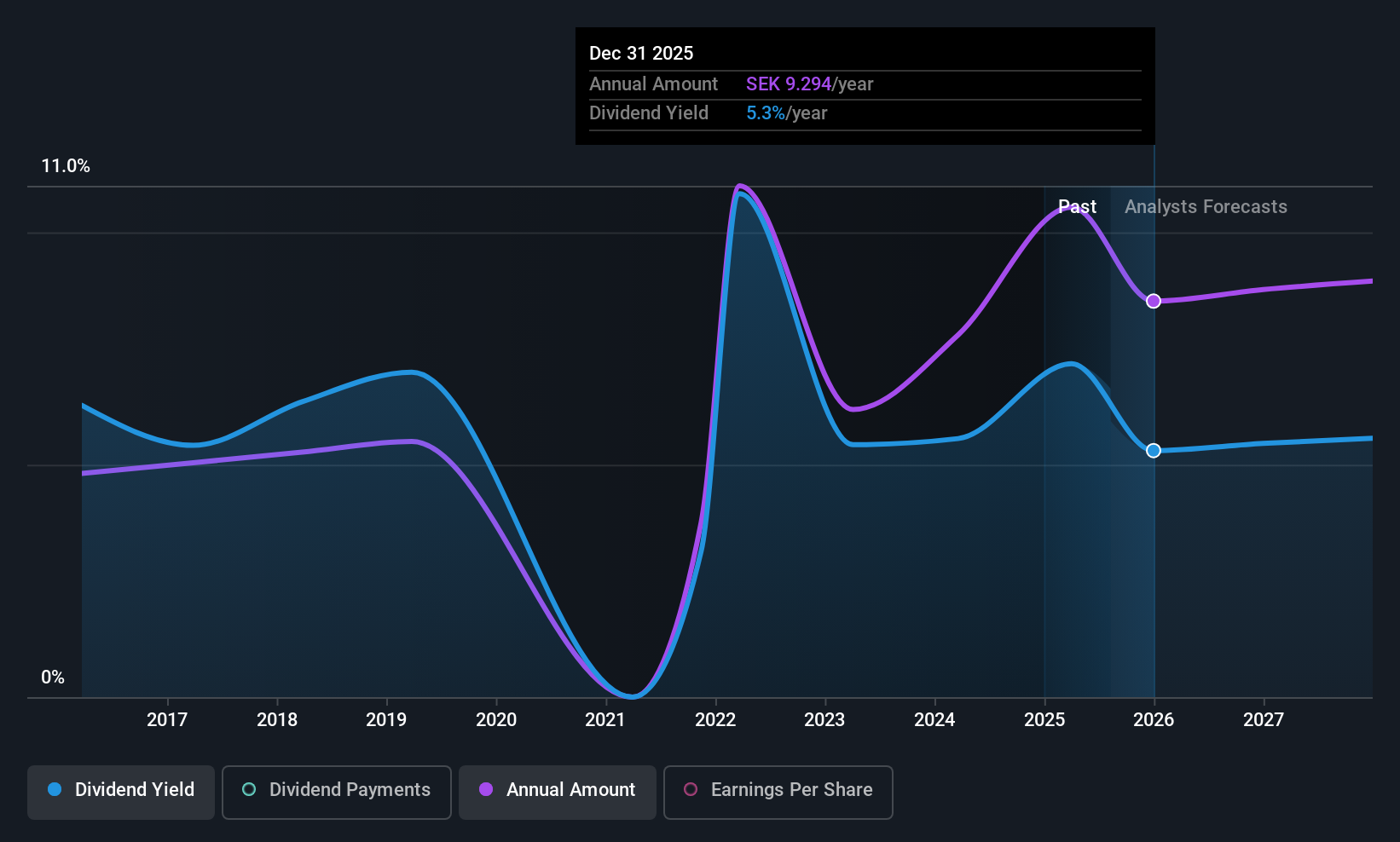

Dividend Yield: 6.7%

Skandinaviska Enskilda Banken's dividend yield ranks in the top 25% of Swedish payers, backed by a reasonable payout ratio of 52%. Despite this, its dividend history has been volatile over the past decade. Recent earnings for Q2 2025 showed a decrease in net income to SEK 8.25 billion from SEK 9.42 billion a year ago. The bank is executing a share buyback program worth SEK 2.5 billion to enhance capital management and shareholder value.

- Take a closer look at Skandinaviska Enskilda Banken's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Skandinaviska Enskilda Banken is priced higher than what may be justified by its financials.

Next Steps

- Click through to start exploring the rest of the 223 Top European Dividend Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SEB A

Skandinaviska Enskilda Banken

Provides corporate, retail, investment, and private banking services.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives