Spotlight On Undervalued Small Caps With Insider Activity In November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, small-cap stocks have experienced a notable surge, with the Russell 2000 Index leading gains amidst expectations of favorable economic policies. Despite this rally, small caps remain below their previous record highs, presenting potential opportunities for investors seeking value in an evolving market landscape. In such conditions, identifying promising stocks often involves looking at companies with strong fundamentals and insider activity that might indicate confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Maharashtra Seamless | 9.7x | 1.7x | 36.98% | ★★★★★☆ |

| Calfrac Well Services | 11.5x | 0.2x | 36.43% | ★★★★★☆ |

| Rogers Sugar | 15.3x | 0.6x | 48.45% | ★★★★☆☆ |

| Franklin Financial Services | 10.3x | 2.0x | 32.74% | ★★★★☆☆ |

| German American Bancorp | 16.3x | 5.4x | 40.28% | ★★★☆☆☆ |

| USCB Financial Holdings | 18.7x | 5.4x | 47.14% | ★★★☆☆☆ |

| Hemisphere Energy | 6.2x | 2.4x | -226.40% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| THG | NA | 0.3x | -262.69% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -64.13% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

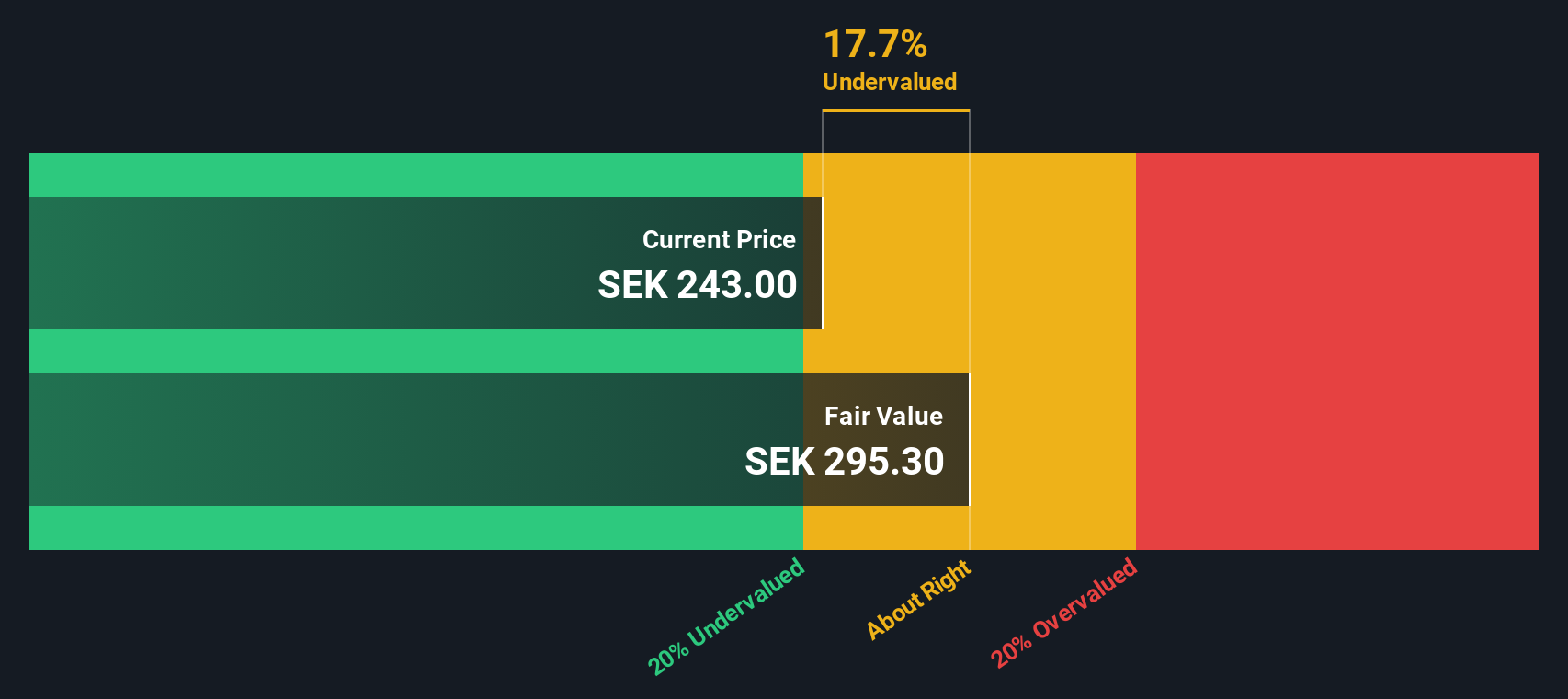

Beijer Alma (OM:BEIA B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Beijer Alma is an industrial group based in Sweden, operating primarily through its subsidiaries Lesjöfors and Beijer Tech, with a market capitalization of approximately SEK 9.67 billion.

Operations: Lesjöfors and Beijer Tech are the primary revenue streams, generating SEK 4.82 billion and SEK 2.25 billion, respectively. The company's gross profit margin has shown variation, with a recent figure of 30.65%. Operating expenses have been increasing over time, impacting net income margins which currently stand at around 10.01%.

PE: 15.1x

Beijer Alma, a smaller company in the industrial sector, has shown promising financial performance with Q3 2024 net income rising to SEK 303 million from SEK 134 million the previous year. Earnings per share also increased significantly. Despite being removed from the S&P Global BMI Index and having high debt levels, insider confidence is evident with Oskar Hellstrom purchasing shares worth approximately SEK 533,000 in September. The company's earnings are forecasted to grow annually by over 8%, suggesting potential for future value appreciation despite current challenges.

- Get an in-depth perspective on Beijer Alma's performance by reading our valuation report here.

Understand Beijer Alma's track record by examining our Past report.

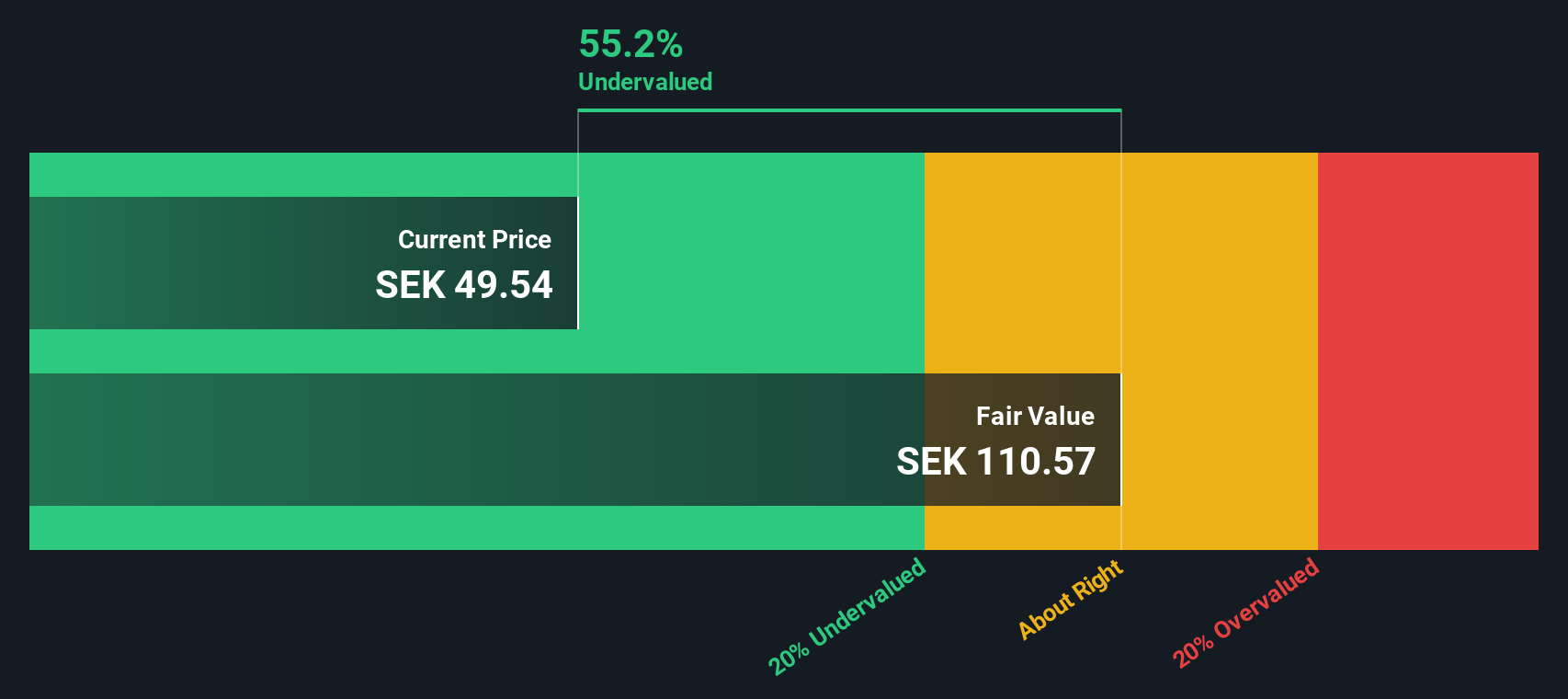

Dometic Group (OM:DOM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Dometic Group is a company that designs and manufactures products for mobile living in areas such as marine, global ventures, and land vehicles across regions including APAC, EMEA, and the Americas with a market capitalization of approximately SEK 25.5 billion.

Operations: Dometic Group generates revenue primarily from its segments in Marine, Global Ventures, and Land Vehicles across different regions. The company's gross profit margin has shown fluctuations over the years, reaching 28.49% as of September 2024. Operating expenses have been a significant part of costs, with notable allocations to sales and marketing as well as general and administrative expenses.

PE: -16.9x

Dometic Group, a smaller player in its industry, faces challenges with high-risk funding due to reliance on external borrowing. Recent earnings show a decline, with third-quarter sales at SEK 5.6 billion and a net loss of SEK 1.9 billion compared to previous profits. A significant SEK 2 billion goodwill impairment further impacted results, particularly in the Land Vehicles Americas segment. Despite these hurdles, insider confidence remains strong as insiders continue purchasing shares this year, indicating belief in potential recovery or growth prospects.

- Delve into the full analysis valuation report here for a deeper understanding of Dometic Group.

Gain insights into Dometic Group's historical performance by reviewing our past performance report.

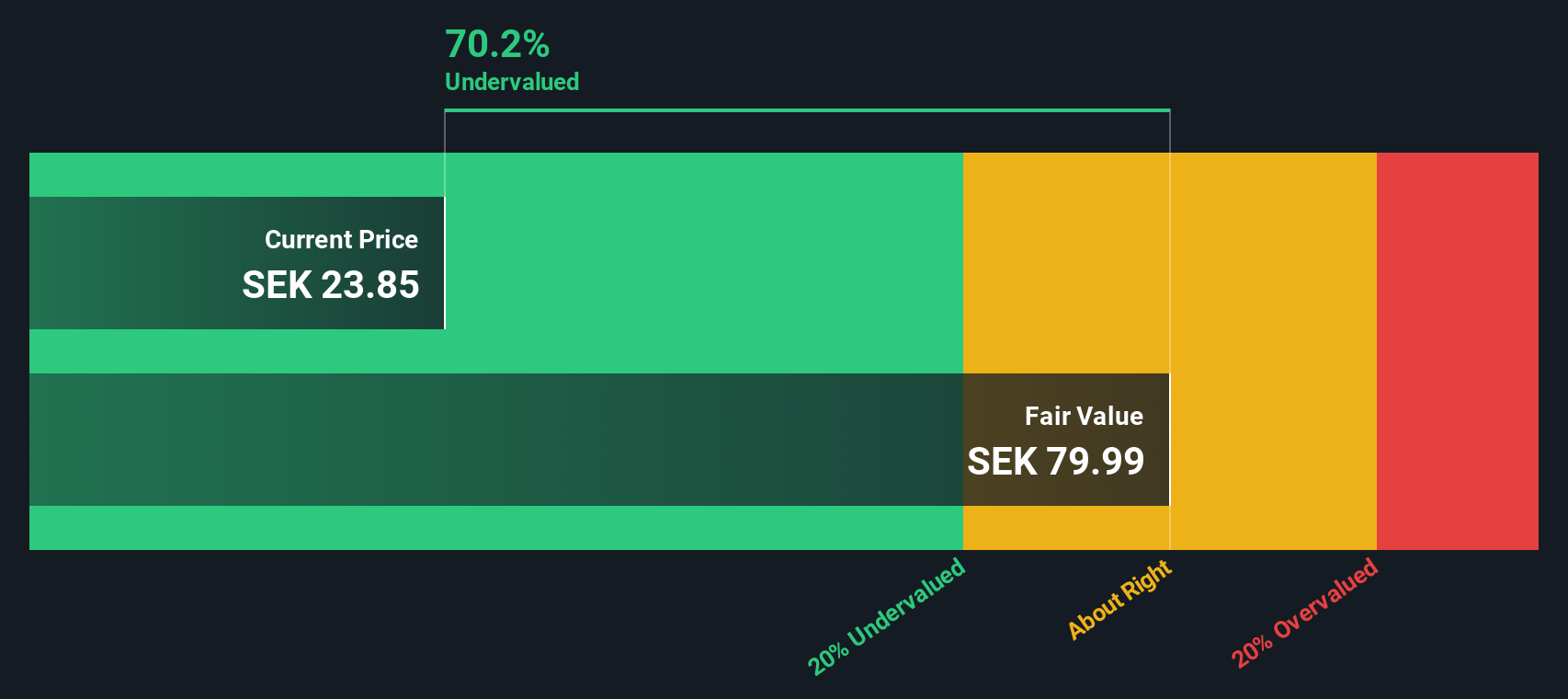

ITAB Shop Concept (OM:ITAB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: ITAB Shop Concept focuses on providing retail solutions, including furniture and fixtures, with a market capitalization of approximately SEK 2.29 billion.

Operations: The company generates revenue primarily from its Furniture & Fixtures segment, with recent revenue reported at SEK 6.42 billion. The gross profit margin has shown a notable trend, reaching 29.13% as of the latest period. Operating expenses are significant, with sales and marketing being a major component at SEK 970 million.

PE: 17.1x

ITAB Shop Concept, a smaller company in the retail solutions sector, has been experiencing mixed financial performance. Recent earnings showed a slight increase in sales to SEK 1,553 million for Q3 2024 but a drop in net income to SEK 43 million from the previous year. Despite shareholder dilution last year and reliance on external borrowing, insider confidence is evident with Director Vegard Soraunet acquiring over 1.7 million shares worth approximately SEK 40 million. ITAB's strategic growth includes significant contracts across Europe and the UK valued at EUR 42 million combined over four years, enhancing its market presence with innovative shop-in-shop concepts and digital platforms.

Taking Advantage

- Navigate through the entire inventory of 173 Undervalued Small Caps With Insider Buying here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijer Alma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BEIA B

Beijer Alma

Engages in component manufacturing and industrial trading businesses in Sweden, rest of Nordic Region, rest of Europe, North America, Asia, and internationally.

Good value with proven track record.