Exploring Undervalued Small Caps With Insider Action In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty, small-cap stocks have faced notable challenges, with the Russell 2000 Index underperforming larger counterparts like the S&P 500. Amidst this backdrop, investors are increasingly focused on identifying opportunities within undervalued small-cap companies that may benefit from insider action. In such an environment, a good stock often exhibits resilience and potential for growth despite broader market headwinds, making it crucial to carefully assess financial health and strategic positioning.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paradeep Phosphates | 25.2x | 0.8x | 26.85% | ★★★★★☆ |

| Maharashtra Seamless | 11.4x | 2.0x | 28.36% | ★★★★★☆ |

| Avia Avian | 13.5x | 3.1x | 26.94% | ★★★★★☆ |

| JiaXing Gas Group | 5.8x | 0.3x | 28.26% | ★★★★☆☆ |

| L.G. Balakrishnan & Bros | 14.5x | 1.7x | -44.42% | ★★★☆☆☆ |

| Yixin Group | 7.8x | 0.8x | -2942.45% | ★★★☆☆☆ |

| Kambi Group | 16.2x | 1.5x | 41.46% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Safari Investments RSA | 5.2x | 3.0x | 9.78% | ★★★☆☆☆ |

| Digital Mediatama Maxima | NA | 1.3x | 12.30% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

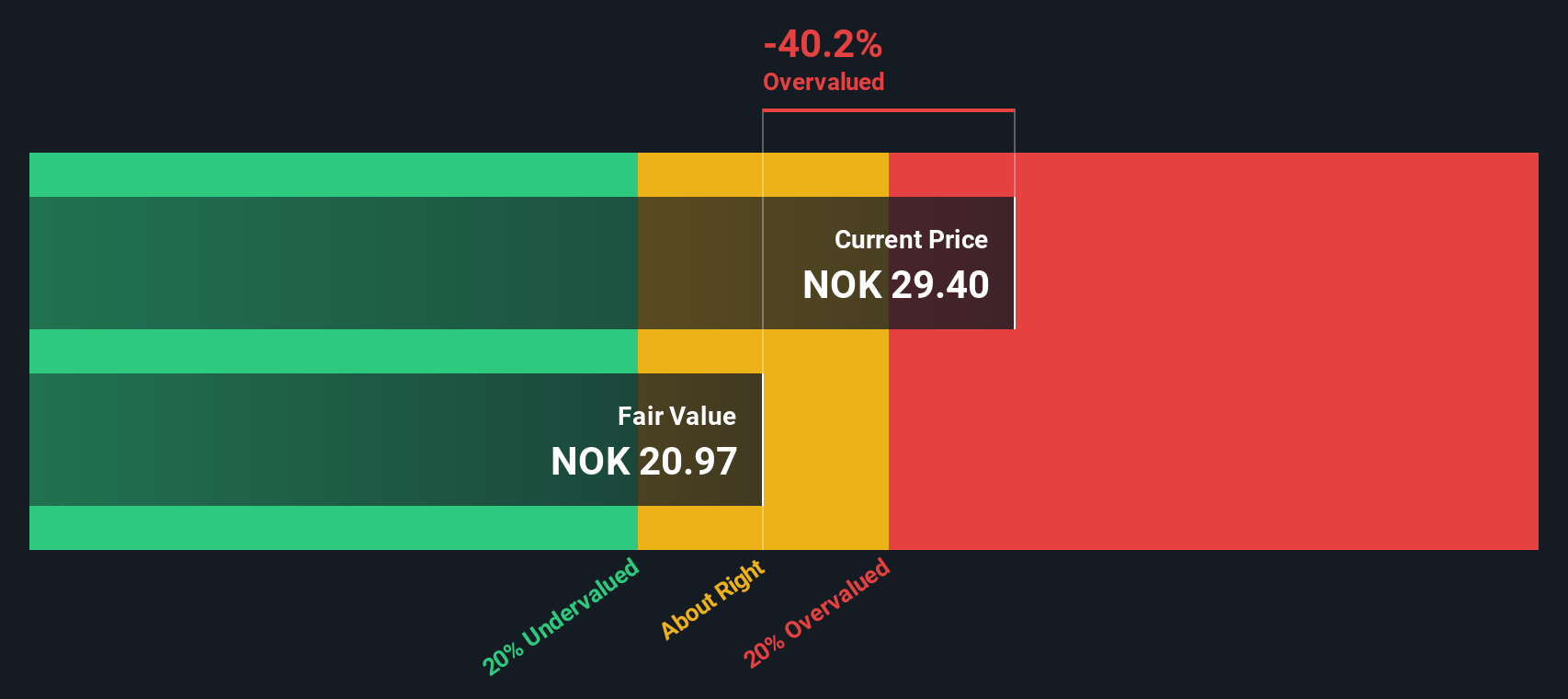

Treasure (OB:TRE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Treasure is a company involved in unclassified services, with a market capitalization of $1.09 billion.

Operations: The company has experienced fluctuations in revenue with notable periods of negative revenue, yet it consistently achieves a gross profit margin of 1.0% in several instances. Operating expenses are relatively low compared to the revenue figures, with general and administrative expenses often being a significant component. Net income margins have varied significantly, reaching as high as 357.47% during certain quarters due to substantial non-operating income or expense adjustments.

PE: 5.6x

Treasure, a small company with limited revenue of US$306K, primarily relies on external borrowing for funding, which carries higher risk compared to customer deposits. Despite its financial structure, the company has shown insider confidence with recent share purchases in 2024, indicating potential future value. Recent board decisions affirming a NOK 0.25 dividend per share suggest stable cash flow management and shareholder returns amidst its current financial dynamics.

- Click to explore a detailed breakdown of our findings in Treasure's valuation report.

Gain insights into Treasure's historical performance by reviewing our past performance report.

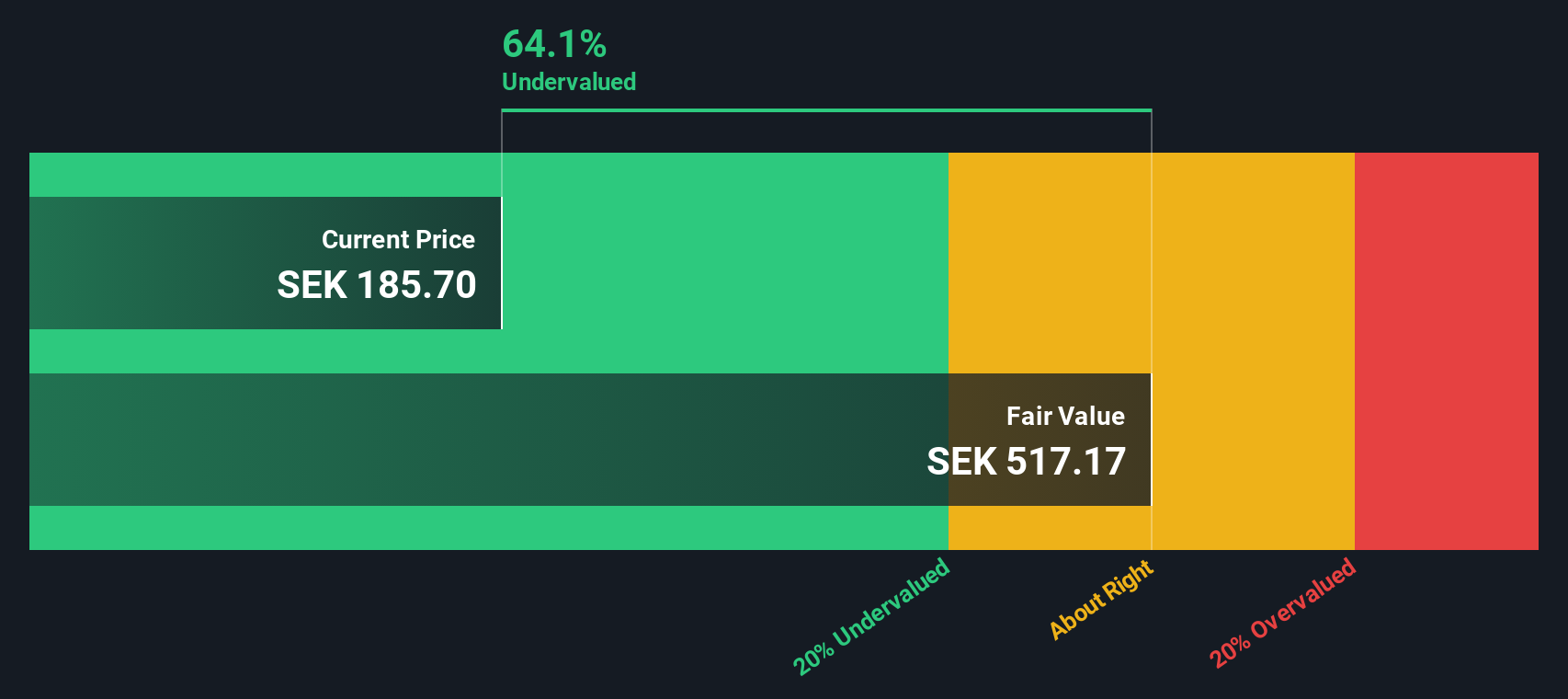

BioArctic (OM:BIOA B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: BioArctic is a Swedish biopharmaceutical company focused on developing innovative treatments for neurodegenerative diseases, with a market cap of SEK 11.31 billion.

Operations: BioArctic generates revenue primarily from its biotechnology segment, with recent figures showing a gross profit margin of 45.85%. The company incurs significant operating expenses, including general and administrative costs and R&D expenses, which have impacted its net income margins negatively in recent periods.

PE: -83.6x

BioArctic, a smaller company in the biotech industry, is drawing attention with its strategic moves and potential growth areas. A recent global license agreement with Bristol Myers Squibb could bring up to US$1.35 billion, including a US$100 million upfront payment, boosting its financial outlook despite recent losses. The company's proprietary BrainTransporter technology offers promising applications across various therapies. However, BioArctic's share price has shown high volatility recently. Earnings forecasts suggest significant growth potential at 62% annually, though the company relies entirely on external borrowing for funding, which carries higher risk compared to customer deposits.

- Click here and access our complete valuation analysis report to understand the dynamics of BioArctic.

Explore historical data to track BioArctic's performance over time in our Past section.

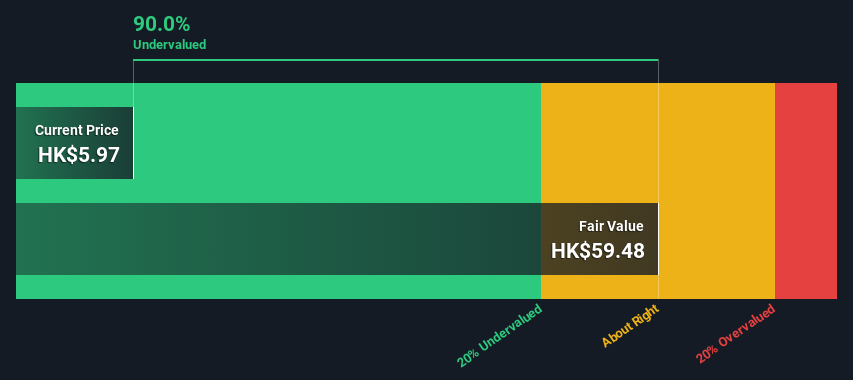

Cutia Therapeutics (SEHK:2487)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Cutia Therapeutics focuses on developing innovative and comprehensive solutions in the healthcare sector, with a market cap of CN¥3.45 billion.

Operations: The company generates revenue primarily from developing innovative and comprehensive solutions, with recent revenue reaching CN¥198.86 million. The gross profit margin has shown a decline from 78.99% in December 2021 to 50.33% by June 2024, indicating changes in cost efficiency or pricing strategies over time. Operating expenses are significant, driven by research and development along with sales and marketing costs, impacting overall profitability as reflected in the negative net income figures across the periods analyzed.

PE: -3.9x

Cutia Therapeutics, a smaller player in the biotech space, is gaining attention with its promising pipeline and recent insider confidence. CFO and Executive Director Yuqing Huang acquired 35,000 shares in November 2024 for approximately RMB 421,698, signaling belief in the company's potential. Despite being unprofitable currently and reliant on external funding sources, Cutia's revenue grew by nearly 130% year-on-year as of September 2024. Notably, their Phase II trial for CU-20401 showed significant efficacy without adverse events.

- Get an in-depth perspective on Cutia Therapeutics' performance by reading our valuation report here.

Gain insights into Cutia Therapeutics' past trends and performance with our Past report.

Taking Advantage

- Get an in-depth perspective on all 194 Undervalued Small Caps With Insider Buying by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioArctic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOA B

BioArctic

Develops biological drugs for patients with central nervous system disorders in Sweden.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives