- Sweden

- /

- Auto Components

- /

- OM:DOM

Is Dometic Group a Bargain After Latest 4% Weekly Stock Rebound?

Reviewed by Bailey Pemberton

Thinking about what to do with Dometic Group stock? You are not alone. Investors weighing recent returns may find themselves wondering if this company’s moderate rebound signals the start of a turnaround or just a bump in a difficult stretch. Over the last week, the stock has climbed by 4.0% and over the last month it is up a modest 0.8%. However, looking at a broader timeframe, Dometic Group shares are still down 3.3% year-to-date, and the one-year chart shows a bigger slide of 8.6%. The five-year picture reveals a steep decline of almost 50%, which is hard to ignore. These shifts have followed broader moves in the consumer durables sector, as investors have alternated between optimism about travel demand and caution regarding global supply chains and inflation risks.

The conversation around valuation is especially intriguing right now. According to our framework, Dometic scores a 3 out of 6 on key checks for undervaluation. That indicates there are some genuinely attractive qualities here, but also that risks and reservations remain. Is the current share price offering a bargain, or simply reflecting the company’s challenges?

It is worth diving into how Dometic stacks up across different valuation yardsticks. As we will discuss, there is a smarter way to interpret what all these valuations mean for your investment decision, so stick with us through the details ahead.

Why Dometic Group is lagging behind its peers

Approach 1: Dometic Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future free cash flows and discounting them back to their present value. This approach helps determine what the business is fundamentally worth today, based on expected cash generation down the line.

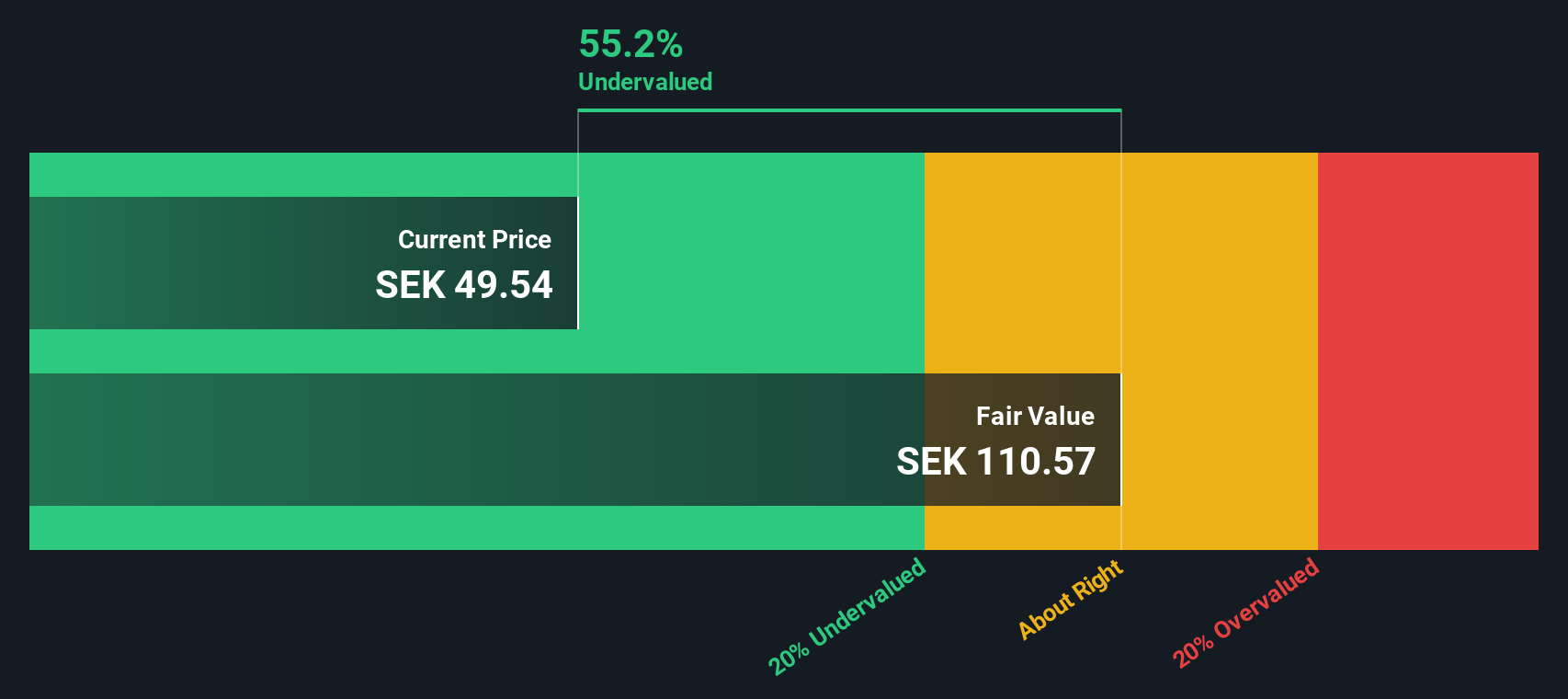

For Dometic Group, the current Free Cash Flow stands at approximately SEK 3.05 billion. Analyst estimates contribute projections for the next five years, after which Simply Wall St extrapolates further growth. If projections hold, Free Cash Flow is expected to reach roughly SEK 2.67 billion in 2027, with subsequent years showing a gradual taper in annual growth. The long-term 10-year forecast sees cash flows fluctuating between SEK 2.04 billion and SEK 2.66 billion, all denominated in SEK.

Comparing the calculated intrinsic value per share of SEK 111.15 to the current market price, the DCF model suggests Dometic Group is trading at a 53.7% discount. This sizable margin points to strong undervaluation, and current market pessimism may be overlooking the business's cash-generating potential under realistic conditions.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Dometic Group is undervalued by 53.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Dometic Group Price vs Sales

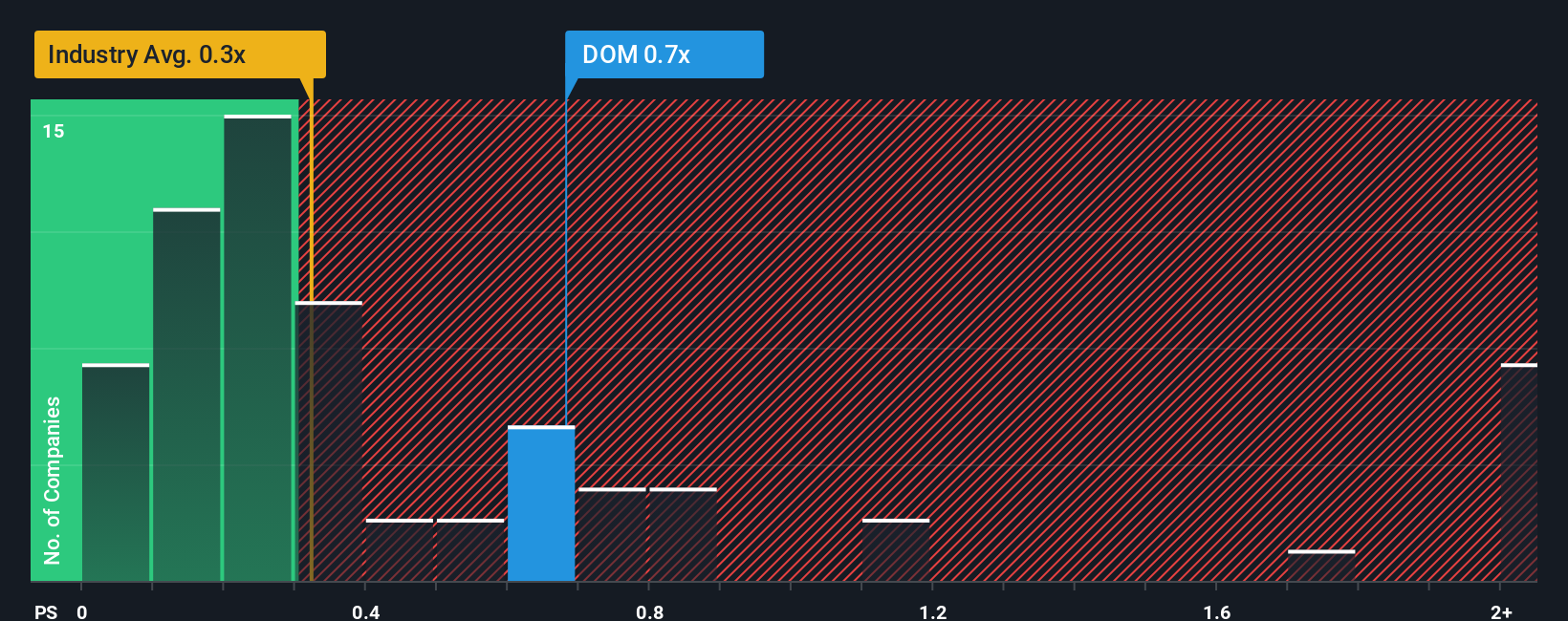

The Price-to-Sales (PS) ratio is a useful valuation measure, especially for companies where profits can fluctuate due to cyclicality or one-off items. It looks past short-term earnings noise and focuses on revenue, which is typically harder to manipulate and less volatile than net income. This makes the PS ratio an appropriate metric when assessing companies in consumer and industrial sectors like Dometic Group.

Growth expectations and business risks are key factors that shape what a “normal” or “fair” PS ratio should be. Companies with stronger revenue growth, higher margins, or lower risk profiles usually command higher PS multiples, while those facing industry headwinds or operational uncertainties tend to trade at a discount. For Dometic Group, the current PS ratio stands at 0.73x. Compared to the Auto Components industry average of 0.91x and its peer group average of 1.23x, Dometic Group is trading at a noticeable discount to both benchmarks.

Simply Wall St also uses a proprietary “Fair Ratio” framework, which calculates what a reasonable PS ratio for Dometic Group should be given its specific growth outlook, industry, profit margins, market capitalization, and risk factors. This tailored approach provides a much more reliable indication of true valuation versus simple peer or industry comparisons, as it accounts for unique company attributes rather than broad averages. For Dometic, the Fair Ratio stands at 0.33x. This is substantially lower than both its actual ratio and industry benchmarks. This suggests the market may still be pricing in risks or near-term challenges, but by our model, shares are currently trading above what is justified by the fundamentals.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dometic Group Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal investment story about a company, linking what you believe about its business, from future revenue and profit margins to overall industry prospects, directly to a financial forecast and, ultimately, a fair value. This approach moves beyond raw ratios, giving you the reason behind the numbers and letting you map your perspective to a concrete forecast.

Narratives are easy to create and share on Simply Wall St’s Community page, a platform trusted by millions of investors. With Narratives, you can see exactly how your insights measure up. By comparing your calculated Fair Value to the current market Price, you gain a practical framework to decide if it is time to buy, hold, or sell.

Best of all, Narratives dynamically update as new information comes in, so your view can evolve with news and earnings. For example, one Dometic Group Narrative might reflect strong optimism for a rapid rebound and a high fair value, while another may predict ongoing headwinds, resulting in a much lower fair value.

This lets you align your investment decisions with your beliefs and respond smartly to the latest developments.

Do you think there's more to the story for Dometic Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DOM

Dometic Group

Provides mobile living solutions for food and beverage, climate, power and control, and other applications in the United States, Germany, Australia, Italy, France, the United Kingdom, Japan, Canada, the Netherlands, Sweden, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion