- Sweden

- /

- Auto Components

- /

- OM:DOM

Earnings Miss: Dometic Group AB (publ) Missed EPS By 42% And Analysts Are Revising Their Forecasts

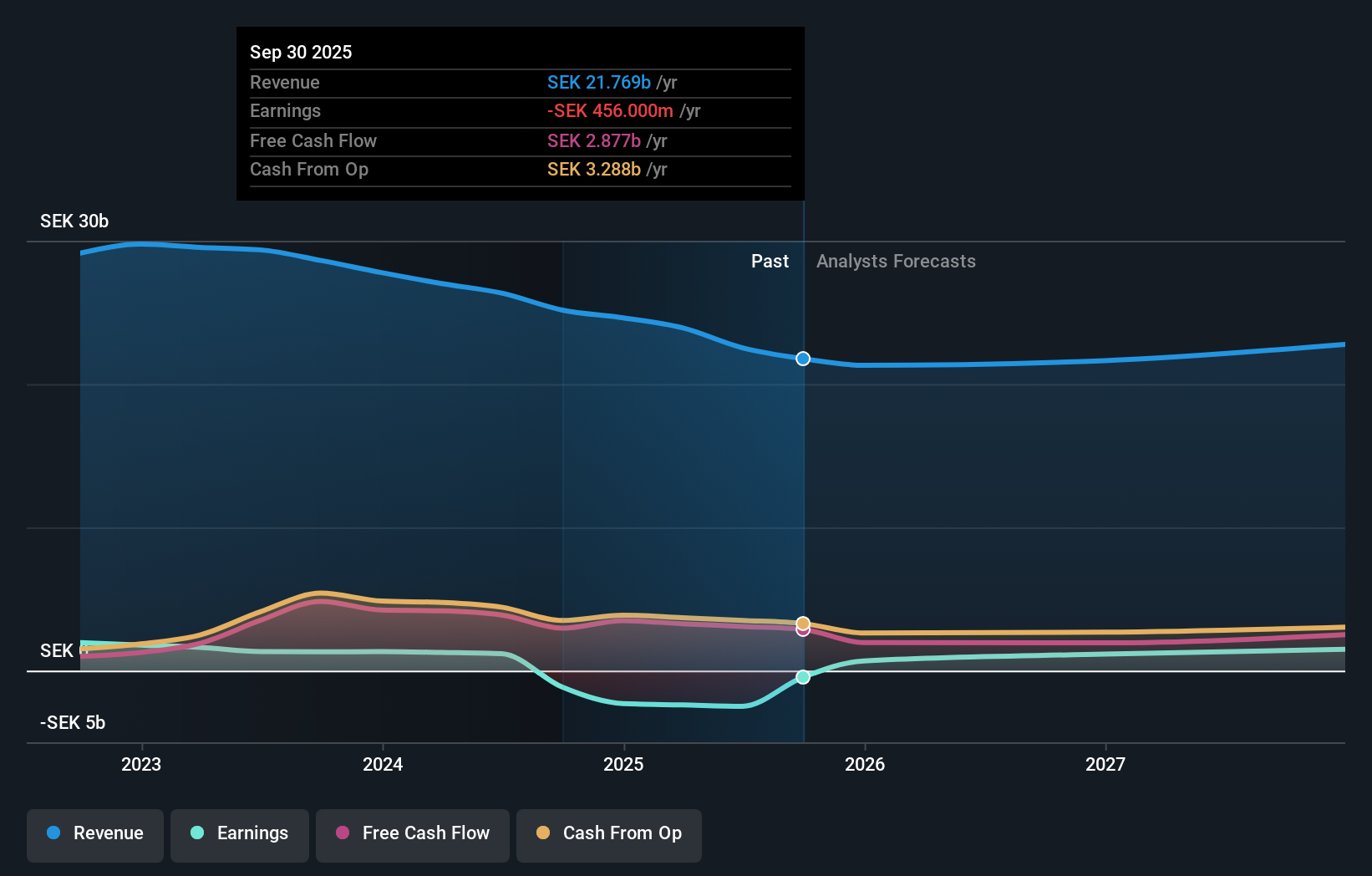

The analysts might have been a bit too bullish on Dometic Group AB (publ) (STO:DOM), given that the company fell short of expectations when it released its third-quarter results last week. It wasn't a great result overall - while revenue fell marginally short of analyst estimates at kr4.9b, statutory earnings missed forecasts by an incredible 42%, coming in at just kr0.35 per share. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

Taking into account the latest results, Dometic Group's six analysts currently expect revenues in 2026 to be kr21.6b, approximately in line with the last 12 months. Dometic Group is also expected to turn profitable, with statutory earnings of kr3.57 per share. Before this earnings report, the analysts had been forecasting revenues of kr21.9b and earnings per share (EPS) of kr3.77 in 2026. So it looks like there's been a small decline in overall sentiment after the recent results - there's been no major change to revenue estimates, but the analysts did make a minor downgrade to their earnings per share forecasts.

Check out our latest analysis for Dometic Group

Althoughthe analysts have revised their earnings forecasts for next year, they've also lifted the consensus price target 17% to kr56.00, suggesting the revised estimates are not indicative of a weaker long-term future for the business. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values Dometic Group at kr60.00 per share, while the most bearish prices it at kr50.00. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or thatthe analysts have a strong view on its prospects.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that revenue is expected to reverse, with a forecast 0.5% annualised decline to the end of 2026. That is a notable change from historical growth of 5.9% over the last five years. Yet aggregate analyst estimates for other companies in the industry suggest that industry revenues are forecast to decline 0.8% per year. The forecasts do look comparatively optimistic for Dometic Group, since they're expecting it to shrink slower than the industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Dometic Group. On the plus side, they made no changes to their revenue estimates - and they expect it to perform better than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that in mind, we wouldn't be too quick to come to a conclusion on Dometic Group. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple Dometic Group analysts - going out to 2027, and you can see them free on our platform here.

You still need to take note of risks, for example - Dometic Group has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:DOM

Dometic Group

Provides mobile living solutions for food and beverage, climate, power and control, and other applications in the United States, Germany, Australia, Italy, France, the United Kingdom, Japan, Canada, the Netherlands, Sweden, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)