- Saudi Arabia

- /

- Other Utilities

- /

- SASE:2083

Getting In Cheap On The Power and Water Utility Company for Jubail and Yanbu (TADAWUL:2083) Might Be Difficult

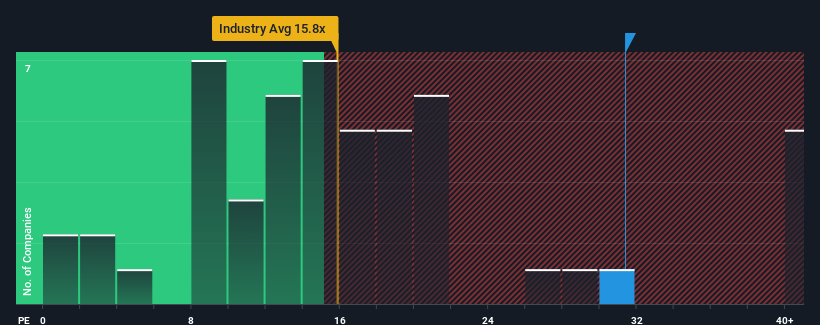

When close to half the companies in Saudi Arabia have price-to-earnings ratios (or "P/E's") below 28x, you may consider The Power and Water Utility Company for Jubail and Yanbu (TADAWUL:2083) as a stock to potentially avoid with its 31.4x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Power and Water Utility Company for Jubail and Yanbu hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Power and Water Utility Company for Jubail and Yanbu

How Is Power and Water Utility Company for Jubail and Yanbu's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Power and Water Utility Company for Jubail and Yanbu's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 38%. Still, the latest three year period has seen an excellent 97% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 26% per year during the coming three years according to the dual analysts following the company. With the market only predicted to deliver 15% per annum, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Power and Water Utility Company for Jubail and Yanbu's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Power and Water Utility Company for Jubail and Yanbu's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Power and Water Utility Company for Jubail and Yanbu (1 is a bit unpleasant!) that you should be aware of before investing here.

Of course, you might also be able to find a better stock than Power and Water Utility Company for Jubail and Yanbu. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2083

Power and Water Utility Company for Jubail and Yanbu

Engages in the operation, maintenance, construction, and management of power and water systems to governmental, industrial, commercial, and residential customers.

Good value with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026