Undiscovered Gems With Strong Fundamentals To Explore January 2025

Reviewed by Simply Wall St

As global markets continue to rally, with the S&P 500 reaching record highs and growth stocks outperforming value shares, investors are closely watching economic indicators that suggest a rebound in manufacturing activity. Amid this backdrop of optimism fueled by potential trade deals and AI advancements, small-cap stocks present intriguing opportunities for those seeking companies with robust fundamentals that may not yet be widely recognized. In this environment, identifying stocks with strong balance sheets and growth potential can be particularly rewarding as they often thrive when broader market conditions are favorable.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Namuga | 14.66% | -1.45% | 33.57% | ★★★★★★ |

| ONEJOON | 9.85% | 24.95% | 4.85% | ★★★★★☆ |

| Giant Heavy Machinery Service | 17.81% | 21.88% | 48.77% | ★★★★★☆ |

| Primadaya Plastisindo | 10.46% | 15.41% | 23.92% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

| Shandong Longquan Pipe IndustryLtd | 34.82% | 2.24% | -22.15% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Alkhorayef Water and Power Technologies (SASE:2081)

Simply Wall St Value Rating: ★★★★☆☆

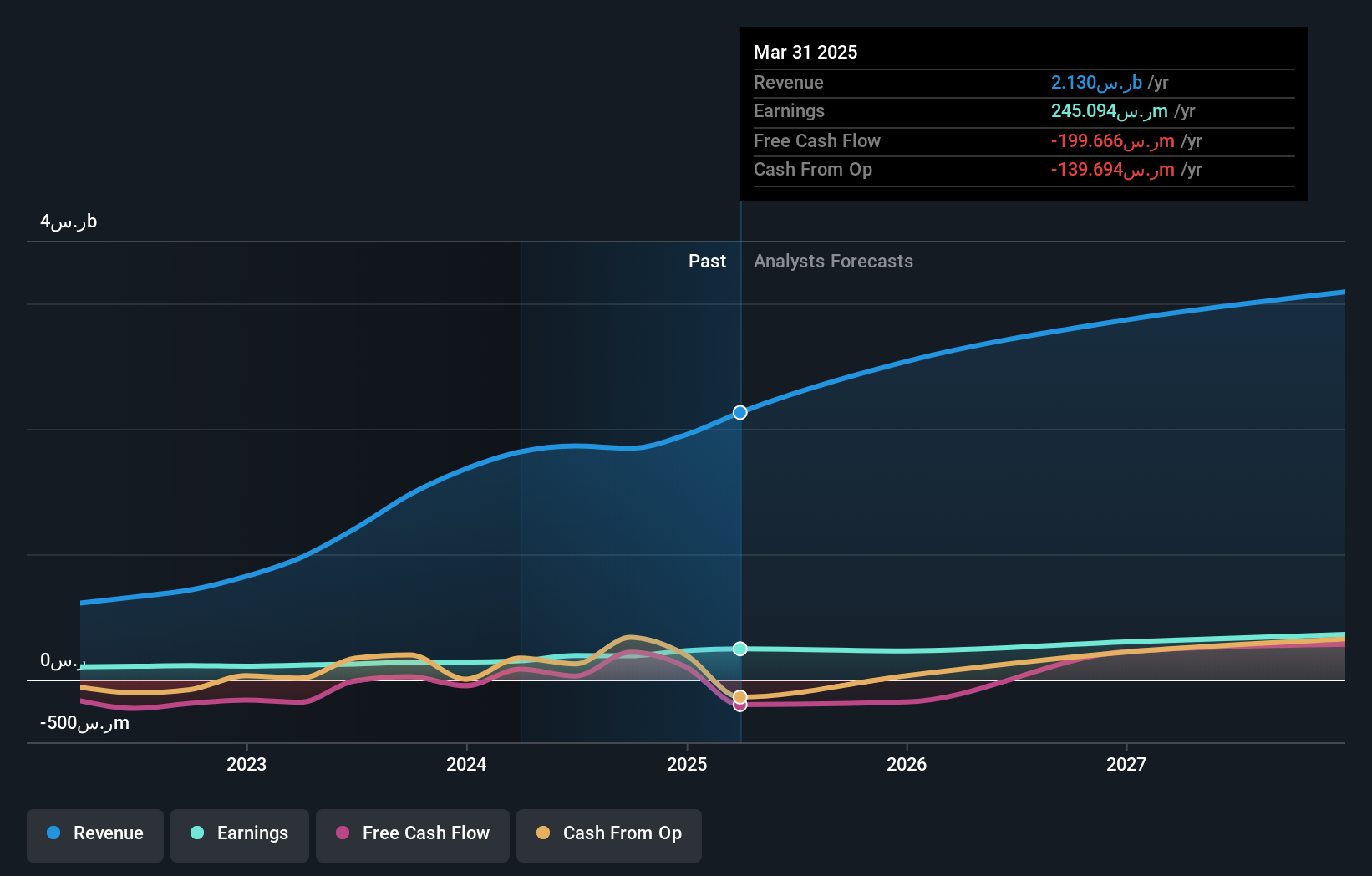

Overview: Alkhorayef Water and Power Technologies Company specializes in the design, construction, operation, maintenance, and management of water and wastewater projects in Saudi Arabia with a market capitalization of SAR5.62 billion.

Operations: Alkhorayef Water and Power Technologies generates revenue primarily from three segments: Integrated Water Solutions (SAR1.12 billion), Water (SAR377 million), and Wastewater (SAR352 million). The company's gross profit margin shows a notable trend, reflecting its operational efficiency in managing costs across these segments.

Alkhorayef Water and Power Technologies, a promising player in the water utilities sector, has shown impressive growth with earnings up 37.5% over the past year, outpacing the industry's 1.1%. The company reported nine-month sales of SAR 1.34 billion compared to SAR 1.21 billion last year, reflecting robust revenue expansion. Despite a high net debt to equity ratio of 43.8%, its interest payments are well covered at 6.2x EBIT, indicating solid financial management. Trading at a significant discount of about 65% below estimated fair value suggests potential for future appreciation as it continues leveraging its high-quality earnings profile.

Almunajem Foods (SASE:4162)

Simply Wall St Value Rating: ★★★★★★

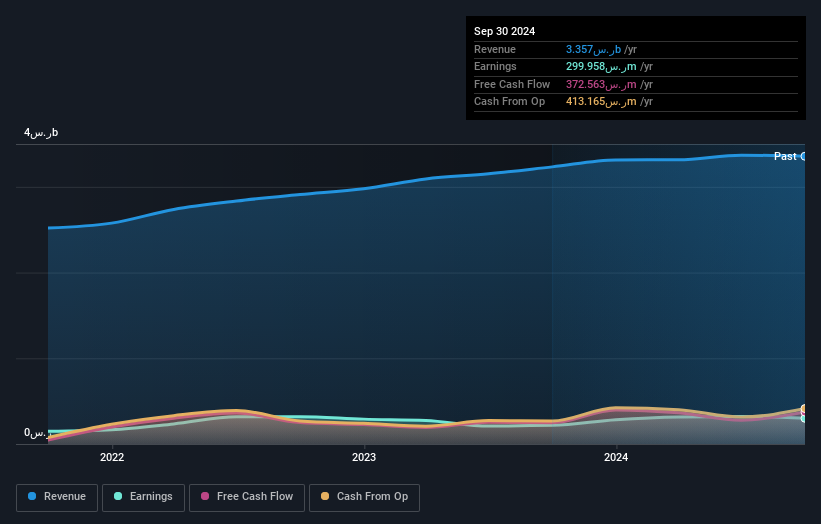

Overview: Almunajem Foods Company specializes in the import, marketing, and distribution of frozen, chilled, and dry foodstuffs across Saudi Arabia with a market cap of SAR5.81 billion.

Operations: Almunajem Foods generates revenue primarily from three regional segments: Central Region (SAR1.41 billion), Eastern & Northern Regions (SAR0.68 billion), and Western & Southern Regions (SAR1.27 billion).

Almunajem Foods, a relatively smaller player in the food industry, has shown robust financial health with earnings increasing by 37.9% over the past year, outpacing the broader Consumer Retailing sector's -2%. The company seems undervalued, trading at 19.4% below its estimated fair value. Despite a dip in third-quarter net income to SAR 40.51 million from SAR 61.14 million last year, nine-month figures paint a brighter picture with net income rising to SAR 218.33 million from SAR 200.59 million previously. A debt-to-equity ratio reduction from 65.8% to just 5.6% over five years highlights prudent financial management and positions Almunajem for potential growth amidst industry challenges.

- Click to explore a detailed breakdown of our findings in Almunajem Foods' health report.

Explore historical data to track Almunajem Foods' performance over time in our Past section.

Chiba Kogyo Bank (TSE:8337)

Simply Wall St Value Rating: ★★★★★☆

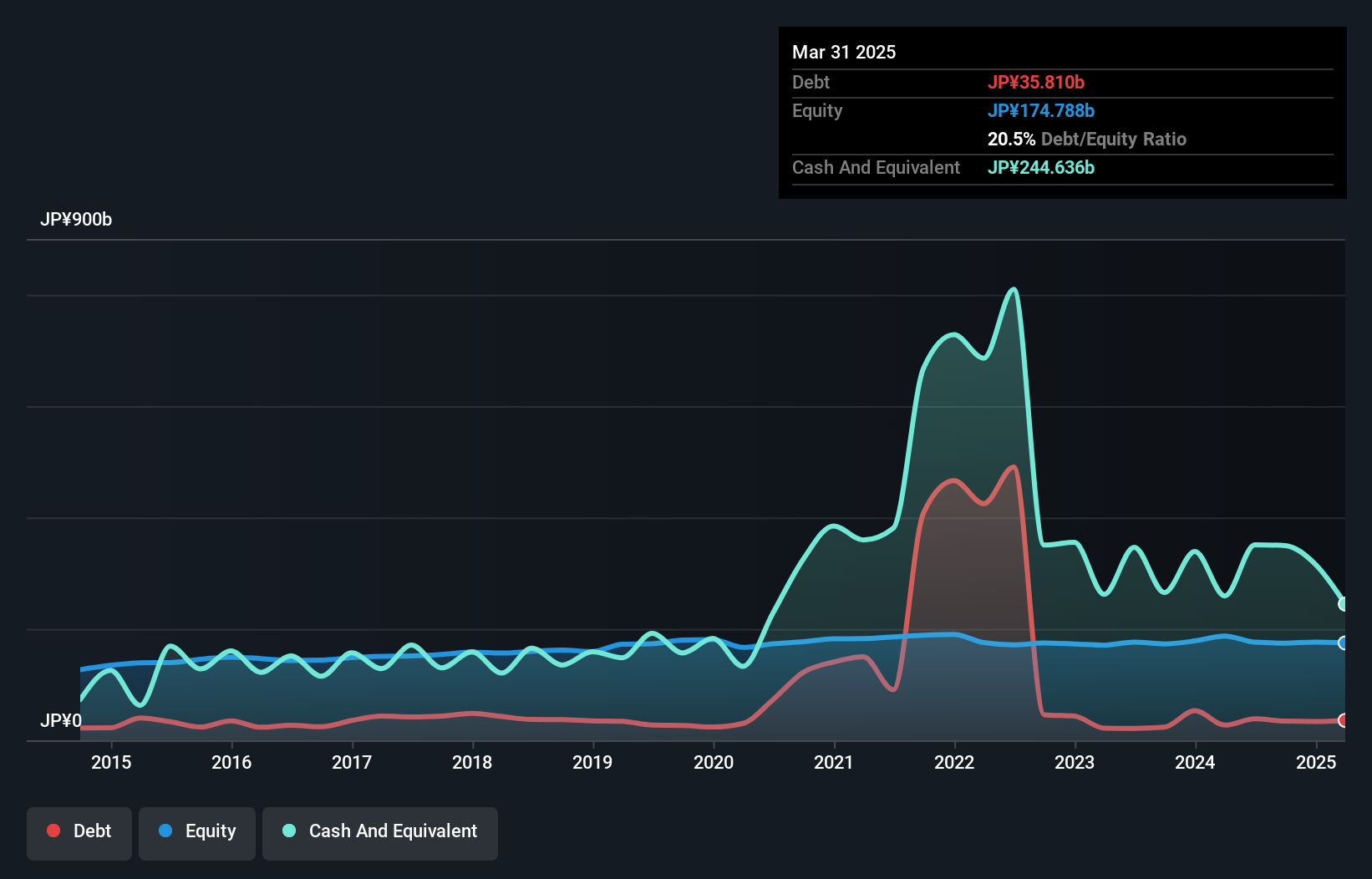

Overview: The Chiba Kogyo Bank, Ltd., along with its subsidiaries, offers a range of banking products and services in Japan and has a market cap of ¥87.70 billion.

Operations: Chiba Kogyo Bank generates revenue primarily from its banking segment, which contributes ¥49.79 billion, followed by its leasing business at ¥8.08 billion and credit guarantee and credit card industry at ¥1.22 billion.

Chiba Kogyo Bank, with assets totaling ¥3,298.6 billion and equity of ¥174.5 billion, is a noteworthy player in the banking sector. It has total deposits of ¥3,053.9 billion and loans amounting to ¥2,390.3 billion but shows a low allowance for bad loans at 1.8% of total loans, which might raise concerns about risk management practices. Despite this, it boasts high-quality earnings with an impressive 18% annual growth over five years and trades at a value 19% below its estimated fair value. The bank's funding is primarily from low-risk sources like customer deposits (98%).

- Get an in-depth perspective on Chiba Kogyo Bank's performance by reading our health report here.

Examine Chiba Kogyo Bank's past performance report to understand how it has performed in the past.

Summing It All Up

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4668 more companies for you to explore.Click here to unveil our expertly curated list of 4671 Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8337

Chiba Kogyo Bank

Provides various banking products and services in Japan.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion