- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:1322

Ghitha Holding P.J.S.C And 2 Other Undiscovered Gems in the Middle East

Reviewed by Simply Wall St

As Middle Eastern markets experience a positive shift, buoyed by U.S. tariff exemptions and rising oil prices, investors are increasingly eyeing the region for potential opportunities. In this dynamic environment, identifying promising stocks requires a keen understanding of market trends and economic indicators that favor growth and resilience.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Amir Marketing and Investments in Agriculture | 13.05% | 5.82% | 3.78% | ★★★★★★ |

| Sure Global Tech | NA | 13.90% | 18.91% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Formula Systems (1985) | 34.50% | 9.19% | 12.63% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 23.69% | 28.47% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Ghitha Holding P.J.S.C (ADX:GHITHA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ghitha Holding P.J.S.C is an investment holding company that offers management and investment services across various projects and businesses in the United Arab Emirates, with a market capitalization of AED4.13 billion.

Operations: Ghitha Holding P.J.S.C generates revenue primarily from Dairy and Protein (AED1.86 billion), Fruits and Vegetables (AED1.45 billion), and Trading and Distribution (AED965.85 million) segments, with additional contributions from Edible Oil and Fats (AED687.93 million). The net profit margin is a key financial metric to consider when evaluating the company's profitability trends over time.

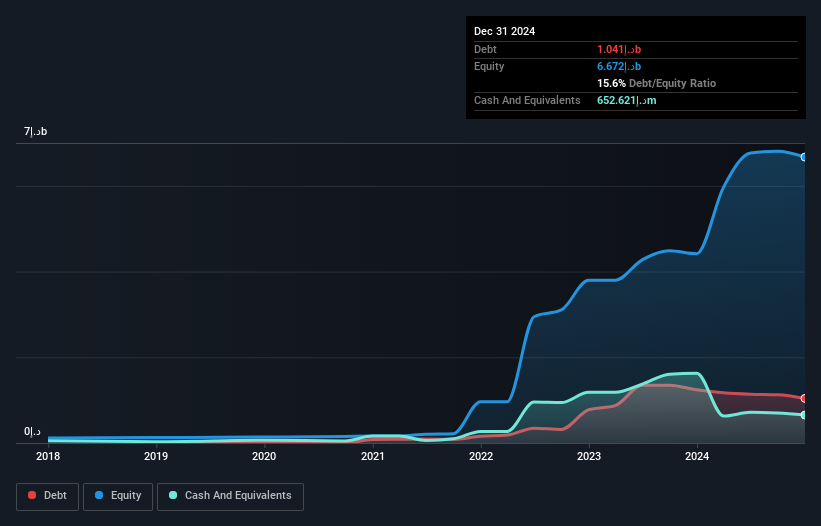

Ghitha Holding P.J.S.C. showcases significant growth potential within the Middle Eastern market, with its earnings skyrocketing by 6330% over the past year, far outpacing the Consumer Retailing industry average of 15.7%. The company's price-to-earnings ratio stands at an attractive 1.5x compared to the AE market's 12.6x, suggesting it could be undervalued. Despite a rise in debt to equity from 0% to 15.6% over five years, its net debt to equity ratio remains satisfactory at 5.8%. With non-cash earnings contributing significantly and interest payments well-covered by EBIT at a ratio of 3.7x, Ghitha appears financially robust despite recent share price volatility.

Al Masane Al Kobra Mining (SASE:1322)

Simply Wall St Value Rating: ★★★★★★

Overview: Al Masane Al Kobra Mining Company operates in the Kingdom of Saudi Arabia, focusing on the production of non-ferrous metal ores and precious metals, with a market cap of SAR4.86 billion.

Operations: The company's revenue streams are primarily derived from three mining operations: Al Masane Mine contributing SAR364.95 million, Mount Guyan Mine generating SAR226.74 million, and Moyeath Min adding SAR188.96 million.

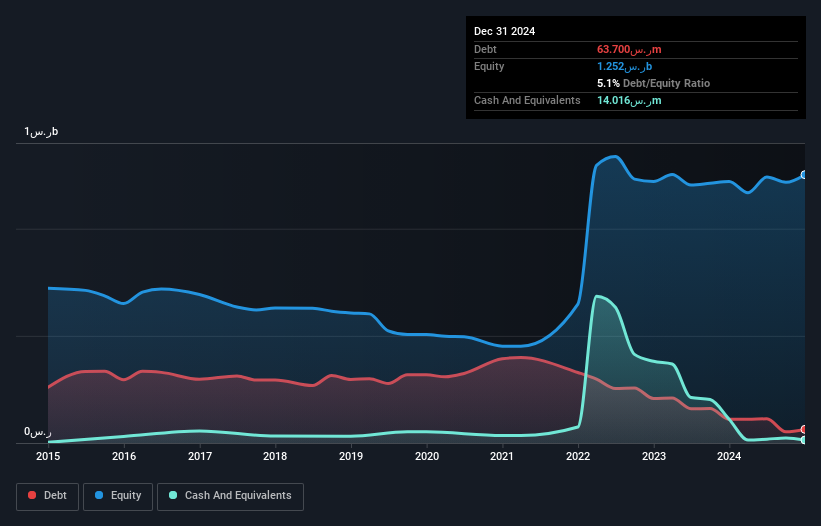

Al Masane Al Kobra Mining, a nimble player in the Middle East mining sector, has shown impressive financial resilience. The company reported a significant earnings surge of 225.9% over the past year, outpacing industry growth of 118.8%. Its debt to equity ratio impressively shrank from 62.8% to just 5.1% in five years, highlighting effective debt management strategies. Interest payments are comfortably covered by EBIT at a robust 60 times coverage, indicating strong operational performance. With net income jumping to SAR 177.9 million from SAR 54.58 million last year and basic earnings per share rising to SAR 2.01 from SAR 0.73, its financial health appears solid for future endeavors.

- Click here to discover the nuances of Al Masane Al Kobra Mining with our detailed analytical health report.

Understand Al Masane Al Kobra Mining's track record by examining our Past report.

Alkhorayef Water and Power Technologies (SASE:2081)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Alkhorayef Water and Power Technologies Company specializes in the design, construction, operation, maintenance, and management of water and wastewater projects in Saudi Arabia with a market capitalization of SAR5.46 billion.

Operations: The company's primary revenue streams include the design, construction, operation, maintenance, and management of water and wastewater projects in Saudi Arabia. It has a market capitalization of SAR5.46 billion.

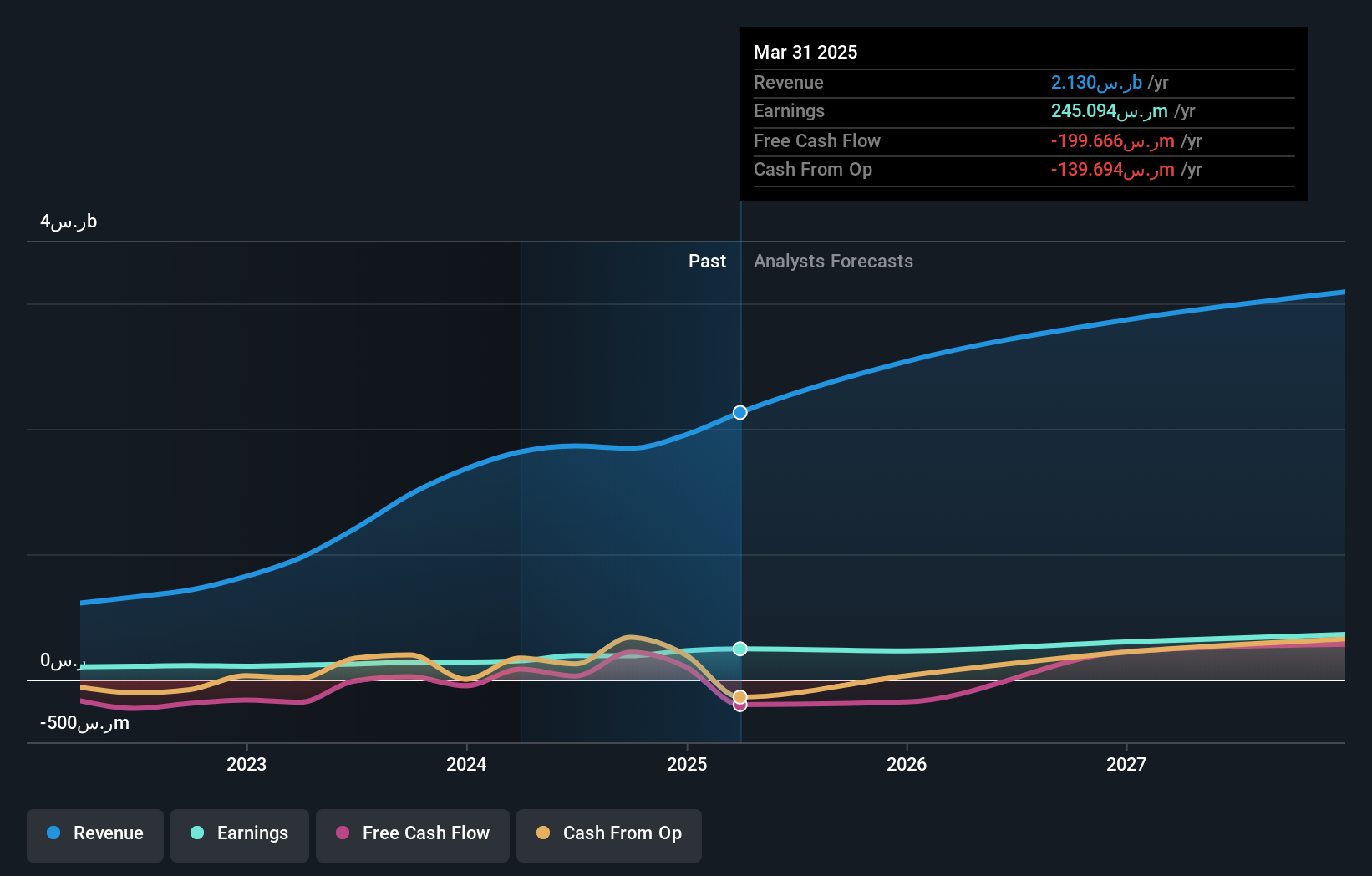

Alkhorayef Water and Power Technologies, a smaller player in the Middle East's water utilities sector, has shown promising growth. Earnings surged 64% over the past year, outpacing industry growth of just 0.2%. Despite a high net debt to equity ratio at 44%, interest payments are well covered with EBIT at 5.8 times interest repayments. The company posted sales of SAR 1.95 billion for the full year ending December 2024, up from SAR 1.71 billion previously, while net income rose to SAR 230 million from SAR 140 million last year. With earnings per share increasing to SAR 6.57 from SAR 5.6, Alkhorayef demonstrates robust performance amidst growing prospects in its industry context.

Key Takeaways

- Discover the full array of 244 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Al Masane Al Kobra Mining, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1322

Al Masane Al Kobra Mining

Engages in the production of non-ferrous metal ores and precious metals in Kingdom of Saudi Arabia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives