- Saudi Arabia

- /

- Water Utilities

- /

- SASE:2081

Do Alkhorayef Water and Power Technologies' (TADAWUL:2081) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Alkhorayef Water and Power Technologies (TADAWUL:2081). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Alkhorayef Water and Power Technologies with the means to add long-term value to shareholders.

View our latest analysis for Alkhorayef Water and Power Technologies

How Fast Is Alkhorayef Water and Power Technologies Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Alkhorayef Water and Power Technologies has grown EPS by 22% per year, compound, in the last three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

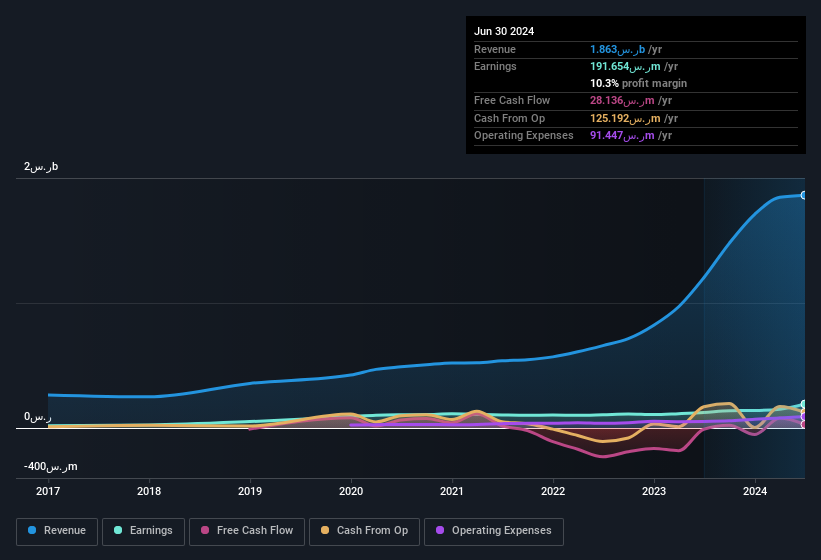

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Alkhorayef Water and Power Technologies achieved similar EBIT margins to last year, revenue grew by a solid 55% to ر.س1.9b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Alkhorayef Water and Power Technologies' balance sheet strength, before getting too excited.

Are Alkhorayef Water and Power Technologies Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that Alkhorayef Water and Power Technologies insiders have a significant amount of capital invested in the stock. To be specific, they have ر.س157m worth of shares. This considerable investment should help drive long-term value in the business. While their ownership only accounts for 2.6%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Is Alkhorayef Water and Power Technologies Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Alkhorayef Water and Power Technologies' strong EPS growth. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. Still, you should learn about the 1 warning sign we've spotted with Alkhorayef Water and Power Technologies.

Although Alkhorayef Water and Power Technologies certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Saudi companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2081

Alkhorayef Water and Power Technologies

Designs, constructs, operates, maintains, and manages water and wastewater projects in Saudi Arabia.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026