- Saudi Arabia

- /

- Transportation

- /

- SASE:4260

United International Transportation Company (TADAWUL:4260) Might Not Be As Mispriced As It Looks

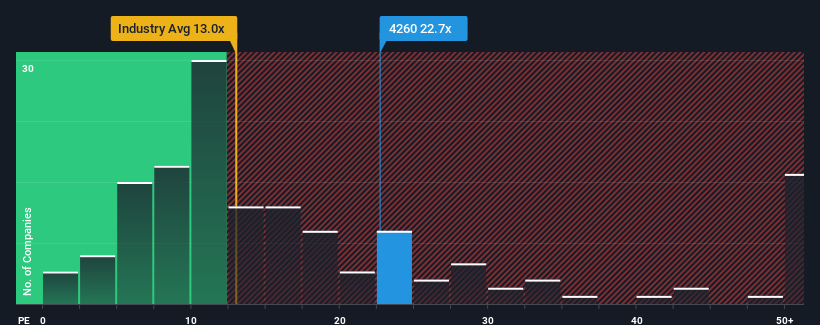

It's not a stretch to say that United International Transportation Company's (TADAWUL:4260) price-to-earnings (or "P/E") ratio of 22.7x right now seems quite "middle-of-the-road" compared to the market in Saudi Arabia, where the median P/E ratio is around 24x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

While the market has experienced earnings growth lately, United International Transportation's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Check out our latest analysis for United International Transportation

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like United International Transportation's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 2.1% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 3.0% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 20% per year over the next three years. With the market only predicted to deliver 14% each year, the company is positioned for a stronger earnings result.

In light of this, it's curious that United International Transportation's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that United International Transportation currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for United International Transportation (1 is significant!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4260

United International Transportation

Engages in the leasing and rental of vehicles, and used car sales under the Budget Rent a Car name in Saudi Arabia.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives