- Saudi Arabia

- /

- Transportation

- /

- SASE:4040

Saudi Public Transport (TADAWUL:4040 investor three-year losses grow to 39% as the stock sheds ر.س220m this past week

For many investors, the main point of stock picking is to generate higher returns than the overall market. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term Saudi Public Transport Company (TADAWUL:4040) shareholders, since the share price is down 39% in the last three years, falling well short of the market decline of around 5.3%. Shareholders have had an even rougher run lately, with the share price down 16% in the last 90 days. Of course, this share price action may well have been influenced by the 7.8% decline in the broader market, throughout the period.

If the past week is anything to go by, investor sentiment for Saudi Public Transport isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Saudi Public Transport

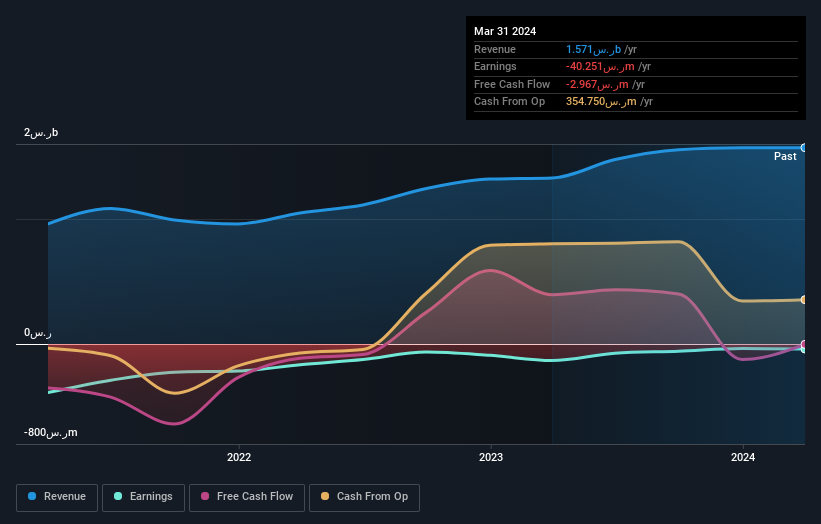

Because Saudi Public Transport made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last three years, Saudi Public Transport saw its revenue grow by 19% per year, compound. That's a fairly respectable growth rate. Shareholders have seen the share price fall at 12% per year, for three years. So the market has definitely lost some love for the stock. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Saudi Public Transport's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Although it hurts that Saudi Public Transport returned a loss of 2.2% in the last twelve months, the broader market was actually worse, returning a loss of 5.4%. Longer term investors wouldn't be so upset, since they would have made 3%, each year, over five years. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Saudi Public Transport , and understanding them should be part of your investment process.

We will like Saudi Public Transport better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4040

Saudi Public Transport

Engages in the provision of transportation services in the Kingdom of Saudi Arabia and internationally.

Acceptable track record with imperfect balance sheet.

Market Insights

Community Narratives