- Saudi Arabia

- /

- Infrastructure

- /

- SASE:2190

Saudi Industrial Services Company's (TADAWUL:2190) Financials Are Too Obscure To Link With Current Share Price Momentum: What's In Store For the Stock?

Saudi Industrial Services (TADAWUL:2190) has had a great run on the share market with its stock up by a significant 17% over the last three months. But the company's key financial indicators appear to be differing across the board and that makes us question whether or not the company's current share price momentum can be maintained. Particularly, we will be paying attention to Saudi Industrial Services' ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

View our latest analysis for Saudi Industrial Services

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Saudi Industrial Services is:

11% = ر.س186m ÷ ر.س1.7b (Based on the trailing twelve months to September 2020).

The 'return' is the amount earned after tax over the last twelve months. That means that for every SAR1 worth of shareholders' equity, the company generated SAR0.11 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Saudi Industrial Services' Earnings Growth And 11% ROE

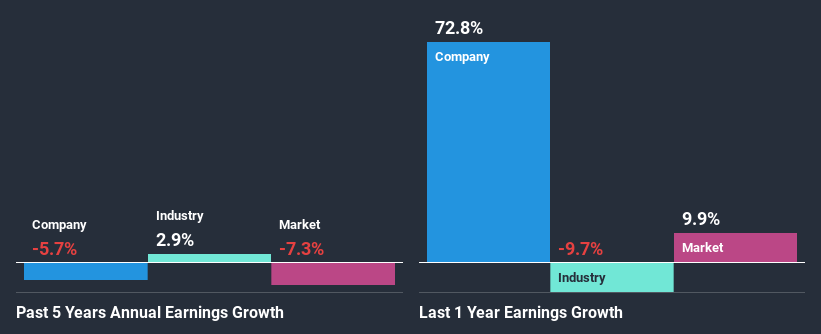

On the face of it, Saudi Industrial Services' ROE is not much to talk about. However, the fact that the company's ROE is higher than the average industry ROE of 5.9%, is definitely interesting. But then again, seeing that Saudi Industrial Services' net income shrunk at a rate of 5.7% in the past five years, makes us think again. Remember, the company's ROE is a bit low to begin with, just that it is higher than the industry average. Hence, this goes some way in explaining the shrinking earnings.

So, as a next step, we compared Saudi Industrial Services' performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 3.0% in the same period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Saudi Industrial Services''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Saudi Industrial Services Efficiently Re-investing Its Profits?

With a high three-year median payout ratio of 59% (implying that 41% of the profits are retained), most of Saudi Industrial Services' profits are being paid to shareholders, which explains the company's shrinking earnings. With only a little being reinvested into the business, earnings growth would obviously be low or non-existent. You can see the 2 risks we have identified for Saudi Industrial Services by visiting our risks dashboard for free on our platform here.

Additionally, Saudi Industrial Services has paid dividends over a period of six years, which means that the company's management is rather focused on keeping up its dividend payments, regardless of the shrinking earnings.

Summary

On the whole, we feel that the performance shown by Saudi Industrial Services can be open to many interpretations. Specifically, the low earnings growth is a bit concerning, especially given that the company has a respectable rate of return. Investors may have benefitted, had the company been reinvesting more of its earnings. As discussed earlier, the company is retaining a small portion of its profits. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. To gain further insights into Saudi Industrial Services' past profit growth, check out this visualization of past earnings, revenue and cash flows.

When trading Saudi Industrial Services or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:2190

Sustained Infrastructure Holding

Engages in the development and management of port and terminal operations primarily in the Kingdom of Saudi Arabia.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives