- Saudi Arabia

- /

- Telecom Services and Carriers

- /

- SASE:7040

Undiscovered Gems To Explore In October 2024

Reviewed by Simply Wall St

As global markets navigate the impact of rising U.S. Treasury yields and a cautious economic outlook, small-cap stocks have faced particular pressure, with indices like the Russell 2000 experiencing notable declines. In this environment, identifying undiscovered gems requires a keen eye for companies that demonstrate resilience and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 15.53% | 54.51% | 76.29% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| DorightLtd | 0.56% | 14.02% | 7.14% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi | 0.21% | 50.35% | 68.60% | ★★★★★☆ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 6.86% | 64.15% | 63.49% | ★★★★★☆ |

| Kappa Create | 74.42% | -0.45% | 3.62% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Etihad Atheeb Telecommunication (SASE:7040)

Simply Wall St Value Rating: ★★★★★★

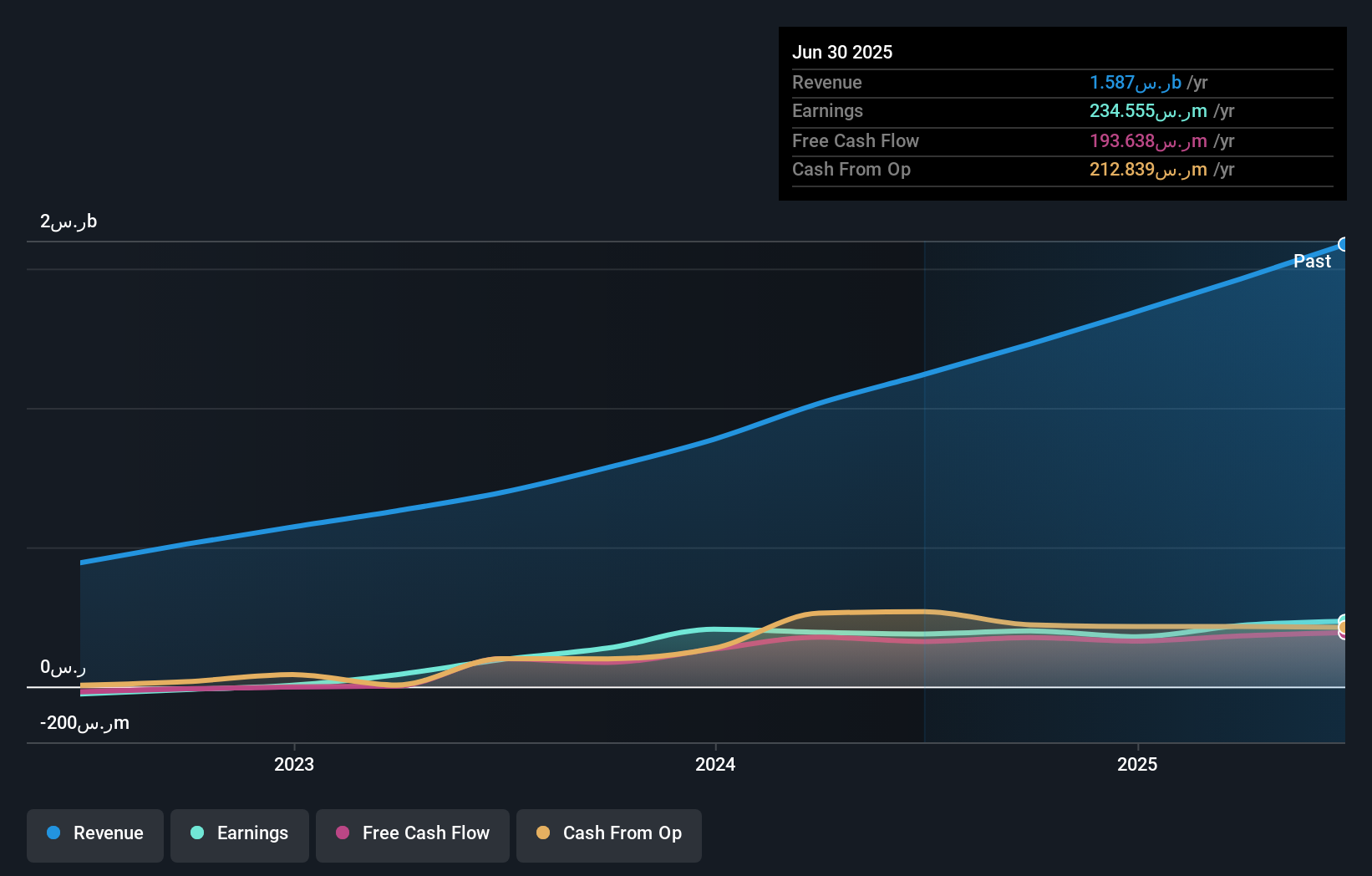

Overview: Etihad Atheeb Telecommunication Company offers telecommunication products and services to individuals and businesses in Saudi Arabia and internationally, with a market capitalization of SAR3.96 billion.

Operations: The company generates revenue primarily from data services amounting to SAR760.47 million and voice services contributing SAR359.50 million.

Etihad Atheeb Telecommunication, a nimble player in the telecom sector, is making waves with its impressive 95% earnings growth over the past year, significantly outpacing the industry's 5%. This debt-free company has seen its stock added to the S&P Global BMI Index recently, highlighting its rising prominence. Despite substantial shareholder dilution over the past year, it trades at a striking 78% below estimated fair value. With robust non-cash earnings and positive free cash flow, Etihad Atheeb appears well-positioned within its industry landscape for potential future opportunities.

Anhui Gourgen Traffic ConstructionLtd (SHSE:603815)

Simply Wall St Value Rating: ★★★★☆☆

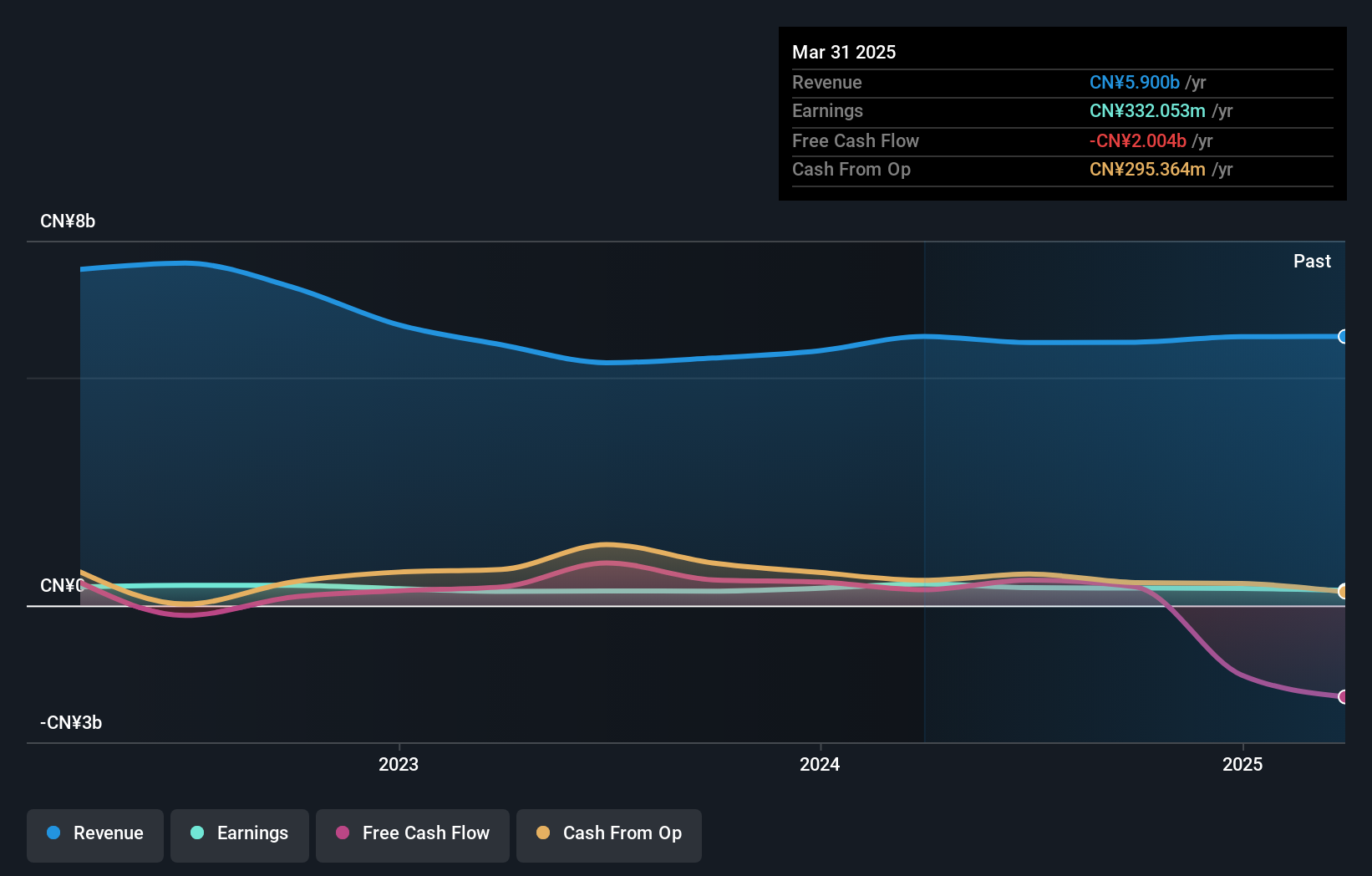

Overview: Anhui Gourgen Traffic Construction Co., Ltd. (SHSE:603815) is involved in infrastructure development and construction projects, with a market cap of CN¥4.30 billion.

Operations: Gourgen Traffic Construction generates revenue primarily from infrastructure development and construction projects. The company has a market cap of CN¥4.30 billion, indicating its scale within the industry.

Anhui Gourgen Traffic Construction, a relatively small player in the construction sector, presents a mixed financial picture. The company's net debt to equity ratio stands at 40.7%, which is considered high, though it has improved from 81.7% over five years. Despite negative earnings growth of -23.1% last year, its interest payments are well covered by EBIT with a coverage of 17.7x, indicating strong operational income relative to debt costs. Recent earnings show a dip in sales and net income compared to last year; however, the company completed a share buyback of nearly CNY 10 million for about 1.92 million shares recently, reflecting confidence in its valuation amidst challenges.

Shenzhen Laibao Hi-Tech (SZSE:002106)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Laibao Hi-Tech Co., Ltd. focuses on the research, development, production, and sale of flat panel display upstream materials and touch devices in China, with a market cap of CN¥7.53 billion.

Operations: Laibao Hi-Tech generates revenue primarily from the sale of flat panel display upstream materials and touch devices. The company's financial performance is influenced by its ability to manage production costs and optimize its net profit margin.

Shenzhen Laibao Hi-Tech, a smaller player in the electronics sector, has shown robust earnings growth of 21.9% over the past year, outpacing the industry average of 0.3%. Its price-to-earnings ratio stands at 19.7x, which is considered a good value compared to the broader Chinese market's 34.3x. The company reported sales of CNY 4.41 billion for nine months ending September 2024, slightly up from CNY 4.23 billion last year, with net income rising to CNY 309 million from CNY 303 million previously. Laibao Hi-Tech also boasts high-quality earnings and positive free cash flow while maintaining more cash than total debt.

Where To Now?

- Discover the full array of 4742 Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Etihad Atheeb Telecommunication, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Etihad Atheeb Telecommunication might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:7040

Etihad Atheeb Telecommunication

Provides telecommunication products and services for individuals and businesses in the Kingdom of Saudi Arabia and internationally.

Excellent balance sheet and fair value.