- Saudi Arabia

- /

- Wireless Telecom

- /

- SASE:7020

With Etihad Etisalat Company (TADAWUL:7020) It Looks Like You'll Get What You Pay For

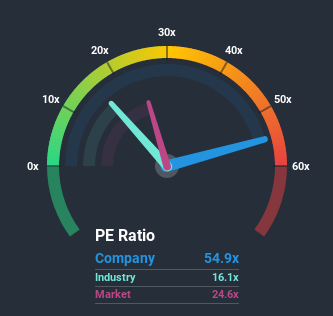

When close to half the companies in Saudi Arabia have price-to-earnings ratios (or "P/E's") below 24x, you may consider Etihad Etisalat Company (TADAWUL:7020) as a stock to avoid entirely with its 54.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been advantageous for Etihad Etisalat as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Etihad Etisalat

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Etihad Etisalat would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 76% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 112% during the coming year according to the nine analysts following the company. With the market only predicted to deliver 3.6%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Etihad Etisalat's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Etihad Etisalat's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Etihad Etisalat's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Etihad Etisalat is showing 1 warning sign in our investment analysis, you should know about.

You might be able to find a better investment than Etihad Etisalat. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

If you’re looking to trade Etihad Etisalat, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Etihad Etisalat, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Etihad Etisalat might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SASE:7020

Etihad Etisalat

Through its subsidiaries, establishes and operates mobile wireless telecommunication and fiber optic networks in the Kingdom of Saudi Arabia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives