- Saudi Arabia

- /

- IT

- /

- SASE:9557

Edarat Communication and Information Technology (TADAWUL:9557) Is Reinvesting To Multiply In Value

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Ergo, when we looked at the ROCE trends at Edarat Communication and Information Technology (TADAWUL:9557), we liked what we saw.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Edarat Communication and Information Technology, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.45 = ر.س20m ÷ (ر.س61m - ر.س16m) (Based on the trailing twelve months to December 2023).

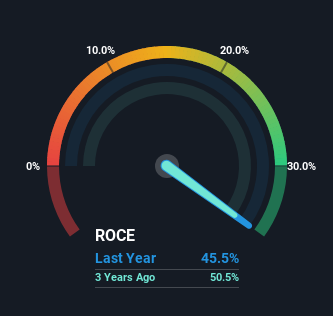

Thus, Edarat Communication and Information Technology has an ROCE of 45%. That's a fantastic return and not only that, it outpaces the average of 28% earned by companies in a similar industry.

View our latest analysis for Edarat Communication and Information Technology

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Edarat Communication and Information Technology has performed in the past in other metrics, you can view this free graph of Edarat Communication and Information Technology's past earnings, revenue and cash flow.

What Can We Tell From Edarat Communication and Information Technology's ROCE Trend?

It's hard not to be impressed by Edarat Communication and Information Technology's returns on capital. Over the past three years, ROCE has remained relatively flat at around 45% and the business has deployed 411% more capital into its operations. Returns like this are the envy of most businesses and given it has repeatedly reinvested at these rates, that's even better. You'll see this when looking at well operated businesses or favorable business models.

One more thing to note, even though ROCE has remained relatively flat over the last three years, the reduction in current liabilities to 27% of total assets, is good to see from a business owner's perspective. This can eliminate some of the risks inherent in the operations because the business has less outstanding obligations to their suppliers and or short-term creditors than they did previously.

Our Take On Edarat Communication and Information Technology's ROCE

In summary, we're delighted to see that Edarat Communication and Information Technology has been compounding returns by reinvesting at consistently high rates of return, as these are common traits of a multi-bagger. On top of that, the stock has rewarded shareholders with a remarkable 143% return to those who've held over the last year. So while the positive underlying trends may be accounted for by investors, we still think this stock is worth looking into further.

If you want to know some of the risks facing Edarat Communication and Information Technology we've found 2 warning signs (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if Edarat Communication and Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9557

Edarat Communication and Information Technology

Edarat Communication and Information Technology Co.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026