- Saudi Arabia

- /

- IT

- /

- SASE:9550

A Look Into Sure Global Tech's (TADAWUL:9550) Impressive Returns On Capital

If you're looking for a multi-bagger, there's a few things to keep an eye out for. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Ergo, when we looked at the ROCE trends at Sure Global Tech (TADAWUL:9550), we liked what we saw.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Sure Global Tech, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.29 = ر.س37m ÷ (ر.س196m - ر.س65m) (Based on the trailing twelve months to December 2024).

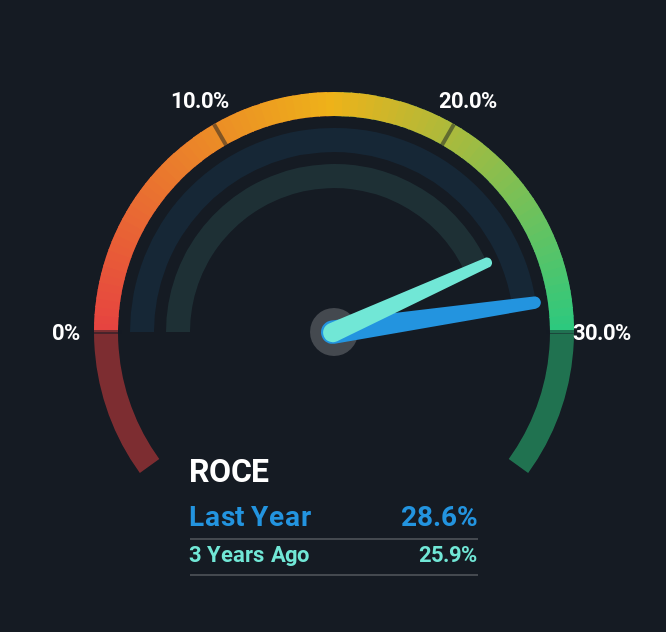

Thus, Sure Global Tech has an ROCE of 29%. In absolute terms that's a very respectable return and compared to the IT industry average of 27% it's pretty much on par.

See our latest analysis for Sure Global Tech

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Sure Global Tech's past further, check out this free graph covering Sure Global Tech's past earnings, revenue and cash flow.

What Can We Tell From Sure Global Tech's ROCE Trend?

It's hard not to be impressed by Sure Global Tech's returns on capital. Over the past five years, ROCE has remained relatively flat at around 29% and the business has deployed 123% more capital into its operations. Now considering ROCE is an attractive 29%, this combination is actually pretty appealing because it means the business can consistently put money to work and generate these high returns. You'll see this when looking at well operated businesses or favorable business models.

One more thing to note, even though ROCE has remained relatively flat over the last five years, the reduction in current liabilities to 33% of total assets, is good to see from a business owner's perspective. This can eliminate some of the risks inherent in the operations because the business has less outstanding obligations to their suppliers and or short-term creditors than they did previously.

What We Can Learn From Sure Global Tech's ROCE

Sure Global Tech has demonstrated its proficiency by generating high returns on increasing amounts of capital employed, which we're thrilled about. Yet over the last year the stock has declined 11%, so the decline might provide an opening. That's why we think it'd be worthwhile to look further into this stock given the fundamentals are appealing.

While Sure Global Tech looks impressive, no company is worth an infinite price. The intrinsic value infographic for 9550 helps visualize whether it is currently trading for a fair price.

If you want to search for more stocks that have been earning high returns, check out this free list of stocks with solid balance sheets that are also earning high returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:9550

Sure Global Tech

Provides technological and consultative solutions for public and private sectors in the Kingdom of Saudi Arabia.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion