- United Arab Emirates

- /

- Industrials

- /

- DFM:DIC

3 Middle Eastern Dividend Stocks Yielding Up To 8.2%

Reviewed by Simply Wall St

Amid easing trade tensions and a positive shift in global markets, most Gulf stock indices have seen gains, buoyed by U.S. tariff exemptions that have provided relief to key sectors. In this environment, dividend stocks in the Middle East offer an attractive opportunity for investors seeking steady income streams; these stocks can provide stability and potential growth even as market dynamics evolve.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Emaar Properties PJSC (DFM:EMAAR) | 8.20% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 8.05% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.18% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.91% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 5.91% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.76% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.96% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.17% | ★★★★★☆ |

| Nuh Çimento Sanayi (IBSE:NUHCM) | 3.41% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 6.60% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top Middle Eastern Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

R.A.K. Ceramics P.J.S.C (ADX:RAKCEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: R.A.K. Ceramics P.J.S.C. is involved in the manufacture and sale of a wide range of ceramic products across the Middle East, Europe, Asia, and internationally, with a market cap of AED2.40 billion.

Operations: R.A.K. Ceramics P.J.S.C.'s revenue is primarily derived from its Ceramic Products segment, which generated AED3.26 billion, complemented by AED516.02 million from Faucets and AED183.42 million from Other Industrial activities.

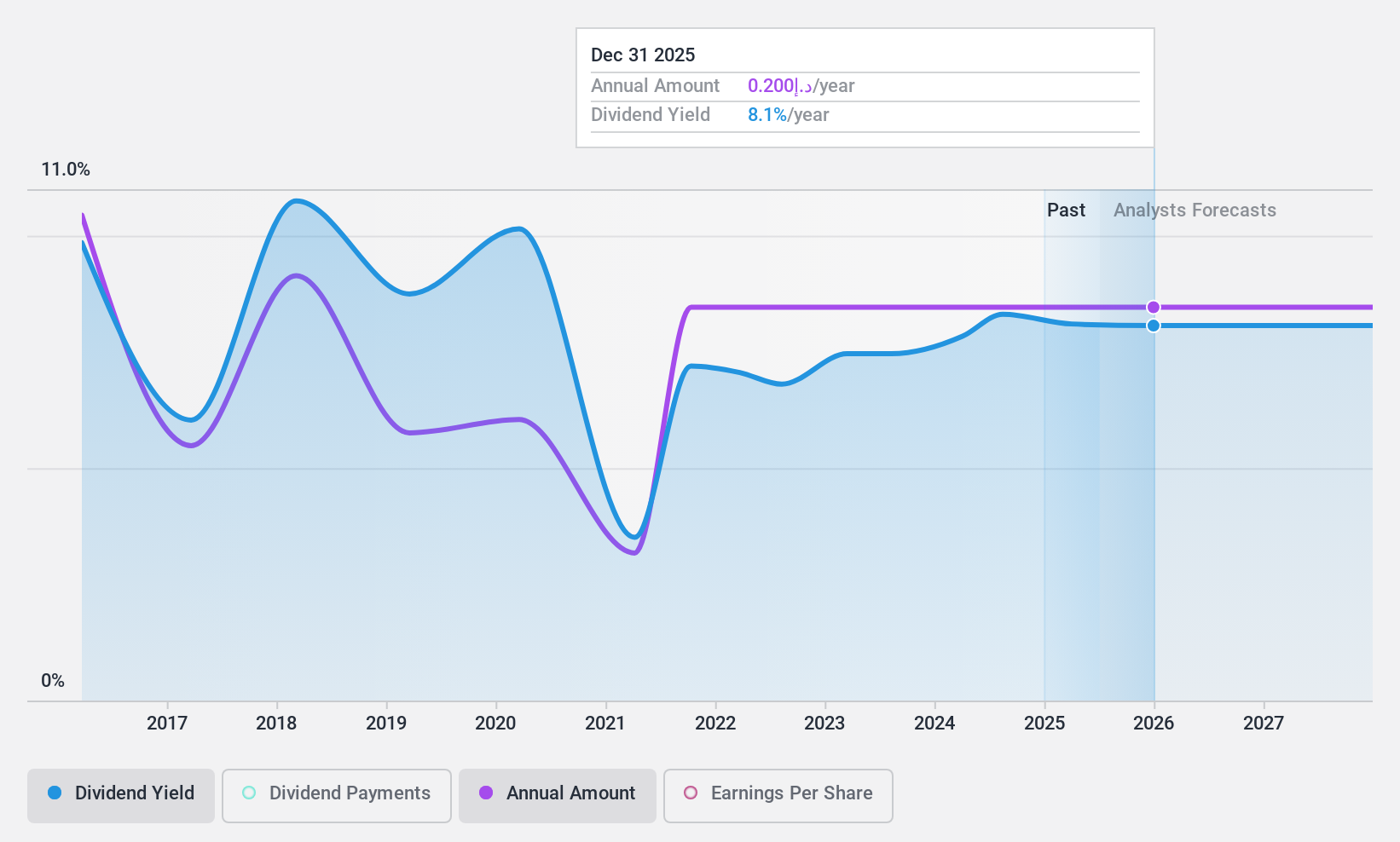

Dividend Yield: 8.3%

R.A.K. Ceramics P.J.S.C. offers a dividend yield of 8.26%, placing it among the top 25% of dividend payers in the AE market. Despite this, its dividends have been volatile over the past decade, with a payout ratio of 89.9% covered by earnings and a cash payout ratio of 49.7%. The company recently proposed AED 198.74 million in total dividends for 2025, reflecting its commitment to shareholder returns despite declining net income from AED 320.9 million to AED 221.09 million year-over-year.

- Click here to discover the nuances of R.A.K. Ceramics P.J.S.C with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of R.A.K. Ceramics P.J.S.C shares in the market.

Dubai Investments PJSC (DFM:DIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Investments PJSC operates in property, investment, manufacturing, contracting, and services sectors both in the United Arab Emirates and internationally, with a market cap of AED10.37 billion.

Operations: Dubai Investments PJSC generates revenue from three main segments: Property (AED2.17 billion), Investments (AED302.49 million), and Manufacturing, Contracting, and Services (AED1.33 billion).

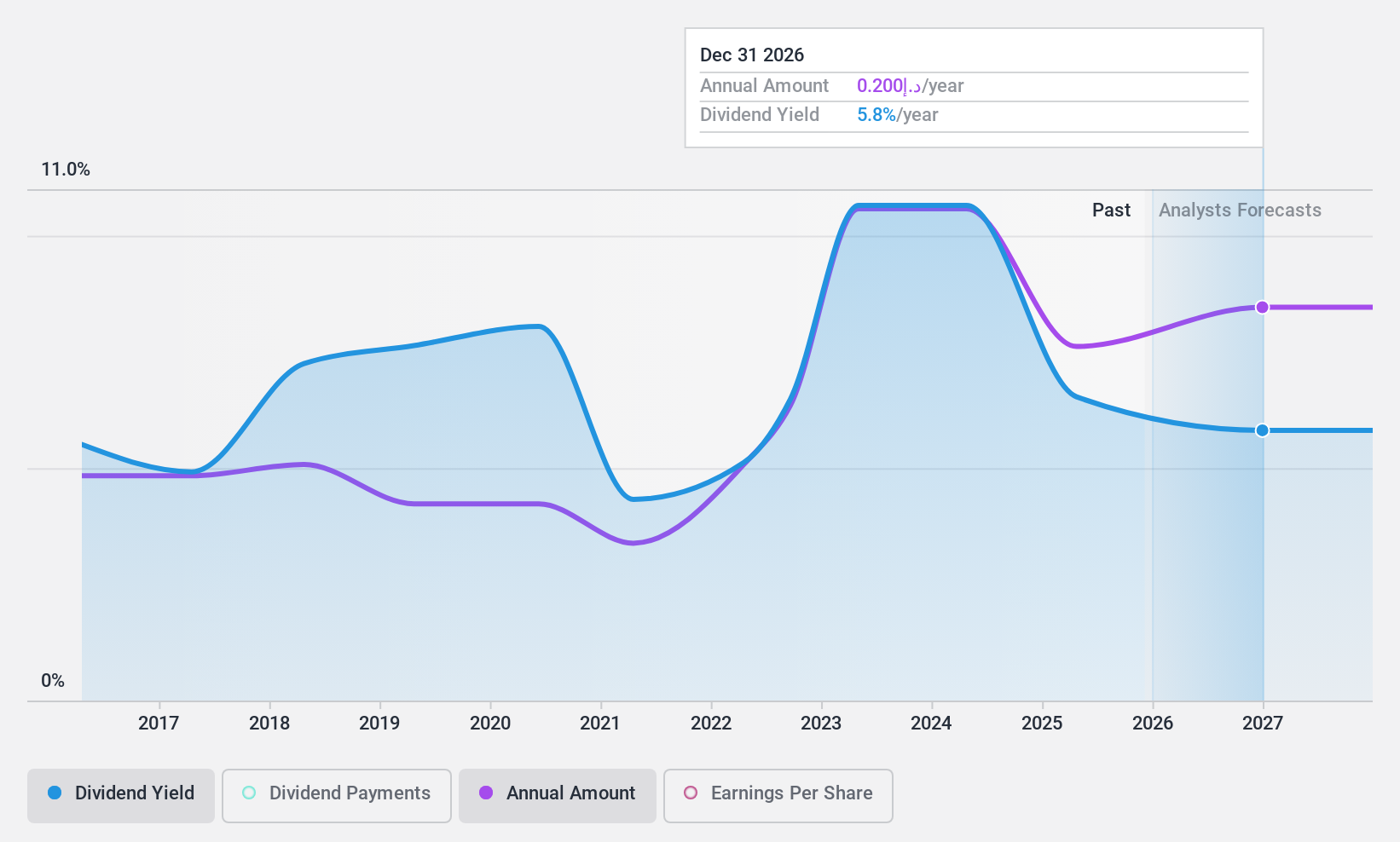

Dividend Yield: 7.4%

Dubai Investments PJSC recently announced an annual dividend of AED 0.18 per share, reflecting a commitment to shareholder returns despite historically unreliable and volatile dividends over the past decade. The company's earnings grew by 6.6% last year, with net income reaching AED 1.21 billion from AED 1.13 billion previously. While its dividend yield of 7.38% ranks in the top quartile of AE market payers, coverage by cash flows is weak due to a high cash payout ratio of 93.1%.

- Unlock comprehensive insights into our analysis of Dubai Investments PJSC stock in this dividend report.

- Our valuation report here indicates Dubai Investments PJSC may be undervalued.

Saudi Networkers Services (SASE:9543)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Saudi Networkers Services Company operates in the Kingdom of Saudi Arabia, focusing on implementing, establishing, maintaining, operating, installing, and managing telecommunication networks with a market cap of SAR434.40 million.

Operations: Saudi Networkers Services Company generates revenue of SAR571.06 million from its Computer Services segment.

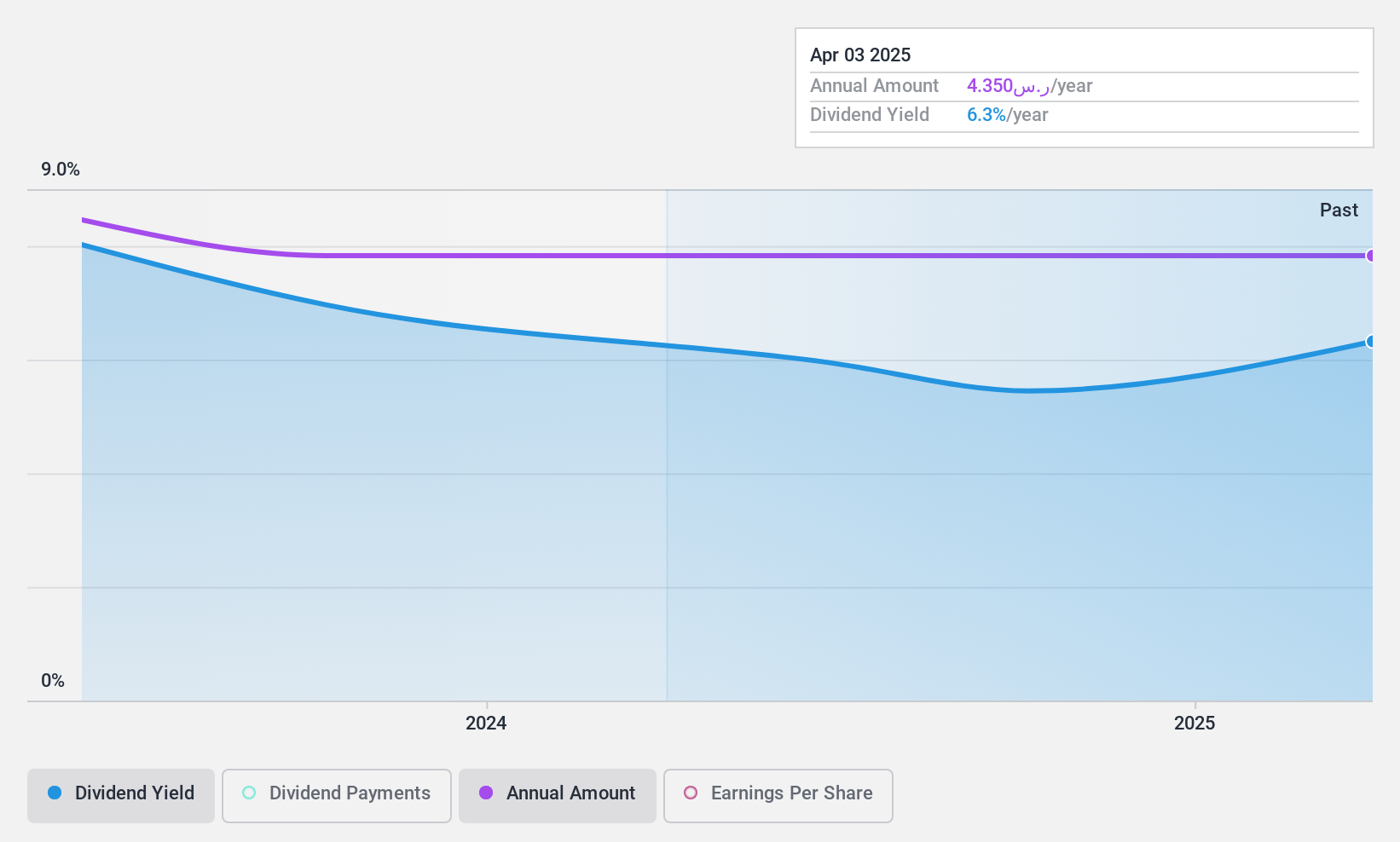

Dividend Yield: 6%

Saudi Networkers Services' dividend yield of 5.97% places it in the top 25% of dividend payers in Saudi Arabia, supported by a payout ratio of 73.2%, indicating dividends are well-covered by earnings and cash flows (cash payout ratio: 47.3%). Despite only three years of dividend history, payments have been stable and reliable. However, recent earnings showed a decline with net income dropping to SAR 30.93 million from SAR 36.56 million the previous year.

- Click to explore a detailed breakdown of our findings in Saudi Networkers Services' dividend report.

- The analysis detailed in our Saudi Networkers Services valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Unlock our comprehensive list of 61 Top Middle Eastern Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:DIC

Dubai Investments PJSC

Engages in property, investment, manufacturing, contracting, and services businesses in the United Arab Emirates and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives