- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4193

Three Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

In a week marked by volatility, global markets have been influenced by fluctuating corporate earnings and geopolitical tensions, with the U.S. Federal Reserve maintaining steady interest rates amid persistent inflation concerns. While major indices like the Nasdaq Composite faced declines due to competitive pressures in the AI sector, small-cap stocks reflected in indices such as the S&P 600 continue to capture attention for their potential resilience and growth opportunities. In this environment, identifying promising stocks involves looking beyond immediate market noise to find companies with strong fundamentals and innovative strategies that could thrive despite broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chilanga Cement | NA | 13.46% | 35.92% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

OEM International (OM:OEM B)

Simply Wall St Value Rating: ★★★★★★

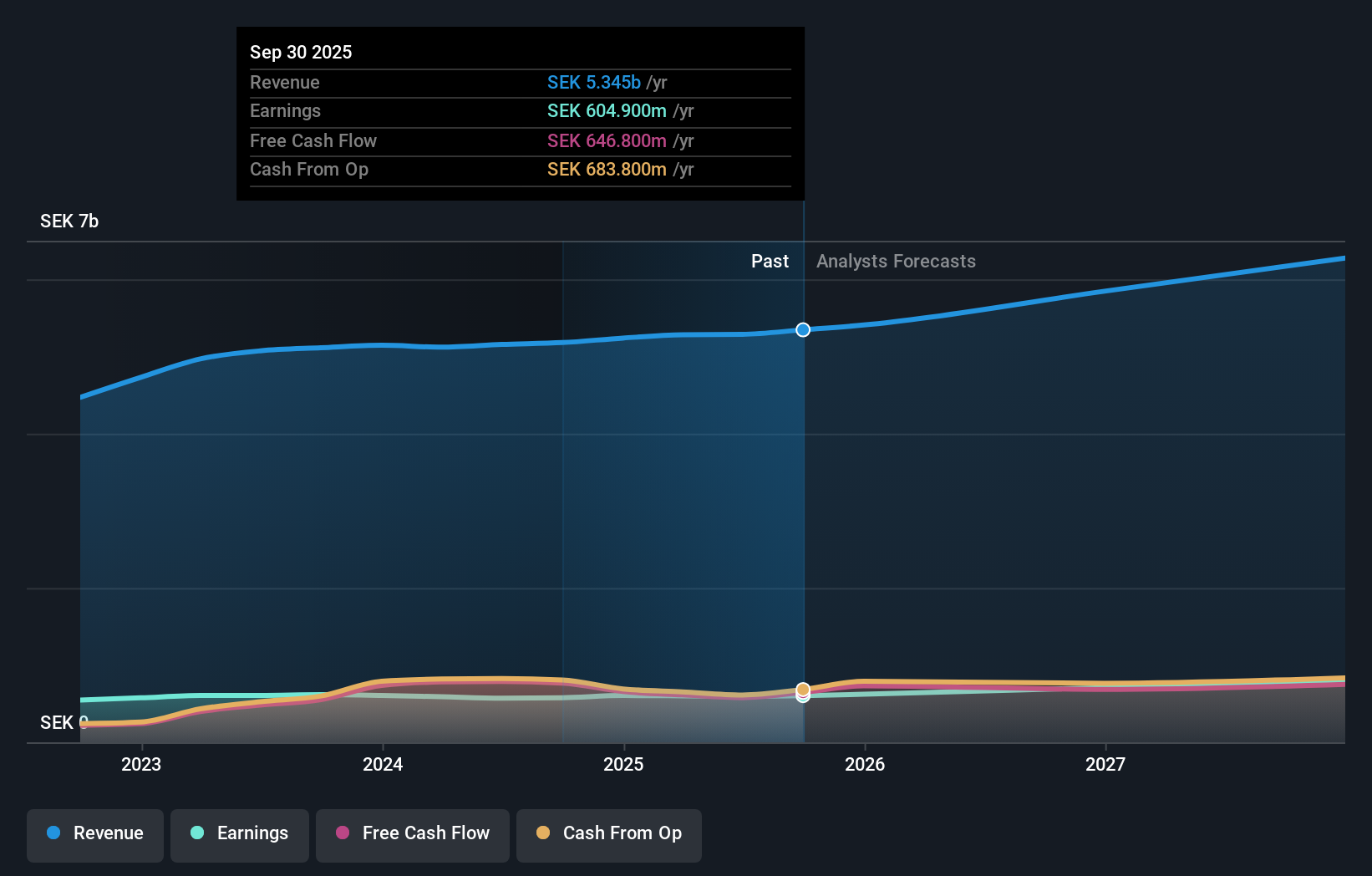

Overview: OEM International AB (publ) is a technology trading company that operates through its subsidiaries across various countries including Sweden, Finland, the UK, and China, with a market capitalization of approximately SEK 17.19 billion.

Operations: The company's revenue streams are primarily derived from Sweden, contributing SEK 3.31 billion, followed by Denmark, Norway, the British Isles, and East Central Europe with SEK 1.21 billion. Finland, the Baltic States, and China add SEK 1.03 billion to the total revenue.

OEM International, a smaller player in the industry, is trading at 45.3% below its estimated fair value, presenting potential upside for investors. Over the past five years, its debt to equity ratio has seen a significant reduction from 22.9% to 2.6%, highlighting improved financial health. Despite negative earnings growth of -6.2% last year compared to the industry average, OEM B remains profitable with free cash flow positivity and high-quality earnings reported consistently. Interest payments are comfortably covered by EBIT at 244 times over, suggesting strong operational efficiency and management's focus on maintaining fiscal discipline amidst challenging market conditions.

- Get an in-depth perspective on OEM International's performance by reading our health report here.

Examine OEM International's past performance report to understand how it has performed in the past.

Nice One Beauty Digital Marketing (SASE:4193)

Simply Wall St Value Rating: ★★★★★☆

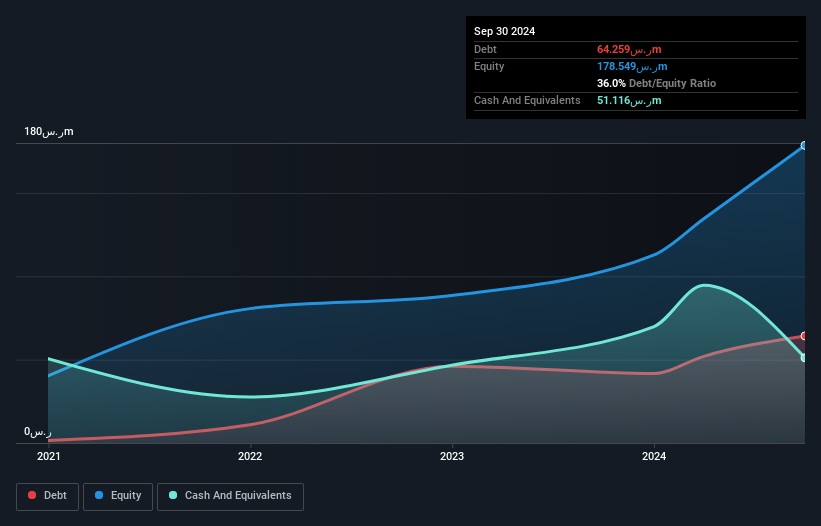

Overview: Nice One Beauty Digital Marketing Company operates an e-commerce platform offering beauty and personal products in Saudi Arabia, with a market capitalization of SAR6.70 billion.

Operations: The company generates revenue primarily from its retail specialty segment, amounting to SAR966.07 million.

Nice One Beauty Digital Marketing recently completed an IPO, raising SAR 1.21 billion, which highlights its growing market presence. The company's earnings surged by 142% last year, significantly outpacing the Specialty Retail industry's growth of 21%. This robust performance is supported by a satisfactory net debt to equity ratio of 7%, ensuring financial stability. Interest payments on its debt are well-covered with EBIT covering them 17 times over. Despite these strengths, shares remain highly illiquid, posing a challenge for investors seeking liquidity. Earnings are projected to grow at a healthy rate of nearly 52% annually moving forward.

Senshu Ikeda Holdings (TSE:8714)

Simply Wall St Value Rating: ★★★★☆☆

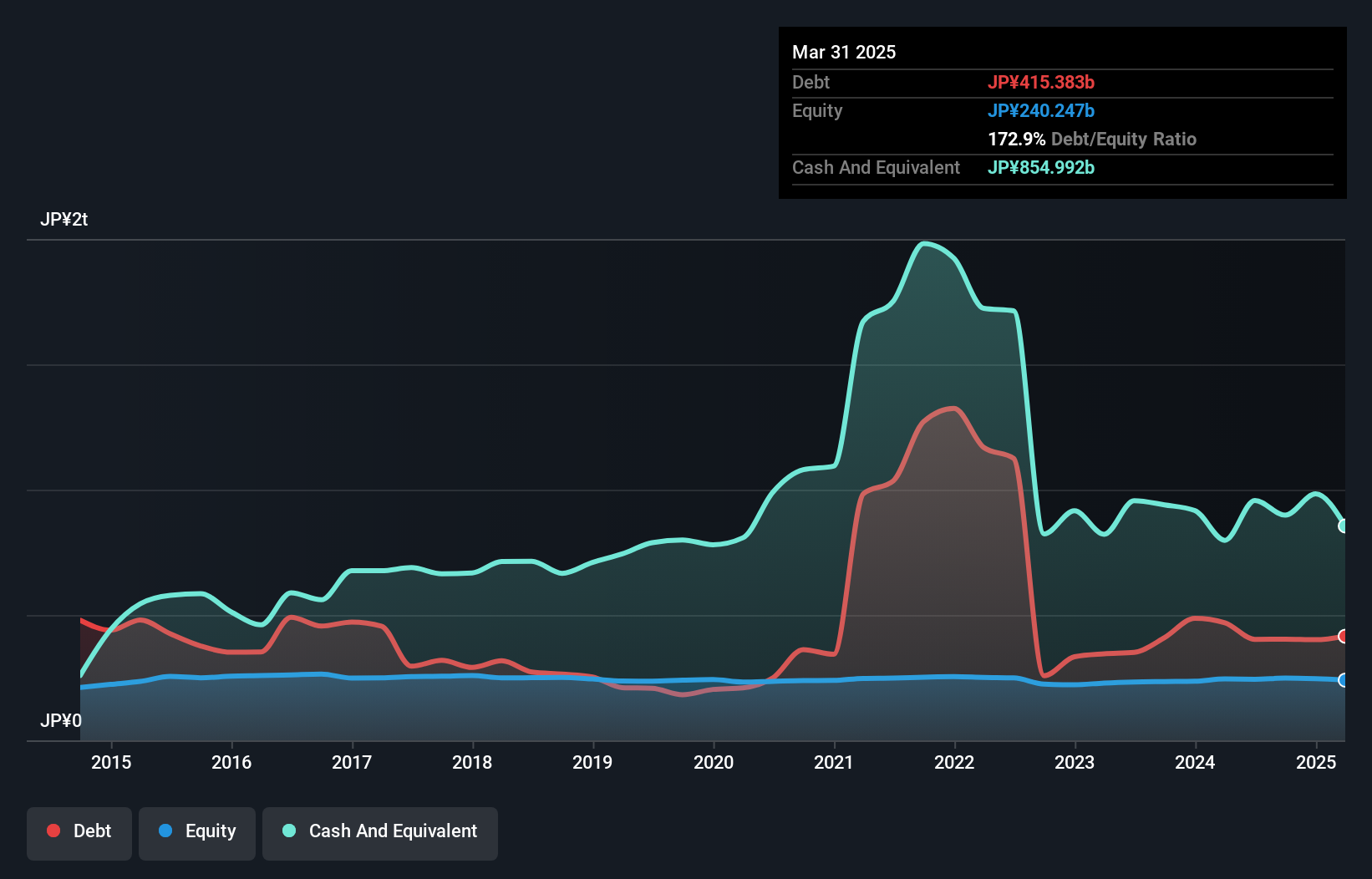

Overview: Senshu Ikeda Holdings, Inc. offers banking products and services to small and medium-sized enterprises as well as individuals in Japan and internationally, with a market capitalization of ¥122.55 billion.

Operations: Senshu Ikeda Holdings generates revenue primarily through its banking products and services offered to small and medium-sized enterprises and individuals. The company has a market capitalization of ¥122.55 billion.

Senshu Ikeda Holdings, a small but promising player in the banking sector, showcases a robust financial structure with total assets of ¥6.50 trillion and equity of ¥245.5 billion. It has total deposits of ¥5.78 trillion and loans amounting to ¥4.63 trillion, though its net interest margin stands at 0.8%. The bank's allowance for bad loans is 1.1%, which seems appropriate given industry standards but could be improved upon as it's considered low at 19%. With earnings growing at an impressive rate of 21% annually over the past five years, Senshu Ikeda appears undervalued by about 34% relative to fair value estimates, hinting at potential upside for investors seeking hidden opportunities in less prominent stocks.

- Navigate through the intricacies of Senshu Ikeda Holdings with our comprehensive health report here.

Understand Senshu Ikeda Holdings' track record by examining our Past report.

Taking Advantage

- Click through to start exploring the rest of the 4707 Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nice One Beauty Digital Marketing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4193

Nice One Beauty Digital Marketing

Provides beauty and personal products through e-commerce platform in Saudi Arabia.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives