- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4190

Investors Aren't Buying Jarir Marketing Company's (TADAWUL:4190) Earnings

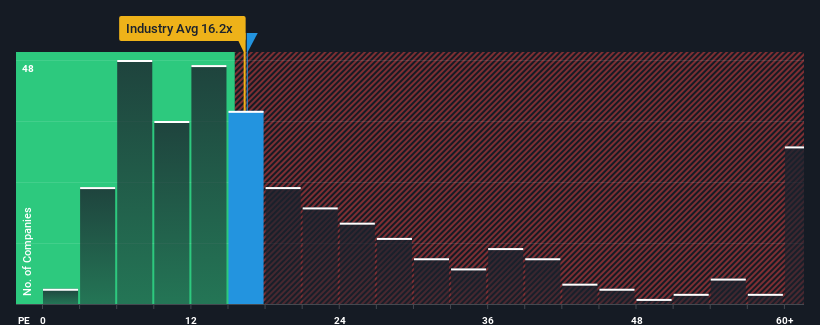

When close to half the companies in Saudi Arabia have price-to-earnings ratios (or "P/E's") above 28x, you may consider Jarir Marketing Company (TADAWUL:4190) as an attractive investment with its 16.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times haven't been advantageous for Jarir Marketing as its earnings have been rising slower than most other companies. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

Check out our latest analysis for Jarir Marketing

How Is Jarir Marketing's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Jarir Marketing's is when the company's growth is on track to lag the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 3.0% drop in EPS. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 4.8% per year during the coming three years according to the eleven analysts following the company. Meanwhile, the rest of the market is forecast to expand by 15% per year, which is noticeably more attractive.

With this information, we can see why Jarir Marketing is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Jarir Marketing maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Jarir Marketing that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4190

Jarir Marketing

Engages in the retail and wholesale trading of office and school supplies in the Kingdom of Saudi Arabia, Egypt, and other Gulf countries.

Flawless balance sheet and fair value.

Market Insights

Community Narratives