- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4003

Shareholders of United Electronics (TADAWUL:4003) Must Be Delighted With Their 581% Total Return

For many, the main point of investing in the stock market is to achieve spectacular returns. And highest quality companies can see their share prices grow by huge amounts. Don't believe it? Then look at the United Electronics Company (TADAWUL:4003) share price. It's 503% higher than it was five years ago. If that doesn't get you thinking about long term investing, we don't know what will. Also pleasing for shareholders was the 13% gain in the last three months.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for United Electronics

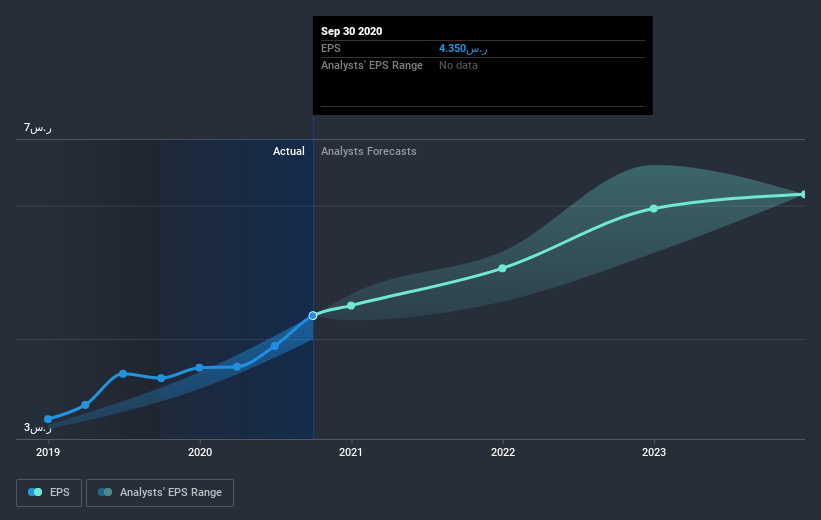

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, United Electronics achieved compound earnings per share (EPS) growth of 39% per year. This EPS growth is reasonably close to the 43% average annual increase in the share price. This indicates that investor sentiment towards the company has not changed a great deal. Rather, the share price has approximately tracked EPS growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how United Electronics has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling United Electronics stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of United Electronics, it has a TSR of 581% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that United Electronics shareholders have received a total shareholder return of 41% over the last year. Of course, that includes the dividend. However, the TSR over five years, coming in at 47% per year, is even more impressive. It's always interesting to track share price performance over the longer term. But to understand United Electronics better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with United Electronics , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

When trading United Electronics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade United Electronics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:4003

United Electronics

Engages in the wholesale and retail trade of electric appliances, electronic gadgets, computers and their spare parts and accessories, furniture, and office equipment and tools in the Kingdom of Saudi Arabia and internationally.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives