- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4003

Cautious Investors Not Rewarding United Electronics Company's (TADAWUL:4003) Performance Completely

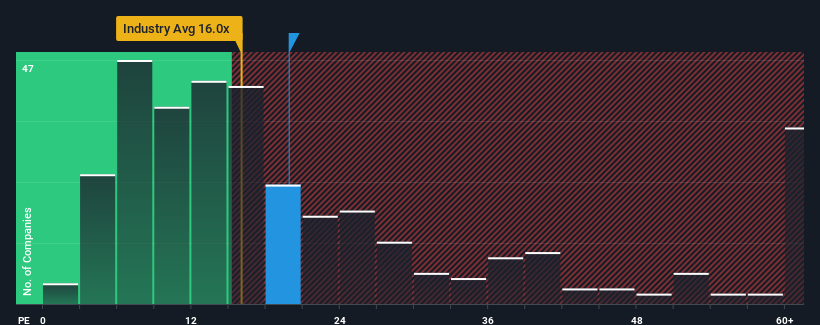

With a price-to-earnings (or "P/E") ratio of 19.9x United Electronics Company (TADAWUL:4003) may be sending bullish signals at the moment, given that almost half of all companies in Saudi Arabia have P/E ratios greater than 28x and even P/E's higher than 44x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

United Electronics could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for United Electronics

Is There Any Growth For United Electronics?

United Electronics' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 12%. Even so, admirably EPS has lifted 35% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 17% per annum over the next three years. With the market predicted to deliver 16% growth per annum, the company is positioned for a comparable earnings result.

With this information, we find it odd that United Electronics is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From United Electronics' P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that United Electronics currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Having said that, be aware United Electronics is showing 2 warning signs in our investment analysis, and 1 of those shouldn't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4003

United Electronics

Engages in the wholesale and retail trade of electric appliances, electronic gadgets, computers and their spare parts and accessories, furniture, and office equipment and tools in the Kingdom of Saudi Arabia and internationally.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives